The post Bitcoin Bull Run To Hit on October 27th, Mirroring Historic Cycle appeared first on Coinpedia Fintech News

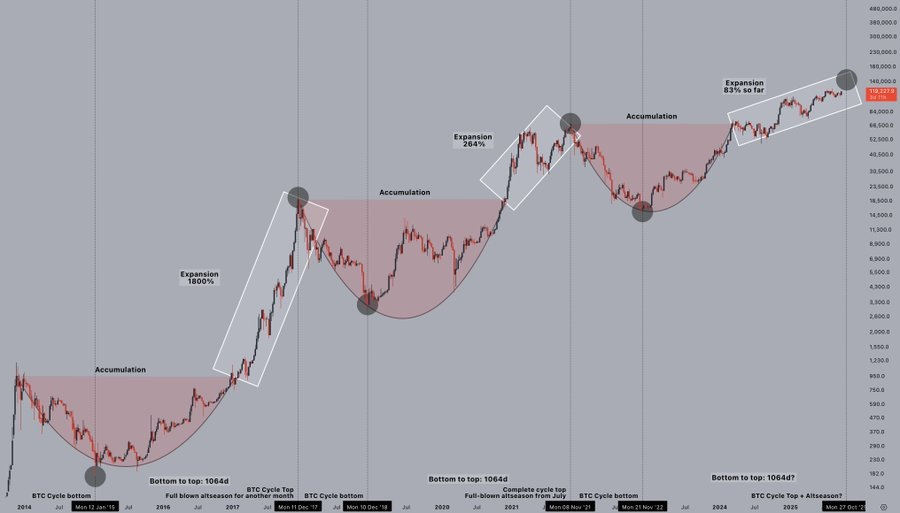

Bitcoin has a way of moving in rhythms, and many traders are paying close attention to those patterns right now. Crypto analyst CryptoJelle recently pointed out that Bitcoin’s past two market cycles lasted exactly 1,064 days from bottom to peak.

If history rhymes once again, the current cycle could reach its top around October 27th, 2025.

The Cycle Pattern: 1,064 Days to the Top

According to Jelle, the last two Bitcoin cycles reached their all-time highs exactly 1,064 days after their respective bear market bottoms.

However, the first cycle in 2015–2017 saw Bitcoin soar from under $500 to nearly $20,000, a gain of over 1,800%. Meanwhile, the second cycle (2018–2021) climbed from $3,100 to $69,000, delivering nearly 2,100% growth.

The current cycle began after Bitcoin dropped below $16,000 in November 2022. Since then, BTC has rebounded sharply, surging over 83%, and recently trading above $120,000.

Institutional Influence and Macro Factors

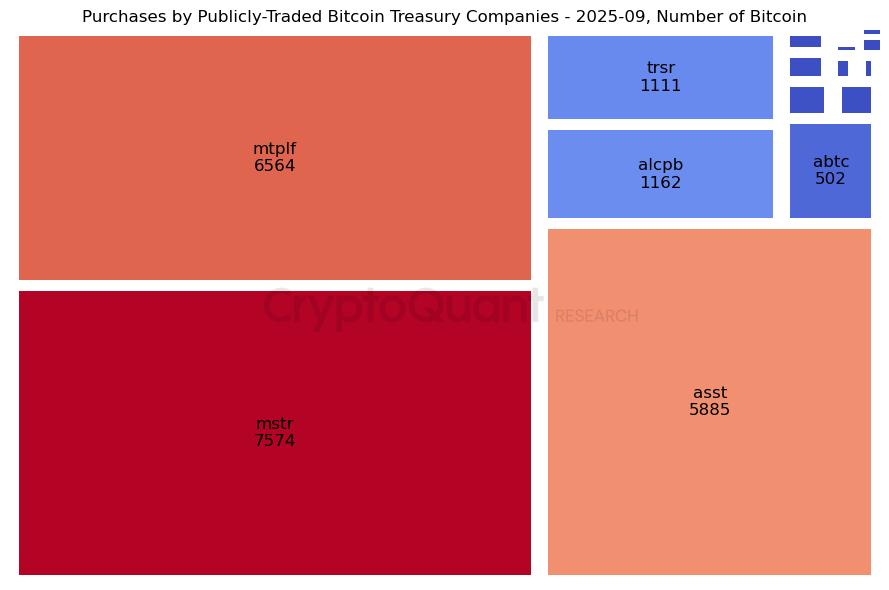

Unlike previous cycles driven mostly by retail traders, 2025 is seeing strong institutional activity, including ETF launches and corporate treasury purchases.

In September, publicly-traded companies bought Bitcoin in notable amounts:

- Strategy: 7.6K BTC

- Metaplanet: 6.6K BTC (+5.3K announced yesterday)

- Strive: 5.9K BTC (via PIPE)

Experts warn that heavy institutional involvement could stretch the cycle or change how the peak unfolds, possibly shifting a sharp, historic spike into a slower, more gradual top.

What About Altcoins?

Jelle doesn’t stop with Bitcoin. He notes that even after Bitcoin peaks, altcoins often have room to run. Historically, smaller coins tend to extend their rallies a few weeks beyond Bitcoin’s top.

That means altcoins could potentially keep climbing well into late November, giving traders extra time to capitalize on the trend.

If Bitcoin follows history, October could be a key turning point for BTC and the crypto market, with altcoins likely gaining, but traders should stay cautious.