CryptoQuant chief executive Ki Young Ju has revived a cycle-top debate with a fresh model-based call that puts Bitcoin’s upper bound at roughly $208,000 per coin. Sharing CryptoQuant’s “Price Prediction Based on Realized Cap” dashboard on X, Ki wrote: “Nobody cares about my calls anymore, but just saying I’m bullish on Bitcoin. Too much capital inflows onchain. Way too much.”

The post reprises his data-driven commentary from early 2024, when he argued that “#Bitcoin could reach $112K this year driven by ETF inflows, worst-case $55K.” That framework came conspicuously close: Bitcoin went on to register a 2024 high above $108,000, narrowly under his $112,000 projection.

Why Bitcoin Price Could Top Above $208,000

The chart Ki published on September 18 visualizes three time series derived from CryptoQuant’s realized-cap methodology: the spot price of BTC (black), a model “ceiling_price” (red) and a model “floor_price” (green).

As of 17 September 2025 (UTC), the panel annotated a spot marker at $116,453, a ceiling at $208,310 and a floor at $41,662, with the dashboard showing it was “last run” two hours prior. In other words, the model currently locates Bitcoin well above its inferred floor and still materially below the band it treats as an overvaluation zone.

The implication of Ki’s share is not a guarantee, but a statement that, given prevailing on-chain capital inflows and the realized-cap structure, the market has room—by this metric—to extend toward that $208,000 upper band.

Realized cap values the network by summing each coin at the price it last moved on-chain rather than the current market price, a construction that tends to track investor cost basis over time. CryptoQuant’s dashboard projects dynamic “floor” and “ceiling” bands around spots that, historically, have framed multi-year expansions and contractions.

Ki’s renewed bullishness ties those bands to what he describes as surging demand pressure visible in settlement flows and ETF-linked capital migration onto the network. The continuity with his February 2024 note is explicit: then he cited exchange-traded product inflows as the dominant driver of an advance toward six figures; now he points to “too much capital inflows onchain” while circulating a model that places the ceiling near $208,000.

It is noteworthy that Ki is not presenting an open-ended forecast but rather a model snapshot that updates with market structure. The same dashboard that prints a $208,310 ceiling today also marks the risk floor at $41,662, underscoring the spread of outcomes the realized-cap approach contemplates. His track record with the $112,000 “this year” guidance—followed by a print just above $108,000—will inevitably color how traders receive the new post.

But the framing remains analytical: a data readout of where Bitcoin sits relative to its realized-value envelope after a year and a half defined by US spot ETF adoption and deepening institutional participation. For now, Ki’s message is simple and blunt—“I’m bullish on Bitcoin”—and anchored in the same on-chain lens he used 10 months ahead of the 2024 peak.

Whether the market ultimately approaches the model’s $208,000 ceiling will depend on how those on-chain inflows evolve against macro liquidity, ETF and corporate treasury demand as well as miners’ supply behavior. What his chart makes clear is that, by CryptoQuant’s realized-cap bands, Bitcoin has not yet tested the top of its statistical range in this cycle.

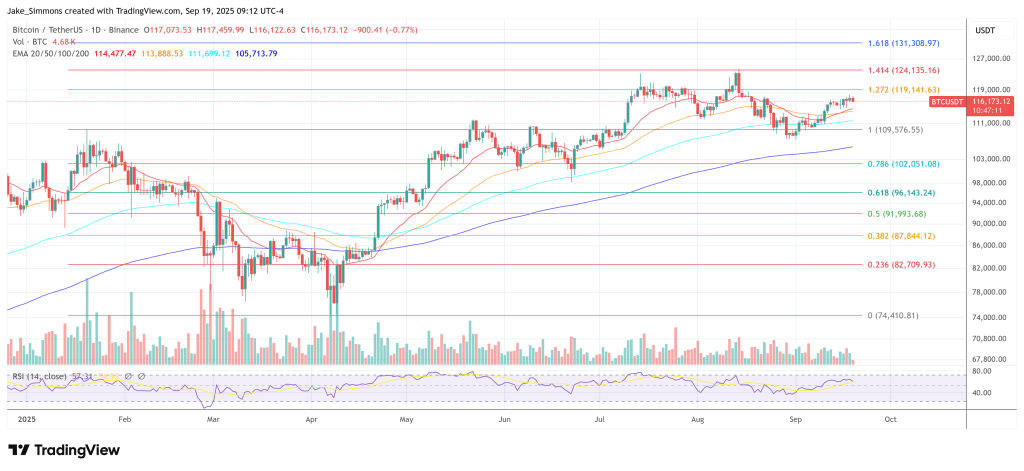

At press time, BTC traded at $116,173.