Bitcoin heads into the final days of August with choppy, two-way trade and a familiar seasonal question hanging over it: will September once again be a drag—or a reset into Q4 strength? As of Wednesday, August 28, BTC hovers near $112,900 after a stop-start month that has bulls and bears circling the same range rather than breaking conviction.

Macro expectations, market positioning and Bitcoin’s own statistical quirks now converge in a narrow window before the Federal Reserve’s September policy meeting, making the next few weeks unusually consequential. The Fed’s rate-setting FOMC convenes September 16–17, and futures markets currently price a high probability of a cut, though officials continue to emphasize data-dependence.

Bitcoin’s September Seasonality

Seasonality is the first prism through which traders are reading the tape. Daan Crypto Trades captured the prevailing mood on X, noting a “choppy August” and pointing to a historical oddity: “During BTC’s history it has never closed both August & September in the green.” He added a pragmatic caveat about why this matters at all: “Whether you believe in seasonality or not, the thing that matters is if a lot of others do. And if enough people do, it can work as a self-fulfilling prophecy.”

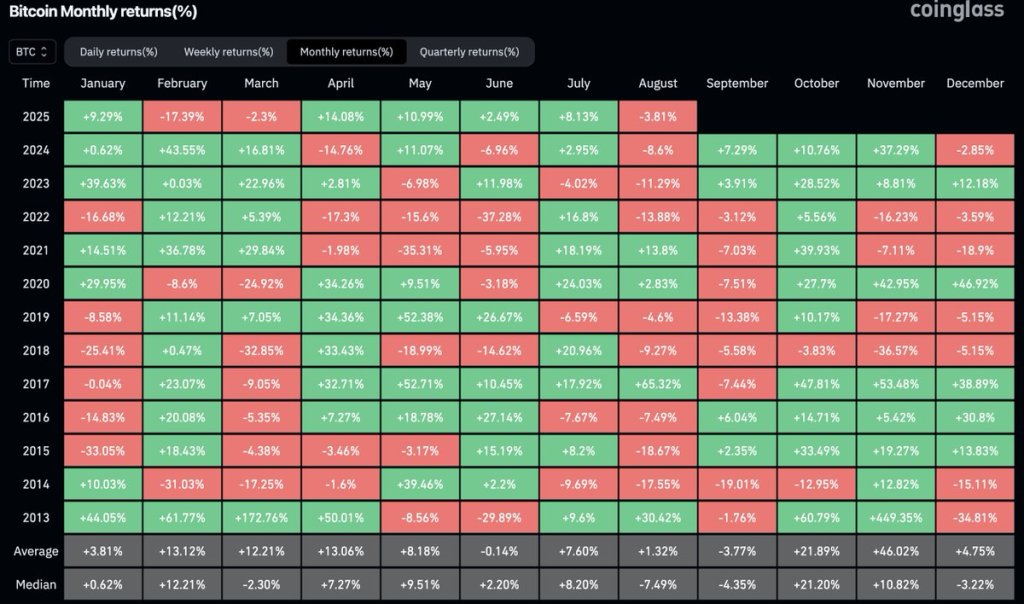

Independent datasets support the caution around September. CoinGlass-based compilations show that across the past 12 years, September has delivered an average negative return for BTC of roughly 3.8%, making it the worst month on the calendar. By contrast, Q4—and especially October and November—has historically outperformed on average, a profile that helps explain why traders often look to buy late-Q3 weakness.

However, there is a silver lining. Across Bitcoin’s history, September has closed in the green on four occasions—most notably in 2015 and 2016, and again in recent years. In 2023, BTC gained 3.9%, followed by a 7.3% rise in 2024.

Anthony Pompliano offered a broader framing this week, starting with the simple, if stubborn, statistics: “September is actually the only month of the year that historically is negative.” He attributes the late-summer doldrums in part to investor behavior—“Everyone is on vacation… not in front of their screens”—and in part to unresolved macro questions from traditional finance.

“There’s a lot of uncertainty still,” he said, even as “Jerome Powell has come out and said that he’s going to likely cut rates in September.” While markets have swiftly moved to price that outcome after the Jackson Hole speech, Fed officials have been careful to say the decision remains data-driven; major brokerages nonetheless shifted their base cases to a September cut following Powell’s labor-market warnings.

Pompliano’s second theme is about the path higher. A straight line from last November’s ~$69,000 to six-figure prices, he argued, would risk a “very big dump on the other side.” Instead, the market “wants… some sort of correction and resetting,” flushing leverage and “setting a foundation of the price.” He sketched a broad consolidation band—“call it $125,00 to maybe $110,000”—before buyers return.

Why is Bitcoin’s price going down?

The answer is simpler than you think. pic.twitter.com/lYqbqQJO9R

— Anthony Pompliano

(@APompliano) August 27, 2025

That sequencing rhymes with the way many systematic funds and discretionary crypto desks treat September: as a month to reduce risk into thin liquidity, then rebuild as Q4 flows approach. It also resonates with Daan Crypto Trades’ tactical lens: “Probably any larger dip in the next 1–2 weeks is the one to bid for the EOY bounce/rally to new all time highs in my opinion. We will see.”

All Eyes On The Fed

Macro timing could be the deciding factor. The FOMC’s September 16–17 meeting is now the key waypoint, with rate futures implying an ~85–90% chance of a cut and some odds of a second move by year-end.

Chair Powell signaled at Jackson Hole that labor-market risks have risen even as inflation risks linger, a balance that has pushed several Wall Street houses to bring forward their easing timelines. At the same time, senior Fed officials have stressed that every meeting is “live” and contingent on incoming data—an important caveat for risk assets that have already leaned into the dovish narrative. If a cut materializes, the question for BTC will be whether it validates the existing bid or merely meets expectations and fades.

This week’s immediate focus will fall on Friday’s release of the Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred gauge of inflation. The July PCE data will be published on August 29, providing policymakers and markets alike with a crucial read on both headline and core consumer price pressures.

From there, attention will pivot to the next major cluster of inflation releases landing just days before the September FOMC. On Thursday, September 11, the Bureau of Labor Statistics will publish the Consumer Price Index (CPI) and the Producer Price Index (PPI) for August. These will represent the final inflation checkpoints before the Fed convenes on September 16–17, meaning they could decisively shape the tone of the meeting.

At press time, BTC traded at $113,049.