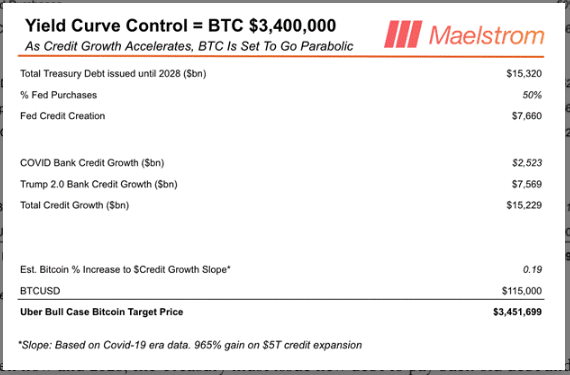

According to Former BitMEX CEO and Maelstrom Fund manager Arthur Hayes, Bitcoin could hit $3.4 million By 2028. That figure sits on a chain of big assumptions about credit growth, debt buying and policy shifts.

Hayes pins his math to an estimated $15.3 trillion in combined Federal Reserve and commercial bank credit growth through 2028, with the Fed buying 50% of new Treasury debt and bank credit rising by $7.57 trillion.

How The Fed Could Shift

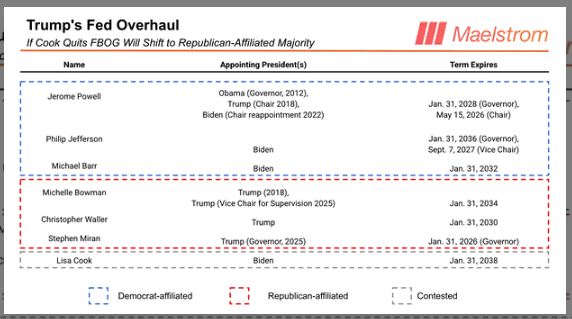

Hayes argues that control of the Fed matters more than usual. He says US President Donald Trump’s team, led by Treasury Secretary Scott Bessent, plans to reshape Federal Reserve policy through board picks and regulatory pressure.

The plan would need four seats on the Board of Governors to swing votes on short-term rates by using Interest on Reserve Balances rules.

Hayes points to Governors Bowman and Waller and the newly confirmed Stephen Miran as potential allies, which he says brings the Trump camp to three supporters.

He also predicts pressure on Governor Lisa Cook, including a DOJ review of mortgage fraud claims that, Hayes says, could push her out by early 2026.

Reports say the administration aims to replace some regional Fed presidents around the February 2026 elections.

As promised “Four, Seven” discusses the Trump takeover of the Fed and is the corresponding essay to my KBW speech this morning.https://t.co/NV2XQei69d pic.twitter.com/9NKC8uq7An

— Arthur Hayes (@CryptoHayes) September 23, 2025

Stablecoin Flows And Eurodollar Fallout

According To Hayes, the broader funding shift would come from Eurodollars and foreign deposits. He estimates $10-13 trillion could be steered away from offshore dollar deposits by threats to withdraw US support during crises.

That money, plus other overseas holdings, forms what Hayes calls a $34 trillion pool of non-dollar deposits that stablecoin firms could target.

He expects compliant stablecoin issuers such as Tether—who park reserves in US bank deposits and Treasury bills—to absorb much of that flow.

Hayes goes further, suggesting social media wallets could pull in $21 trillion in Global South retail deposits and that apps like WhatsApp might become a route for people to hold dollar-pegged stablecoins instead of local bank accounts.

Stablecoins And Treasury Demand

Hayes outlines a mechanics of demand. If depositors shift into stablecoins that hold Treasuries and bank deposits, demand for short-term US paper could become less price-sensitive.

He says adding roughly $16.74 trillion in European bank deposits helps build a total addressable market of about $34 trillion for stablecoin conversion.

In that scenario, the Treasury could offer yields below Fed Funds and still find buyers—weakening central banks’ hands abroad and giving Washington new influence over short-term rates.

Featured image from Unsplash, chart from TradingView