After a staggering rally exceeding 200% in the first two weeks of November, Dogecoin (DOGE) has entered a consolidation phase. Crypto analyst Kevin (@Kev_Capital_TA) suggests this could be the calm before the storm, hinting at a potential surge similar to a previous market cycle.

Is Dogecoin Heading Towards $4?

Kevin notes that in Dogecoin’s last cycle, the memecoin consolidated for 24 days after its first massive rally before ascending again to what he describes as the “macro golden pocket”—a price range between $3.80 and $4.00 which aligns with the 1.618 Fibonacci extension level.He believes that if DOGE follows a similar trajectory, price could skyrocket by the end of the week, potentially leading to a new all-time high (ATH) by the end of the month.

“In Dogecoin previous cycle when it had it’s first major leg up it consolidated for 24 days after that move before legging up again to the macro golden pocket. If DOGE were to follow a similar path that would mean that that the next leg will start by the end of the week and Doge will begin its path the macro golden pocket which is at $3.80-$4.00,” Kevin states.

However, he tempers expectations by acknowledging that such astronomical performance is hard to predict: “That would be astronomical performance though and it’s hard to make that type of call. Let’s start with making a new ATH by end of month like I predicted back in September.”

The current price position of Dogecoin is critical. Analyzing the daily DOGE/USD chart, Kevin observes that DOGE is “actively testing this major trend line of support on the daily RSI.” A breach of this support could “accelerate downside. Bulls wants this to hold if possible.”

He adds that while the RSI trend line held on the daily close, “it needs to bounce now if we are going to hold it.” The influence of Bitcoin’s (BTC) price movement could be pivotal: “If BTC can leg up, it would save us,” he notes.

Bitcoin itself has been consolidating since reaching a reported ATH of $99,588 on November 22, trading within a range of $90,800 to $98,500. Kevin describes a “tug of war between price action and this downward momentum on the indicators,” as the daily MACD shows increased downside momentum that the price isn’t reflecting. He emphasizes that “one of them is going to win eventually.”

On the 4-hour BTC/USD chart, Kevin highlights a symmetrical triangle pattern nearing its apex, suggesting an imminent breakout. Despite recent volatility, “BTC still has not broken down or even closed a 4HR candle below this trend line,” indicating strong support levels.

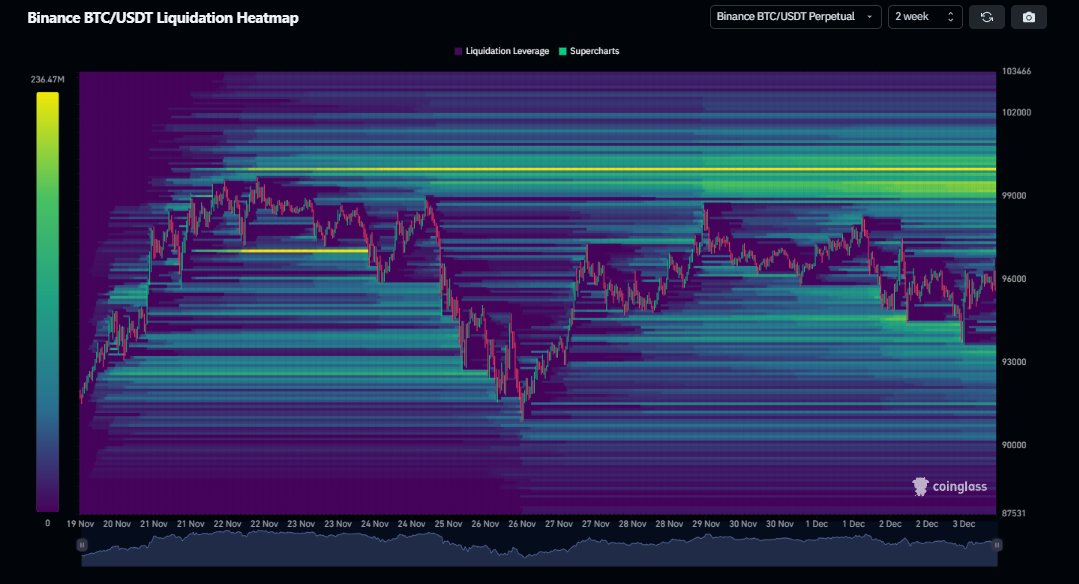

He also points out significant liquidation levels around $100,000, stating that “it’s only a matter of time before BTC decides to come up and take that liquidity at $100K.”

Such a move by Bitcoin could herald the next major price surge for Dogecoin, aligning with the patterns observed in the last cycle. Kevin’s analysis suggests that the interplay between Bitcoin and Dogecoin prices remains a crucial factor in predicting the next market movements.

At press time, DOGE traded at $0.4194.