On-chain data shows that long-term Bitcoin holders have seen their supply increase recently despite the FUD going around the market.

Bitcoin HODLer Balance Has Registered An Increase Recently

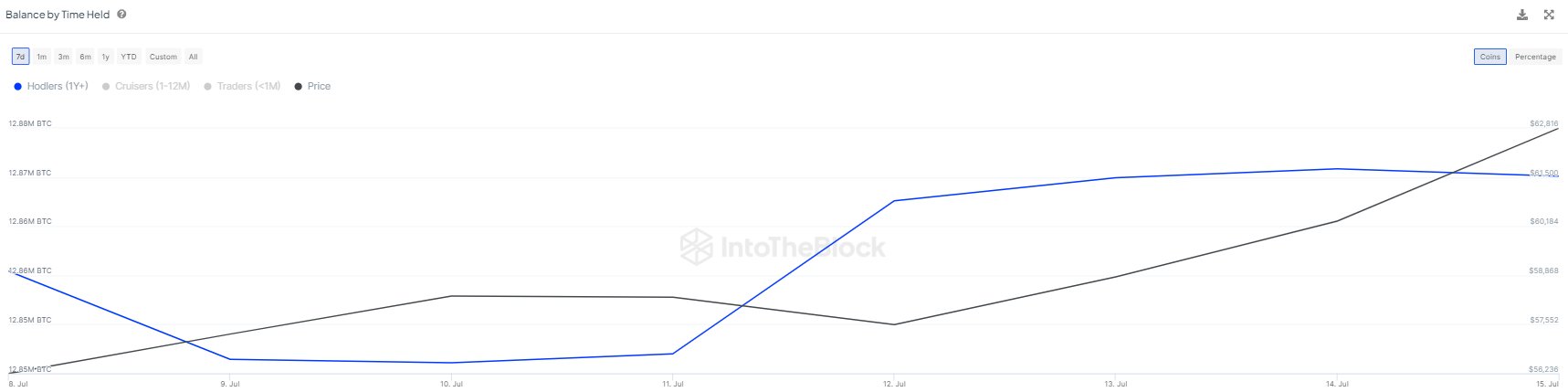

According to data from the market intelligence platform IntoTheBlock, the long-term holder supply has expanded recently. IntoTheBlock defines “long-term holders” (LTHs) or HODLers as those investors who have held onto their coins for at least one year.

Statistically, the longer a holder keeps their coins dormant, the less likely they become to sell them at any point. As such, the LTHs, which tend to hold for relatively long periods, represent the stubborn side of the market.

Whereas the short-term holders (STHs) might easily sell during crashes or rallies, these diamond hands generally stay tight regardless of the situation in the sector.

Recently, FUD has been going around the Bitcoin market due to the bankrupt cryptocurrency exchange Mt. Gox distributing coins back to their rightful owners and the German Government selling BTC it had confiscated.

Despite this, it would appear that the HODLers haven’t cared much, as their combined balance has registered an increase over the past week. The below chart shows this development.

Remember that any increase in the Bitcoin LTH balance doesn’t mean that these HODLers are buying right now. Rather, it suggests that some buying occurred a year ago, and these coins have matured enough to become a part of the cohort.

Selling, however, does reflect immediately on the indicator, as coins see their age reset back to zero as soon as they are moved across the network, leading to them no longer being counted under the cohort.

As such, while this increase in the metric doesn’t indicate accumulation in the present, it does say that these investors who bought a year or more ago still feel comfortable in HODLing even during the recent market conditions.

In some other news, an analyst pointed out in a CryptoQuant Quicktake post that the Coinbase Premium Gap has been positive recently. This metric keeps track of the difference between the Bitcoin prices listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

These positive indicator values suggest that Coinbase is now observing a higher buying pressure than Binance. The platform is known to be the preferred option of American institutional investors, so it’s possible that the buying from these large entities is driving the recovery.

BTC Price

Bitcoin is back above the $64,400 level after seeing a more than 12% surge over the last seven days.