Quick Take

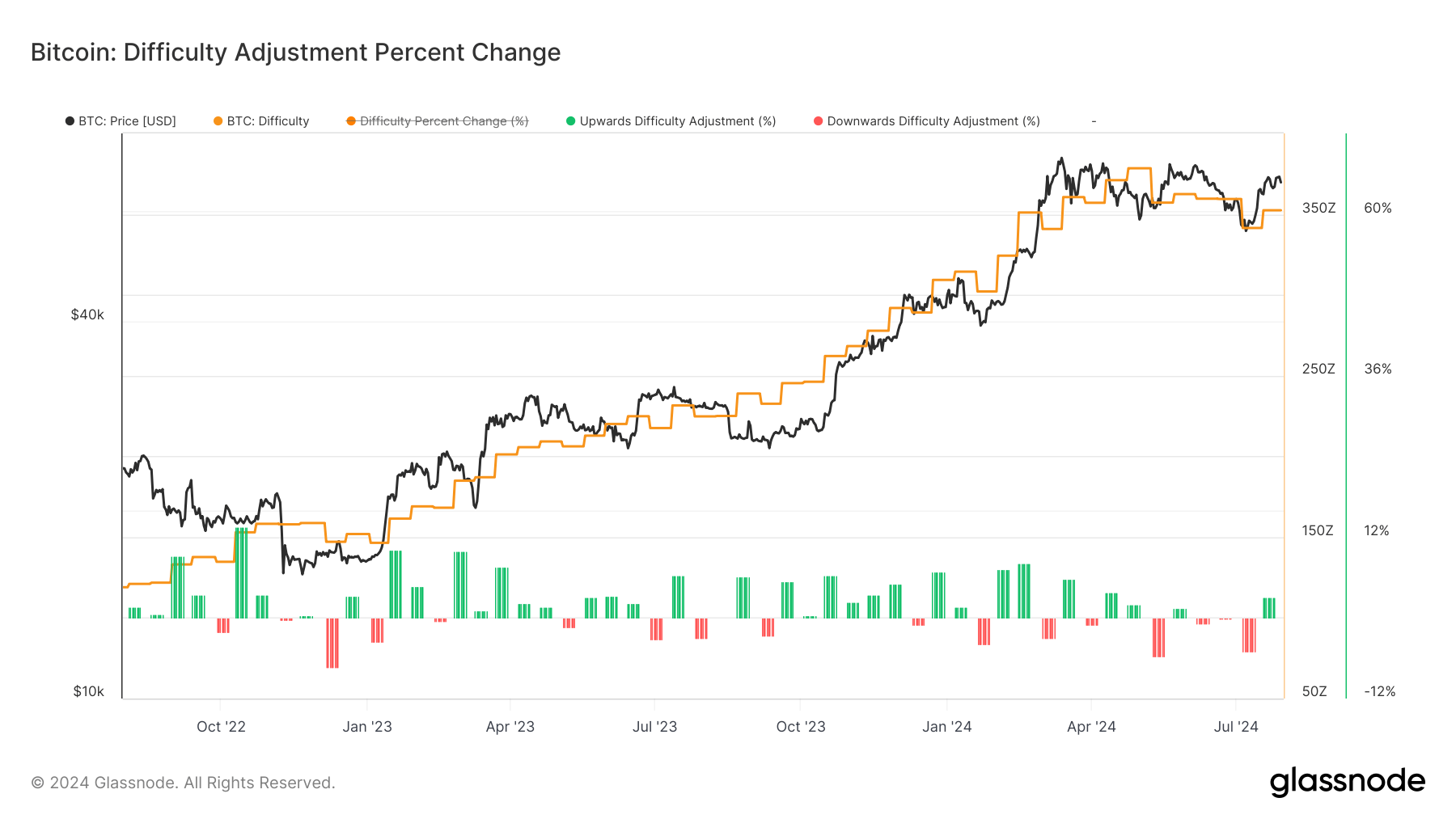

Bitcoin’s network difficulty is anticipated to rise by as much as 11% on July 31 at 8 A.M., reflecting the rise in hash rate we’ve seen over the past weeks. According to Glassnode data, this upcoming adjustment would represent the largest difficulty increase since October 2022, which took place just one month before the FTX collapse.

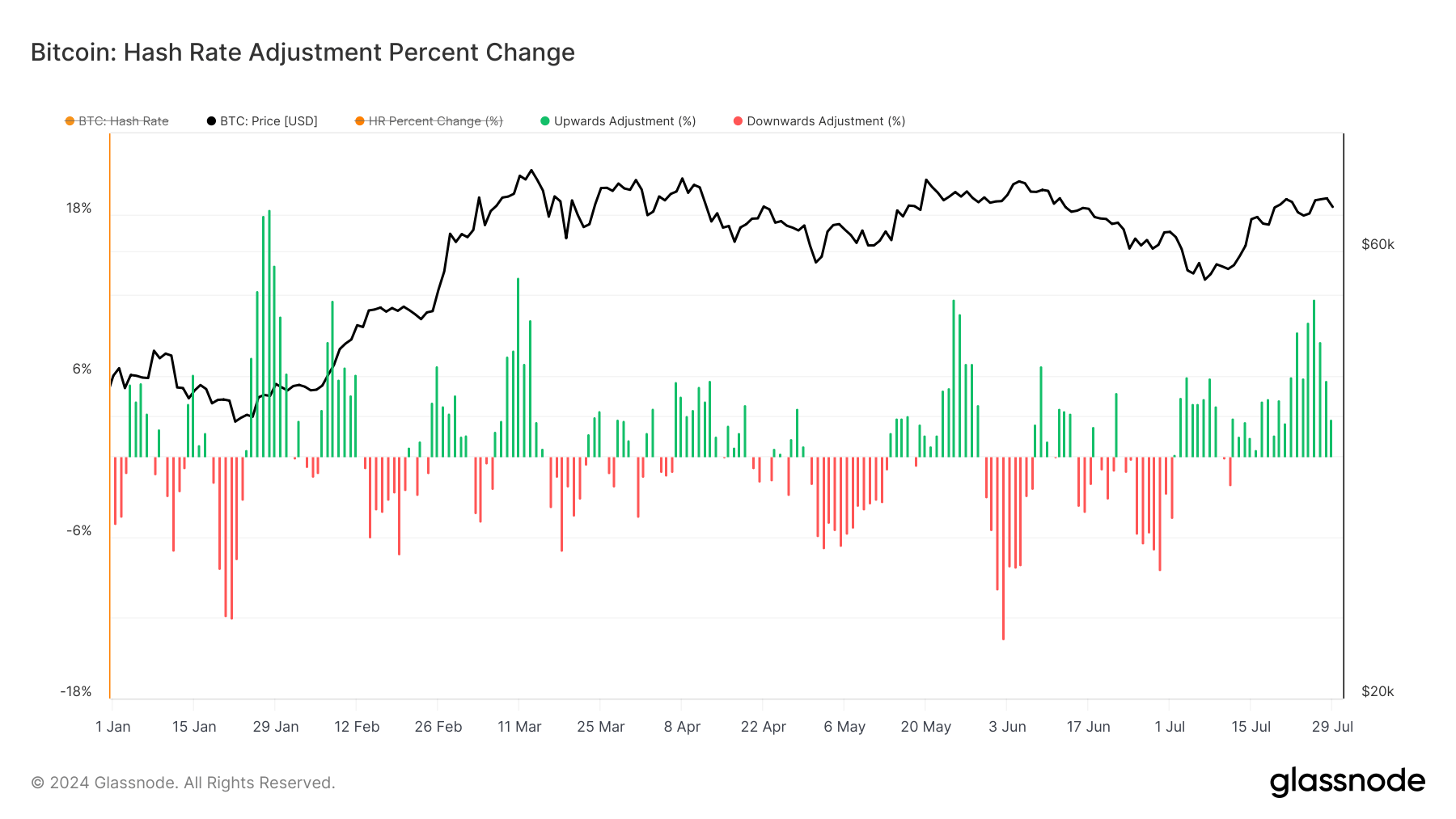

This upcoming adjustment follows a surge in hash rate, which reached an all-time high of approximately 670 EH/s on July 26, based on a 7-day moving average. This recent peak represents an 11% increase over the preceding week.

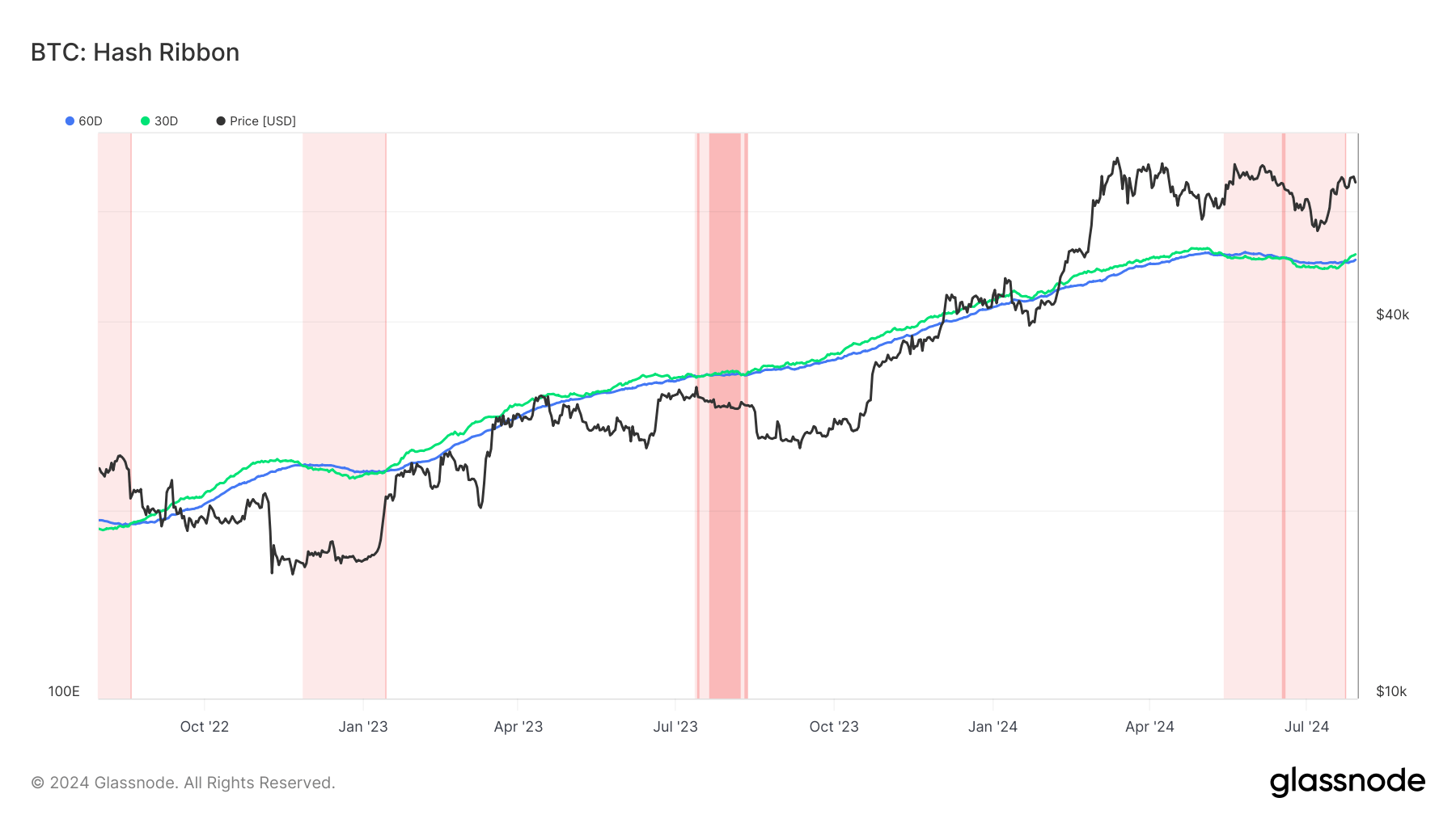

The heightened hash rate has led to the hash ribbon indicator signaling the end of a miner capitulation. This marks the conclusion of a period of miner capitulation that lasted just over two months, one of the longest in recent years. The hash ribbon is a technical indicator used to identify periods of miner distress and recovery, with the current signal suggesting improved miner profitability and network stability.

Additionally, according to data from the Hashrate Index, hash price has continued to grind higher since the halving, which has an expected value of $0.052 TH/s, refers to the anticipated earnings for 1 TH/s of hashing power per day. This metric quantifies the revenue a miner can expect to generate from a specific amount of hashrate.

The post Bitcoin mining difficulty set for largest increase since October 2022 appeared first on CryptoSlate.