Quick Take

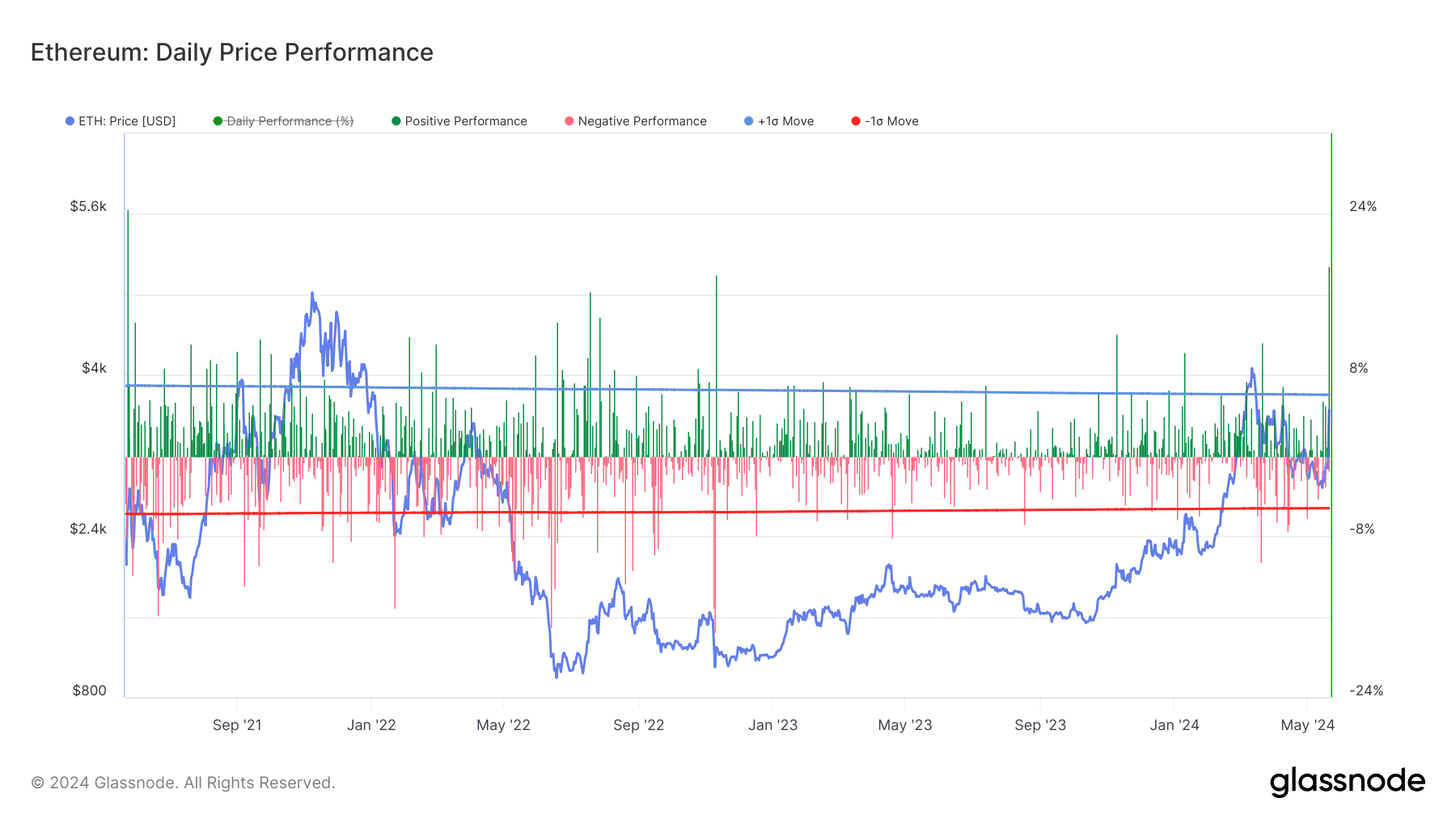

Ethereum, the second-largest digital asset by market capitalization, witnessed a remarkable price surge on May 20, fueled by Bloomberg analysts’ revised odds of a potential Ethereum Exchange-Traded Fund (ETF) approval. The analysts now estimate a 75% chance of the ETF receiving the green light, driving Ethereum’s price up by approximately 18% – the most significant one-day jump since May 24, 2021, when it rose over 22%, according to Glassnode data.

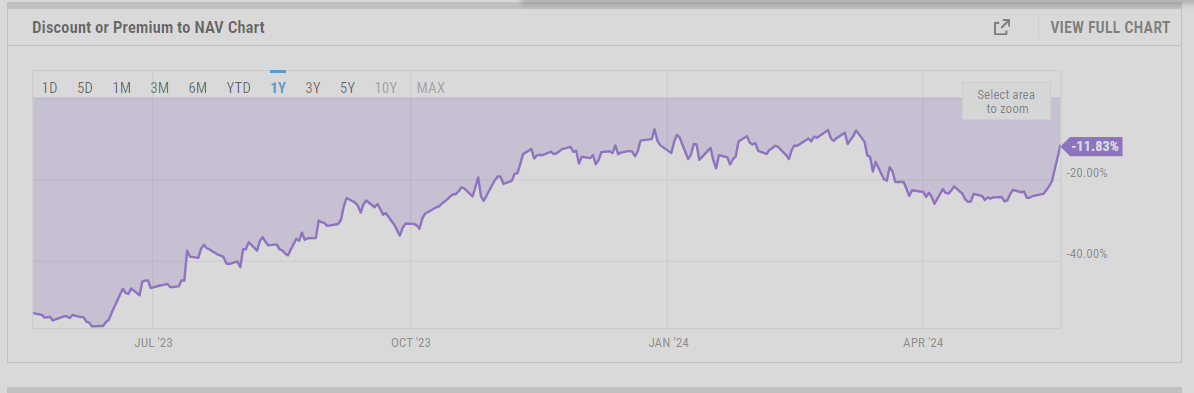

Further evidence of the market’s reaction can be seen in the performance of the Grayscale Ethereum Trust (ETHE). As news of the potential ETF approval spread, the discount to the trust’s net asset value (NAV) narrowed significantly, jumping from around -20% to -12%, according to ycharts.

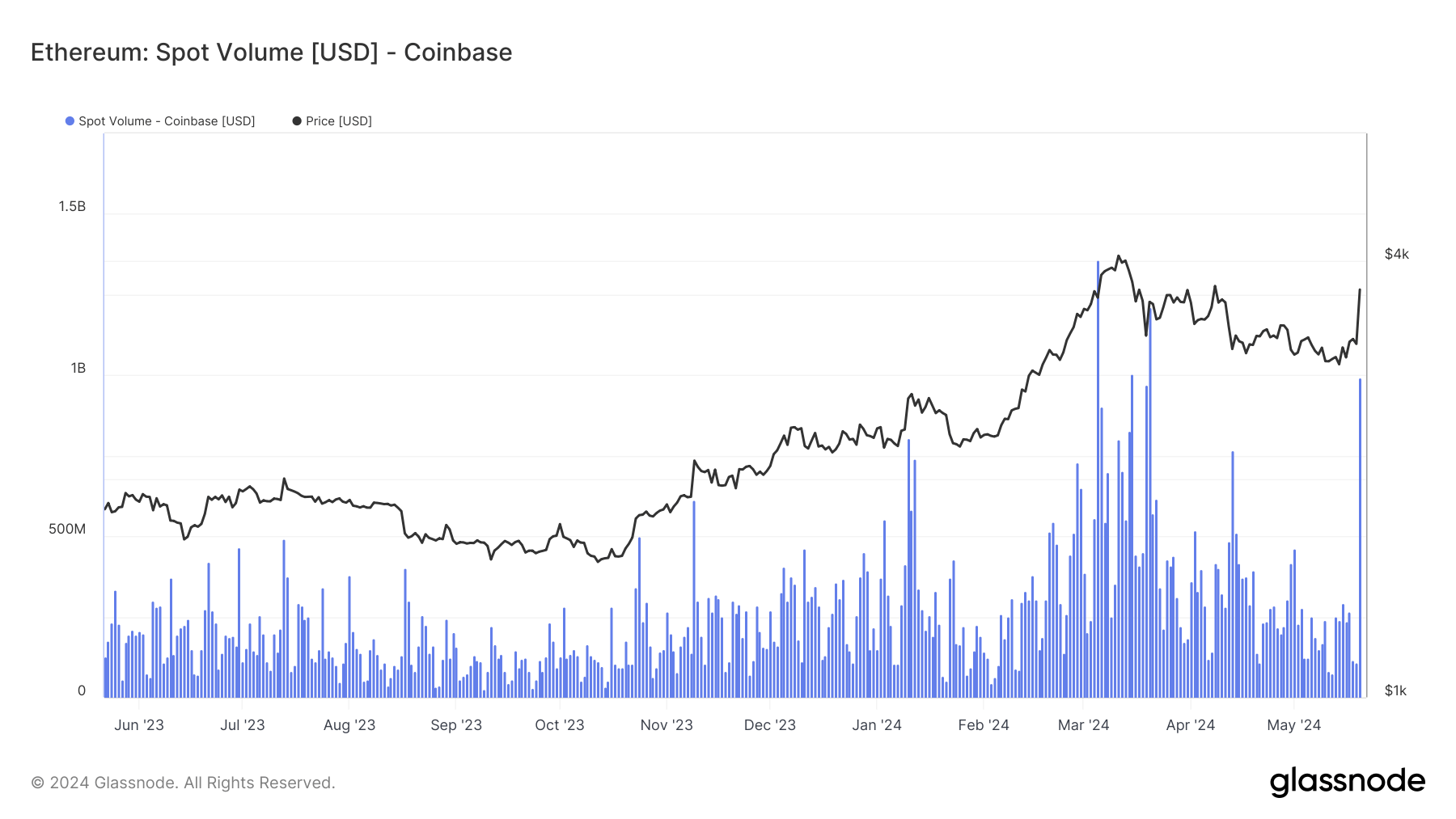

Glassnode data shows that Ethereum spot volume on Coinbase surged to approximately $1 billion on May 20, marking the fourth highest volume in the past year. This was only surpassed by periods in March 2024, when Bitcoin reached its all-time high, likely driven by retail participation fueled by FOMO and greed.

Ethereum now hovering just below $3,700, representing a gain of over 55% year to date.

The post Potential ETF approval fuels 18% Ethereum surge, highest since 2021 appeared first on CryptoSlate.