Bitcoin may be demonstrating a slight rebound from its recent downward trend, which began after it hit a new all-time high, but discussions about a possible cycle top are intensifying within the community. While this discussion is accompanied by speculations about this bull cycle nearing its end, an analyst has highlighted a key metric that shows that the cycle could end sooner than anticipated.

Historic Fractals Flashes Bitcoin Bull Cycle End

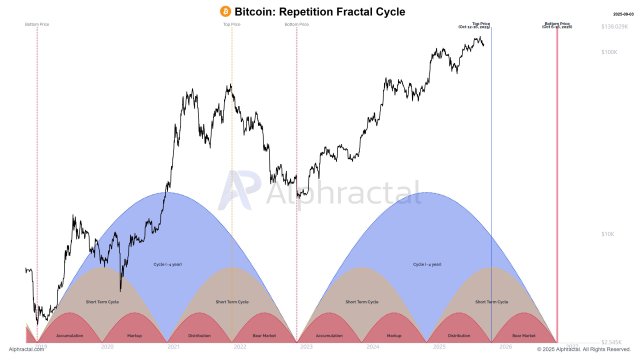

After dropping hard, Bitcoin has reclaimed the $112,000 price mark once again, suggesting renewed momentum fueled by bulls. In the meantime, Joao Wedson, a market expert and founder of Alphractal, has revealed that BTC’s price is once again drawing parallel to past fractal patterns, which is raising questions about whether the current bull cycle is nearing its peak.

Although some contend that macroeconomic tailwinds and robust institutional demand might prolong the current bull run, fractal indications signal caution. Tracking long-term market trends, Wedson outlined that the ongoing cycle is extremely close to its end based on past patterns.

In the X post, Wedson recalled his 2024 prediction where he pointed out that October 2025 could mark the completion of a fascinating Bitcoin fractal cycle. Should this forecast play out, it would mark the formal end of this chapter in Bitcoin’s history within the month.

Based on this trend, BTC has only a little over one month left before the bull run stops in this cycle. However, the expert believes there might still be just enough time for Bitcoin to fall to around $100,000 before soaring to over $140,000 in the same time frame.

The cycle may come to an end in October, but what really matters is whether this fractal will remain reliable in light of heavy speculation around the Exchange Traded-Funds (ETFs) and growing institutional demand.

Regardless of the fractal readings, whether the four-year cycle is over and whether Bitcoin will continue to increase indefinitely, or if 2025 marks the final breath before a sharp correction, remains Wedson’s main focus. This notion will be validated with prices potentially dropping below the $50,000 price level in the 2026 bear market.

Musk’s Suggestion Toward The Next Bear Market Phase

Wedson has pointed to the recent suggestion from Tesla’s CEO, Elon Musk, about US President Donald Trump triggering a bear market in Q4 2025, which is adding to the intrigue. According to the on-chain expert, Musk’s suggestion is not one to dismiss lightly, considering Trump’s position as the second most influential figure in the crypto sector.

Highlighting the importance of this statement, Wedson has drawn attention to the 2021 cycle, where Musk somehow foresaw Bitcoin’s precise peak at $69,000 months ahead of time with a single cryptic post.

While these bold predictions and trends seem highly likely to occur, the expert warned that they are just theories. He added that nobody might really know what is going to happen next except Satoshi Nakamoto, the anonymous founder of BTC.