Quick Take

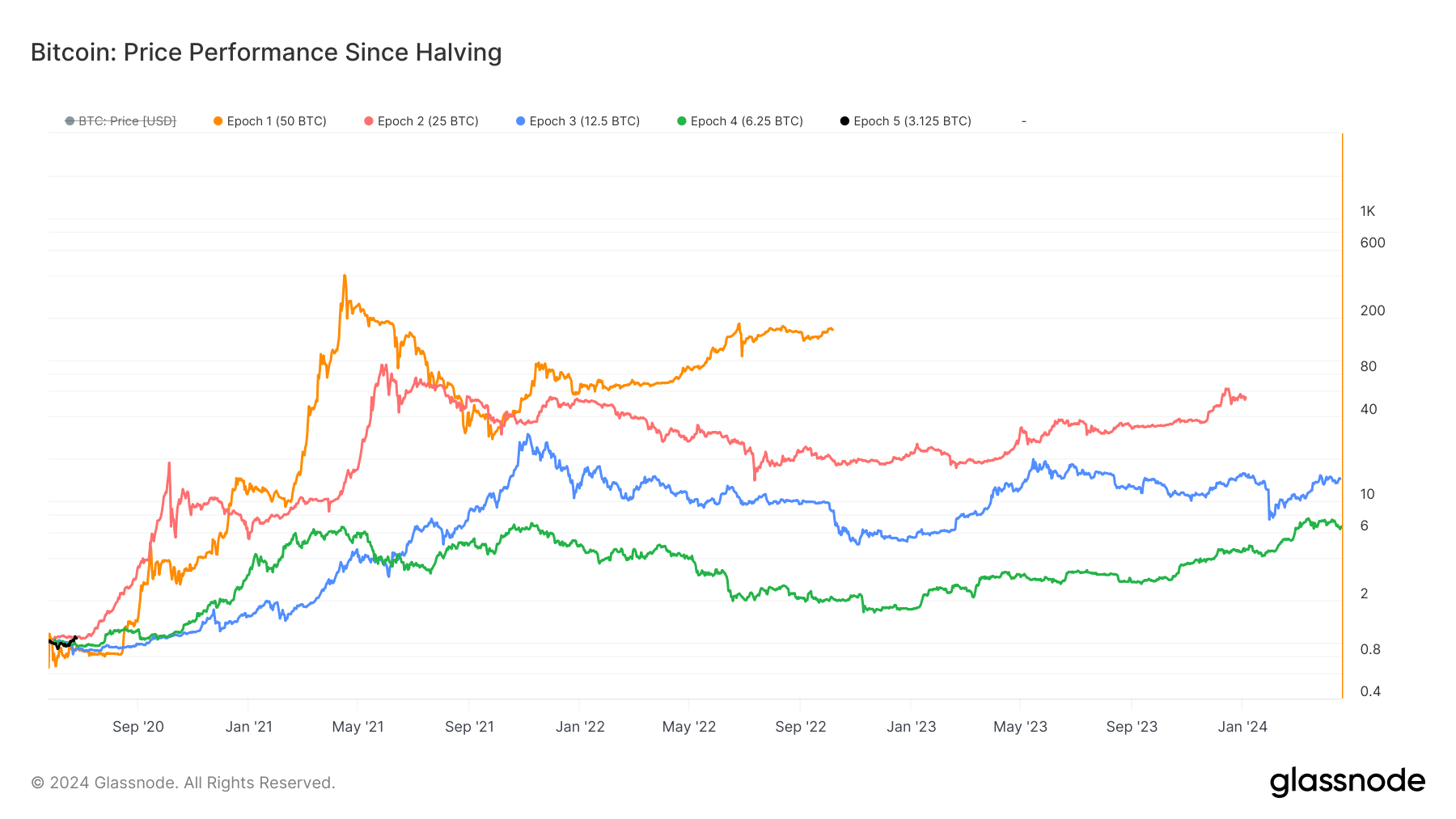

Bitcoin has shown a positive trend since its halving on April 20, with an increase of approximately 8%. It traded around $64,000 and is now consolidating just below $70,000.

This performance positions Bitcoin as one of the best-performing cycles since the start of a halving event, second only to Epoch 2, which experienced substantial returns in the following five months.

Analyzing previous epochs reveals that Bitcoin often begins to increase in value at this stage in the cycle, though the duration of these increases varies, as seen in Epochs 3 and 4, according to Glassnode data.

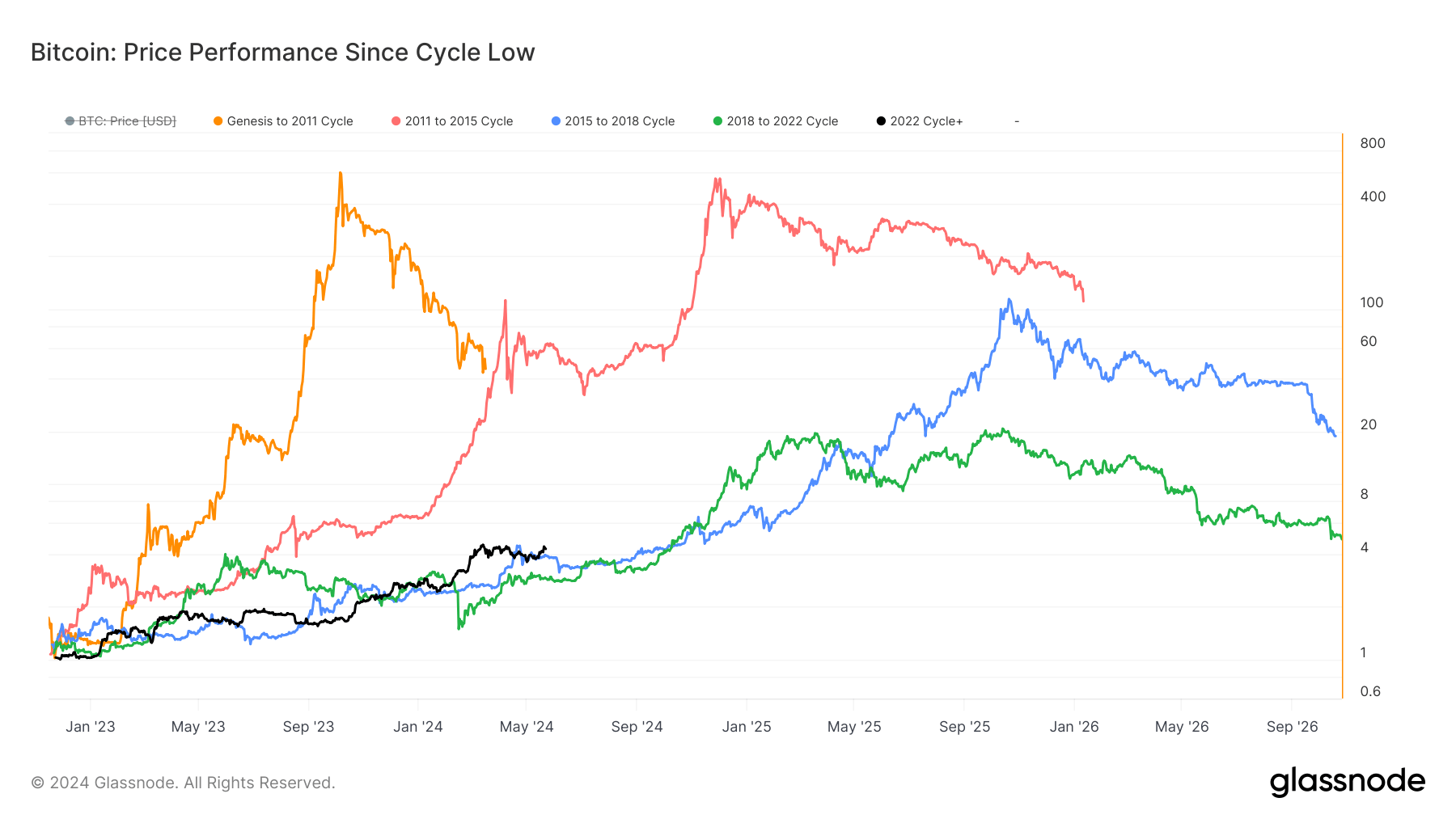

Glassnode data shows that comparing the current cycle to previous ones, Bitcoin is now 330% higher from its cycle low, which occurred during the FTX collapse.

This performance surpasses the previous two cycles; the 2015-2018 cycle was 285% higher at the same point, and the 2018-2022 cycle was 190% higher. It positions Bitcoin favorably as the cycle progresses, indicating potential for further gains in the coming months and quarters.

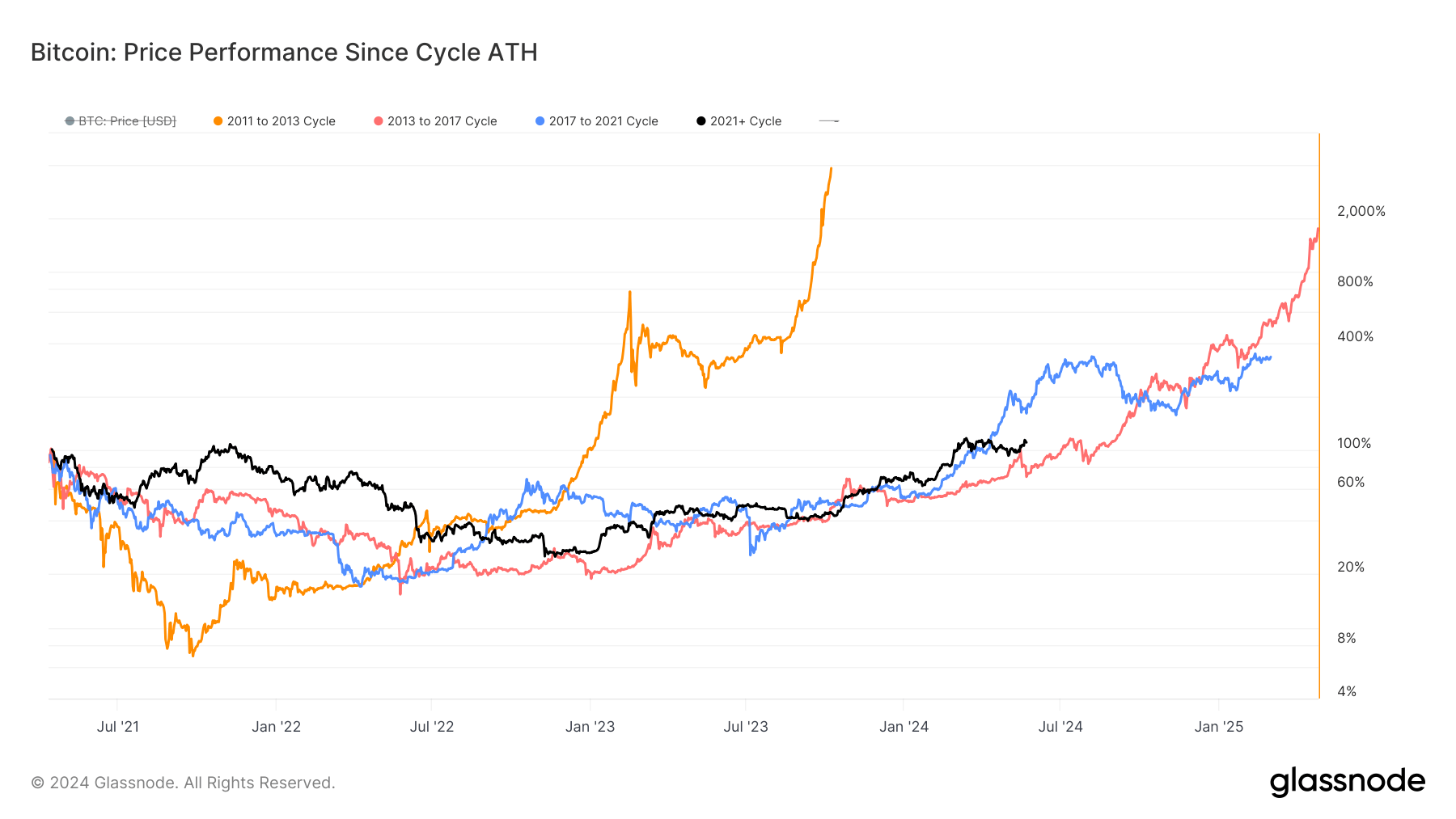

Looking at the cycle from its all-time high (ATH) in April 2021, Bitcoin is currently about 10% higher. This performance is positioned between the two previous cycles: the 2017 to 2021 cycle was roughly 70% higher at this stage, while the 2013 to 2017 cycle was 20% lower, according to Glassnode.

This comparison highlights that Bitcoin is performing well against previous cycles and suggests there is still significant potential for further growth.

The post Bitcoin’s second best start to a halving cycle appeared first on CryptoSlate.