Quick Take

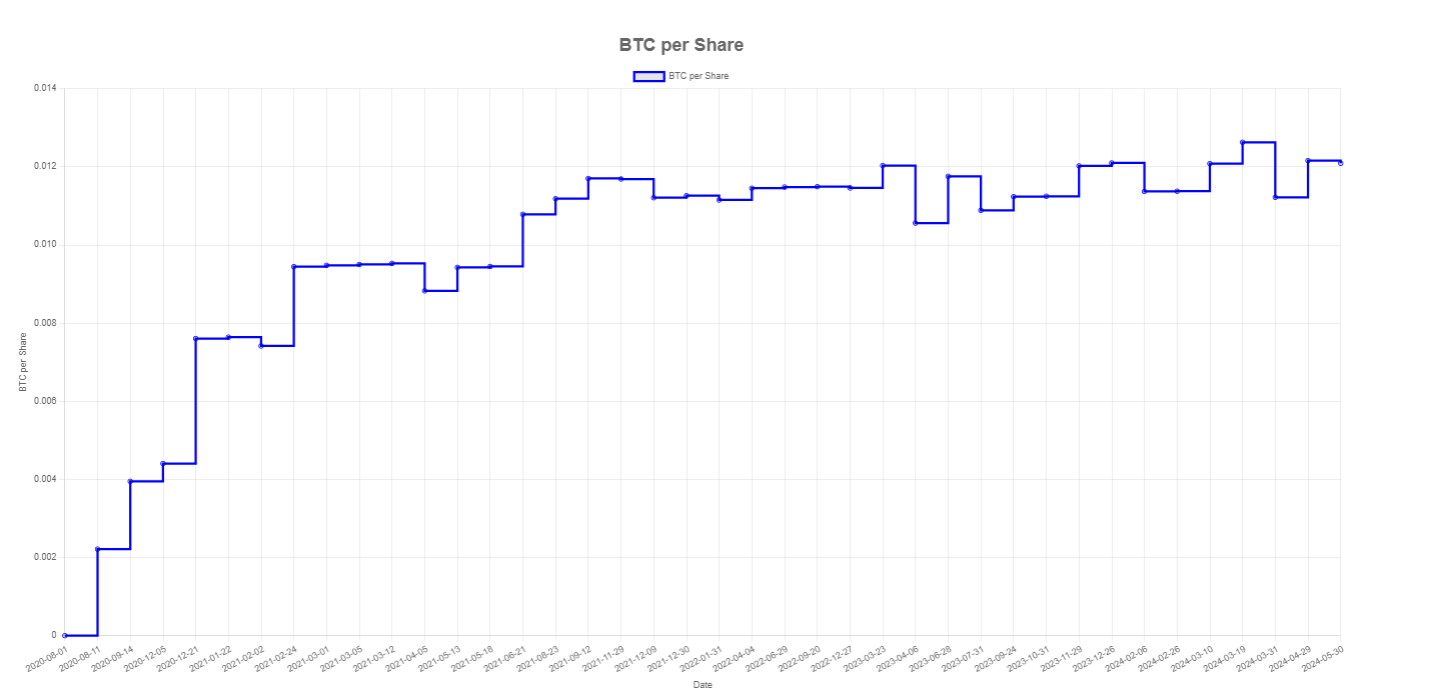

MicroStrategy was the first publicly traded company in the US to acquire Bitcoin and use it as a treasury asset, beginning this practice in August 2020. Since then, the company has amassed 214,400 BTC. A key metric for MicroStrategy is “BTC per Share,” which indicates the amount of Bitcoin each outstanding share of the company equates to, reflecting the Bitcoin exposure per share. Currently, MicroStrategy’s BTC per share stands at 0.01209 BTC, according to mstr-tracker, a crucial figure that shareholders monitor to ensure increasing Bitcoin value per share.

Following MicroStrategy, Tesla exhibited fluctuating involvement with Bitcoin. However, a second US publicly traded company, Semler Scientific, has recently adopted Bitcoin as a reserve asset. This announcement on May 28 has led to a 38% surge in Semler Scientific’s share price over the past five days. With a market capitalization of approximately $227 million, the company purchased $40 million worth of Bitcoin. With 6.9 million shares outstanding, Semler Scientific now has a BTC per share of 0.0000842. This metric will be crucial for assessing the company’s Bitcoin exposure per share.

The post Semler Scientific Bitcoin strategy sets BTC per share at 0.0000842 appeared first on CryptoSlate.