The post Looking For The Next Millionaire Maker? These 3 Cryptos Could Surpass Dogecoin’s 36,000% Rally appeared first on Coinpedia Fintech News

Back in 2013, a little joke called Dogecoin shocked the world with a 36,000% rally. What started as meme culture turned into one of the biggest wealth-creation moments in crypto. Fast forward to today, and the hunt is on for the next millionaire-maker. Which projects could follow Dogecoin’s footsteps and deliver massive upside? Among the names being whispered across crypto communities, three stand out: MYX Finance (MYX), Pump.fun (PUMP), and Paydax Protocol (PDP). Each offers a very different path — let’s break them down.

Pump.fun (PUMP): The Meme Factory

If MYX Finance (MYX) is all about traders, Pump.fun (PUMP) is all about memes, much like Dogecoin. Built on Solana, it acts as a crypto launchpad for viral tokens. Anyone can spin up a coin in minutes, and if it goes viral on X or Telegram, the upside can be explosive.

he PUMP token benefits from this frenzy, since platform activity drives its demand. But with little real-world use, it’s highly tied to sentiment. For investors, Pump.fun (PUMP) offers quick flips if the right meme takes off. But just like Dogecoin’s early days, Pump.fun’s (PUMP) sustainability is questionable.

Paydax Protocol (PDP): The People’s DeFi Bank

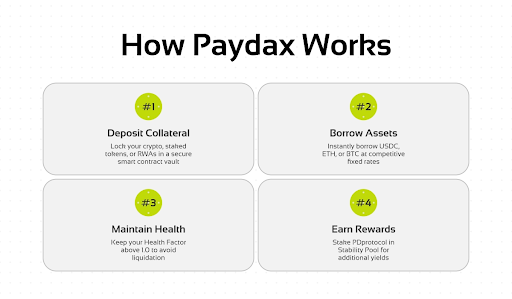

Paydax Protocol (PDP) is the project analysts rank highest among the three. Unlike MYX Finance (MYX) and Pump.fun (PUMP), Paydax Protocol (PDP) is building infrastructure that solves real problems in crypto. The pain point is simple: most investors can look rich on paper but struggle to access liquidity without selling their assets. Paydax Protocol (PDP) addresses this in the following ways:

- Borrowing Without Selling: Users can borrow stablecoins against crypto or tokenized real-world assets, from Bitcoin to gold to luxury collectibles, while keeping ownership intact.

Source: Paydax Protocol

- Fair Terms: Loan-to-value ratios up to 97% and fixed APR options bring clarity and flexibility rarely seen in either DeFi or traditional banking.

- Layered Yields: Lenders earn attractive yields. Peer-to-peer loans offer up to 15.2% APY. The project’s decentralized insurance system, the Redemption Pool, pushes returns as high as 20%. Add in leveraged yield farming above 40%, and Paydax Protocol (PDP) offers multiple ways to earn that go beyond hype.

- Security & Trust: Partnerships with Brink’s, and Sotheby’s, plus audits from Assure DeFi and KYC verification, give Paydax Protocol (PDP) institutional-grade credibility. Additionally, the team is fully doxxed, reinforcing their transparency and assuring investors of the project’s credibility.

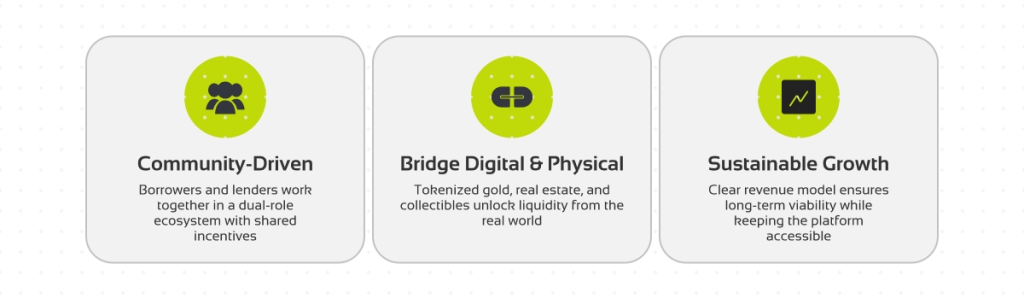

The real edge lies in the PDP token. Unlike Dogecoin, MYX Finance (MYX), and Pump.fun (PUMP), PDP is designed for sustained demand. It powers governance, shares protocol fees with stakers, and unlocks better borrowing terms at higher tiers. Stakers in the Stability Pool also absorb under-collateralized loans, earning liquidation bonuses and discounted assets. This enforced utility ensures PDP remains essential to the Paydax Protocol ecosystem.

MYX Finance (MYX): High-Risk Trading On Steroids

Dogecoin made the crypto community laugh, but MYX Finance (MYX) is the crypto built for serious traders who thrive on volatility. It runs a cross-chain perpetuals exchange with up to 125× leverage, promising lightning-fast execution and minimal slippage.

The MYX token fuels this system, driving trading, liquidity, and governance. As trading volumes rise, so should demand for MYX. But the risks are obvious: leverage cuts both ways, and upcoming token unlocks plus insider allocations could hit prices hard. For thrill-seekers, MYX Finance (MYX) might deliver fireworks, but it’s a gamble, not a guarantee.

Why PDP Could Outlast The Hype

Every bull run has its trading stars and meme winners, but the survivors are tokens tied to real demand. Paydax Protocol’s (PDP) design ensures it isn’t just another speculative bet — it’s the engine of a growing financial system. Governance, revenue sharing, staking, and insurance all require PDP, which means the token’s role grows as adoption does.

That’s a major difference from MYX Finance (MYX) and Pump.fun (PUMP), where token demand hinges on traders or memes staying hot. PDP has the mechanics to thrive in both hype cycles and quieter markets, giving it the staying power to become a long-term player in crypto.

Source: Paydax Protocol

Why The Timing Matters

Dogecoin’s 36,000% rally happened because people got in early. Timing turned a meme into a millionaire-maker. In crypto, waiting often means paying more later. Another Dogecoin-esque rally could already be in motion, the question is whether you’ll catch it at the start.

Today, PDP sits at just $0.015 in presale, with stage-based price increases ahead. Investors can chase short-term thrills with MYX Finance (MYX) and Pump.fun (PUMP), or back a token like PDP that’s tied to real-world utility and long-term growth.

Join The Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper