The post BTC Price and the 600K Transaction Threshold: Tracking Bitcoin’s Hidden Momentum Signal appeared first on Coinpedia Fintech News

Recently, an expert outlined an interesting yet possible BTC price theory that’s attracting attention. This theory is increasingly being influenced by a hidden yet powerful signal thats observed from transaction counts crossing the 600K threshold.

On-chain data highlights a direct correlation between Bitcoin’s activity level and potential price surges, while institutional accumulation continues to strengthen the long-term BTC price forecast narratives.

The 600K Transaction Count and BTC Price

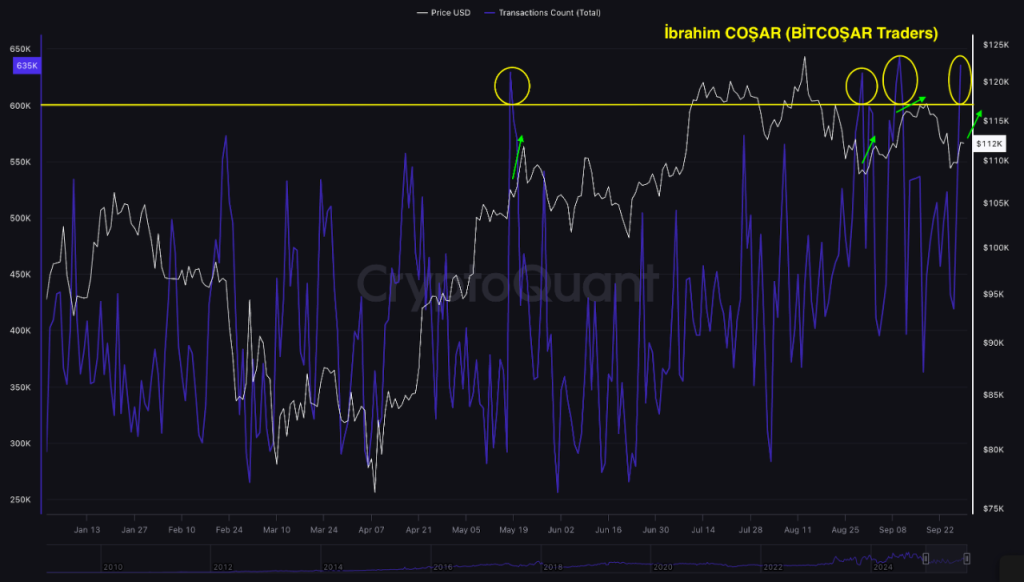

Recent data from CryptoQuant insights has highlighted a striking pattern, as its found whenever Bitcoin’s total transaction count surpasses or nears 600,000, BTC price USD tends to ignite an upward trend.

This threshold, visible since late 2024, almost acts as a trigger for renewed momentum. The Bitcoin price chart reinforces how increased network usage directly aligns with bullish activity.

Why Transaction Activity Matters

Transaction counts serve as a proxy for demand within Bitcoin crypto. A rise in activity demonstrates that more users are engaging with the network, adding vibrancy and liquidity.

As usage expands, buyer pressure grows, often sparking rallies.

In essence, the expert sees this 600K level as a “heartbeat indicator” for BTC price. This will signal when the market is poised for acceleration.

Institutional Accumulation Strengthens Outlook

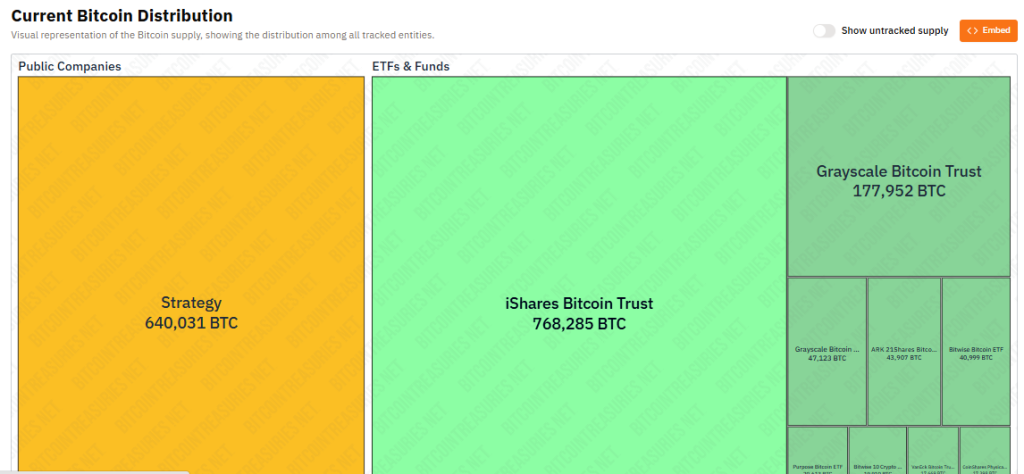

Alongside on-chain momentum, institutional investors continue to buy the dip. MicroStrategy revealed a fresh purchase of 196 BTC for $22.1 million at an average of $113,048 per coin. This brings its total holdings to 640,031 BTC acquired at a cost basis of $73,983 per Bitcoin. The accumulation underscores long-term conviction, reinforcing bullish BTC price prediction narratives.

In comparison, Marathon Digital Holdings sits second among public companies with 52,477 BTC.

Beyond corporate treasuries, ETFs and trusts play a major role in BTC price support.

BlackRock’s iShares Bitcoin Trust leads with 768,285 BTC under management, while Grayscale’s Bitcoin Trust holds 177,952 BTC.

These massive allocations illustrate the growing institutional footprint in Bitcoin crypto and its impact on BTC price forecast scenarios.

This suggests that another leg up beyond the August all-time high is a possibility, and the round number of $130,000 would be the first, and potentially most conservative, target to aim for. However, caution is still warranted, and investors should avoid FOMO.