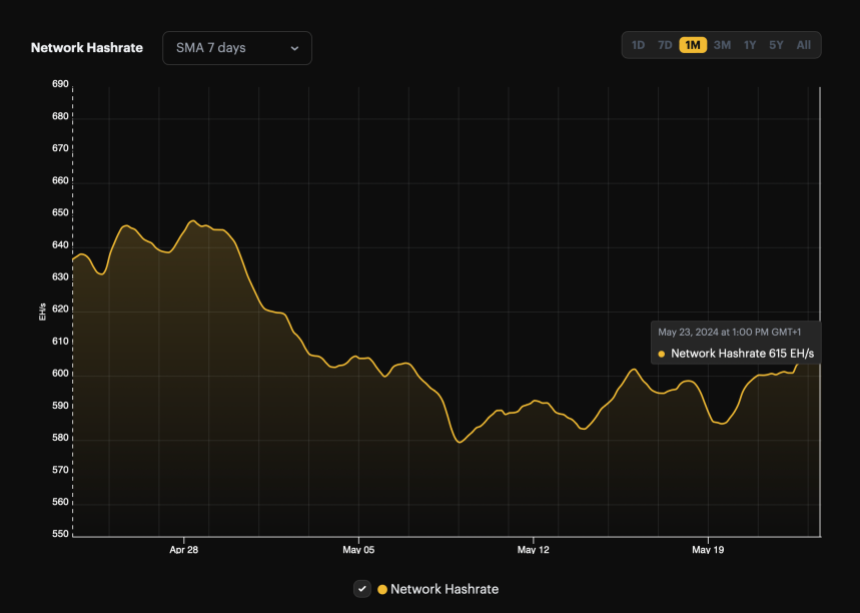

Bitcoin mining difficulty has adjusted upwards by nearly 2%, reaching over 84.4 trillion, as the network’s average hash rate surged past 600 EH/s.

This increase comes amid growing optimism in the crypto market, particularly due to speculation about the potential approval of spot Ethereum ETFs in the United States. Notably, Bitcoin mining difficulty measures how difficult it is to find a hash below a given target.

The Bitcoin network has a global block difficulty that adjusts every 2,016 blocks (roughly every two weeks) to ensure that the time between blocks mined remains around 10 minutes, despite the number of miners and their growing computing power.

This difficulty adjustment helps maintain the network’s regular block time, ensuring stability and security.

Significant Shifts In Bitcoin Mining

The adjustment of BTC mining difficulty seen earlier this month marked a significant shift, as the metric saw a drop of nearly 6%, the largest decrease since the bear market in December 2022.

This rebound in hash rate from the 580-590 EH/s range to over 600 EH/s aligns with a broader crypto market rally fueled by expectations of regulatory advancements in Ethereum products.

The concept of mining difficulty is crucial for understanding how Bitcoin self-regulates the production of new blocks. The difficulty increases as more miners join the network, making it harder to mine new blocks.

Conversely, the difficulty drops if the number of miners decreases, making mining easier. This mechanism ensures that the introduction of new BTC into the market remains steady and predictable, irrespective of fluctuations in the number of miners.

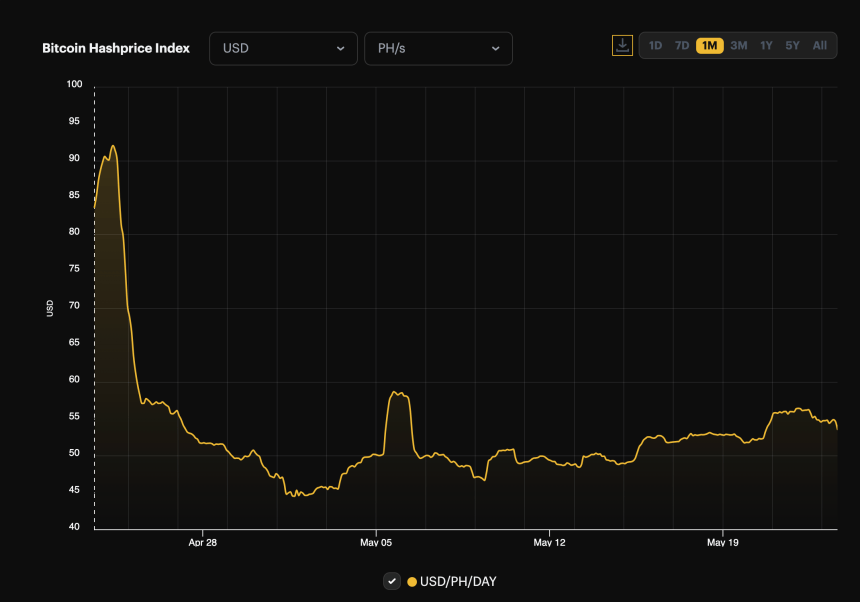

This recent increase in mining difficulty coincides with a slight recovery in Bitcoin’s hash price, which had fallen to an all-time low at the end of April.

The hash price, a metric developed by Luxor, a Bitcoin mining services firm, measures the expected earnings per unit of hash rate daily. It has rebounded from less than $50 per PH/s per day to around $54.6 per PH/s per day, providing a minor relief to miners after the recent market downturns.

Bitcoin’s Price Movements And Future Expectations

While Bitcoin’s price has experienced a minor dip of 2% in the last 24 hours, it maintains a weekly uptrend of 3.9%, trading at $68,132.

This movement is closely watched as investors and traders await the US Securities and Exchange Commission’s decision on spot Ethereum ETFs, which could significantly influence the entire crypto market.

In response to these developments, a prominent analyst known as BitQuant shared insights via social media platform X, predicting substantial growth for Bitcoin. According to BitQuant, Bitcoin is expected to reach $95,000, with a significant rise to $80,000 anticipated in May.

However, BitQuant also forecast a sharp decline from this local peak in June, maintaining that the overall timeline for this top has not changed.

Several updates for those here to build generational wealth and not involved in day trading:

1. Yes, #Bitcoin is going to $95K.

2. Yes, $95K will extend to June, but the sharp decline from this local top will also occur in June, so the overall timeline for this local top hasn’t… pic.twitter.com/VFvMweBVbs— BitQuant (@BitQua) May 22, 2024

Featured image created with DALL·E, Chart from TradingView