Optimism has been seeing bearish action since the start of this month. But this week, it has been much worse for investors and traders. According to Coingecko, the token is down more than 12% since last week.

With a market correction underway, more pain can come to all portfolios carrying OP. However, there are several reasons why investors and traders should still be on board with Optimism.

Growing On-chain Use By An Expanding Userbase

Price-wise, OP looks like a hard bargain after a month of hard-battering by the bears. However, on-chain data looks vastly different.

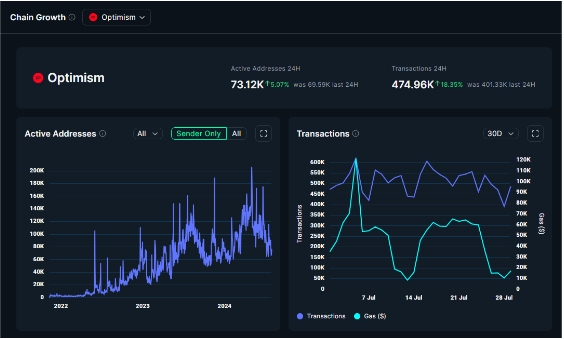

According to data tracked by Nansen, on-chain growth is booming for Optimism. The platform’s growth as the self-named “Superchain” on Ethereum is working as active addresses continue to ramp up along with transactions, indicating chain-wide usage across its different constituent chains.

The platform has also announced several events that potentially impacted this on-chain growth.

Optimism is hosting a chain-wise hackathon tomorrow, July 31, contributing to this sudden increase in active addresses on the platform. This should offset any shift in investor confidence as it paints Optimism positively: a platform worthy of development with the support of a growing community.

Superhack is a Superchain wide hackathon.

Sign up and check out bounties from teams like @worldcoin @base @modenetwork @Celo and more!

Details via link in @ETHGlobal‘s bio.

Apply before July 31. https://t.co/EBsgKWk9Z2— Optimism (@Optimism) July 26, 2024

The organization also announced the next Retro Funding round which will reward projects based on three categories: Ethereum core contributions, OP stack research and development, and OP stack tooling. The reward for the event will be 8 million OP tokens which will further help the winning projects increase their impact on-chain.

PUMP THIS SHIT pic.twitter.com/jySc2uxBnI

— ProfessorAstrones (@Astrones2) July 24, 2024

These metrics contribute to a stronger bullish sentiment among analysts like X user Professor Astrones, showing support for OP as he shows that the token has broken through the downward trend it has followed since early this year.

Although confidence in the platform and token is still high, some things have to happen to OP to see green once more.

Bulls Should Wait For The Perfect Timing

As of writing, OP bulls have a perfect and stable platform for a rocket upwards, and it should be noted that $1.694 is the long-term support level for this movement.

However, its high correlation with Ethereum leaves much to be desired. Bitcoin and Ethereum move in sync, meaning if one experiences pain, the other drops too. OP’s indirect correlation with Bitcoin will have a big impact on how the token moves soon.

With the current market correction, investors and traders should lower their expectations of a breakout in the coming days. However, the strong support on $1.694 gives bulls a stable platform to launch upward.

Should the bulls lose this position, expect more pain within the coming days or weeks. But if the level is held strongly $2.331 will be the target level for the bulls.

Featured image from Pexels, chart from TradingView