An analyst has pointed out how Bitcoin is back above the cost basis of the short-term holders, a sign that can be bullish for the asset.

Bitcoin Is Back Above The Realized Price Of Short-Term Holders

As explained by CryptoQuant community manager Maartunn in a new post on X, BTC has reclaimed the Realized Price of the short-term holders. The “Realized Price” here refers to an indicator that, in short, keeps track of the average cost basis of the investors in the Bitcoin market.

When the value of this metric is greater than the cryptocurrency’s spot price, the average holder in the sector can be assumed to be carrying some unrealized profit. On the other hand, the indicator being under the BTC price implies the dominance of losses in the market.

In the context of the current discussion, the Realized Price of the entire userbase isn’t of interest, but that of only a part of it: the short-term holders (STHs). The STHs refer to the Bitcoin investors who purchased their tokens within the past 155 days.

This cohort makes up one of the two main divisions of the BTC sector based on holding time, with the other part of the market being known as the long-term holders (LTHs).

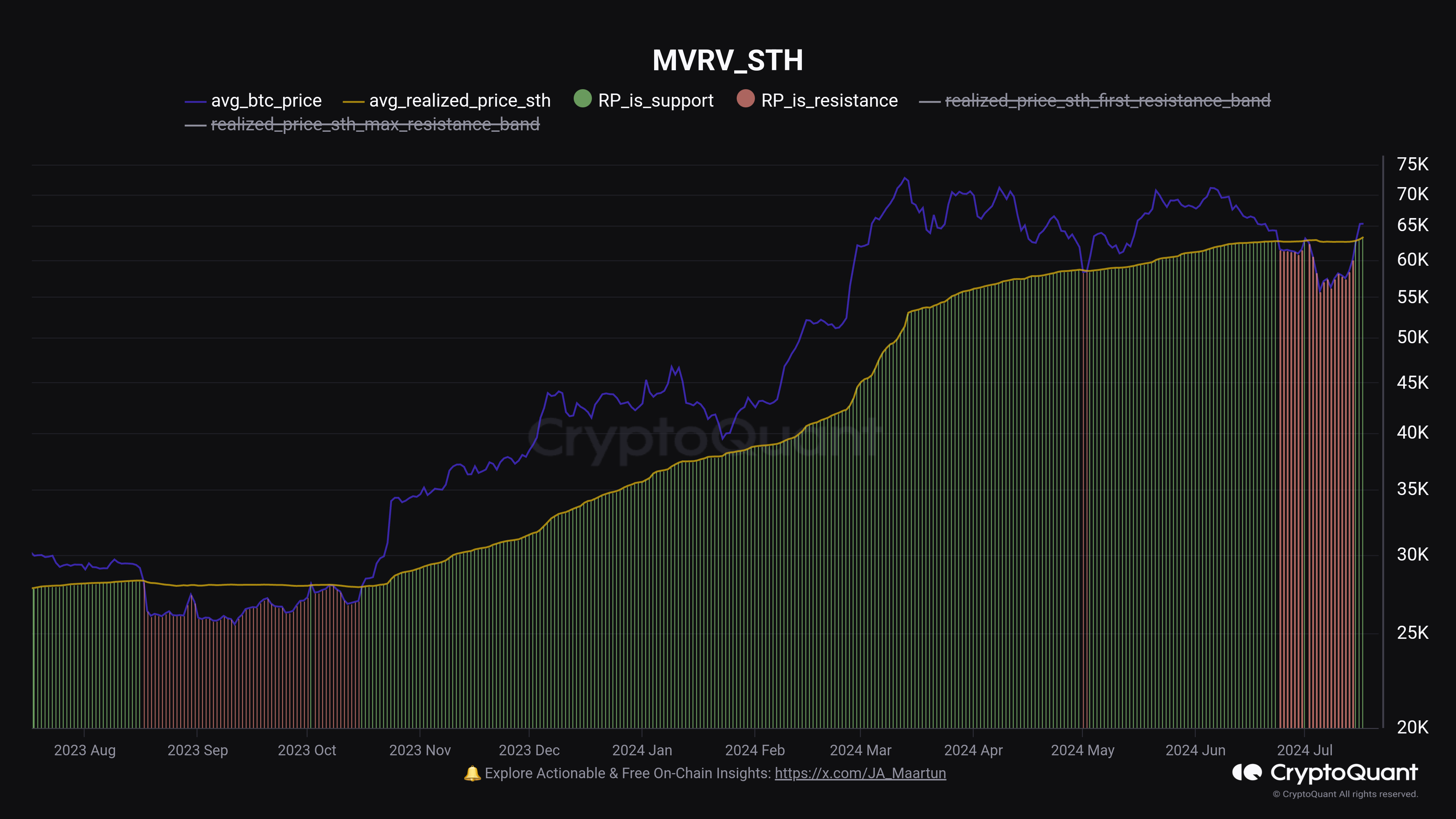

Now, here is a chart that shows the trend in the Bitcoin Realized Price specifically for this cohort over the past year:

As is visible in the above graph, the Bitcoin spot price had plunged under the Realized Price of the STHs last month, meaning that this group had gone into a state of net loss.

After spending some time below the line, though, the cryptocurrency has risen above the metric with the latest rally, thus bringing this cohort back into profit.

“This is usually a very bullish sign,” notes Maartunn. The chart shows that the last time the asset broke back above this level after an extended stay below it was last October. This surge back above the line kicked off a run that would eventually result in the coin setting a new all-time high (ATH).

As for why BTC breaking above the STH Realized Price has historically been something bullish, the answer lies in investor psychology. The STHs, who are relatively inexperienced hands, can be sensitive to price movements. More specifically, they are likely to show a reaction when their average cost basis undergoes a retest.

When these investors are bearish, they may decide to sell when the price rises to their cost basis, as they may worry that the surge won’t last. Similarly, they react by accumulating further instead during bullish periods, as they could see their cost basis as a profitable point for buying more.

As BTC has been able to surge past this line recently, it wouldn’t appear that the STHs are offering resistance right now, and thus, a bullish sentiment is still dominant among them.

BTC Price

Bitcoin had recovered above $66,000 yesterday, but the coin has since seen some pullback as its price is now down to $64,800.