Investment flows into crypto exchange-traded products surged to a record level last week, signaling strong demand from large investors.

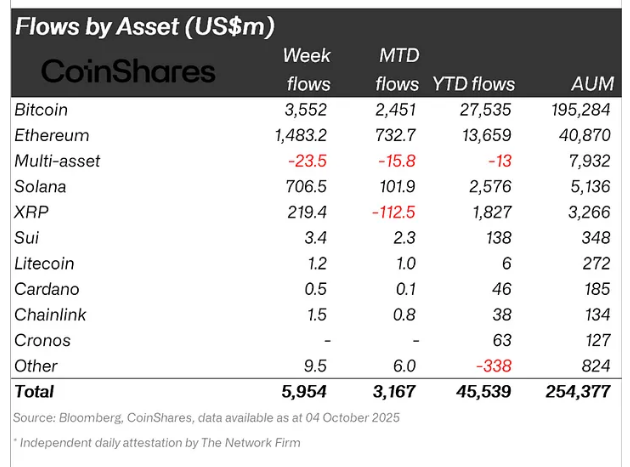

According to CoinShares, crypto ETPs drew close to $6 billion in new money in the week that ended Friday, the biggest weekly inflow on record. Bitcoin led the move, taking in $3.6 billion alone as traders and funds piled into BTC offerings.

Bitcoin Dominates The Week’s Inflows

Reports have disclosed that the latest total beat the prior high of $4.4 billion by about 35%. The week’s gains were not evenly spread. While earlier records had been split more between Bitcoin and Ether, this time Bitcoin funds attracted the lion’s share.

Ether ETPs still registered strong interest, adding $1.48 billion and bringing year-to-date inflows for Ether to roughly $13.7 billion. Solana ETPs pulled in $706.5 million, and XRP products saw $219 million. These figures show that investors are putting fresh capital into a range of crypto products, even as BTC takes the lead.

Macro Headlines Drove Fresh Buying

Based on reports, traders pointed to a mix of macro events that likely pushed allocations into crypto. A recent cut to interest rates by the Fed, weaker-than-expected employment numbers, and concerns about a US government shutdown were all cited by market watchers as triggers.

Some investors treated crypto as an alternative play while political and economic worries persisted. Markets reacted fast. Bitcoin climbed above $125,000 during the week, a move that pushed total crypto assets under management past $250 billion, reaching a little over $254 billion.

Technical Readings And Analyst Targets Add Fuel

According to market analysts and on-chain data observers, the supply of Bitcoin on exchanges has dropped to levels not seen in six years. That trend is often read as holders choosing to keep coins off market platforms, which can reduce selling pressure.

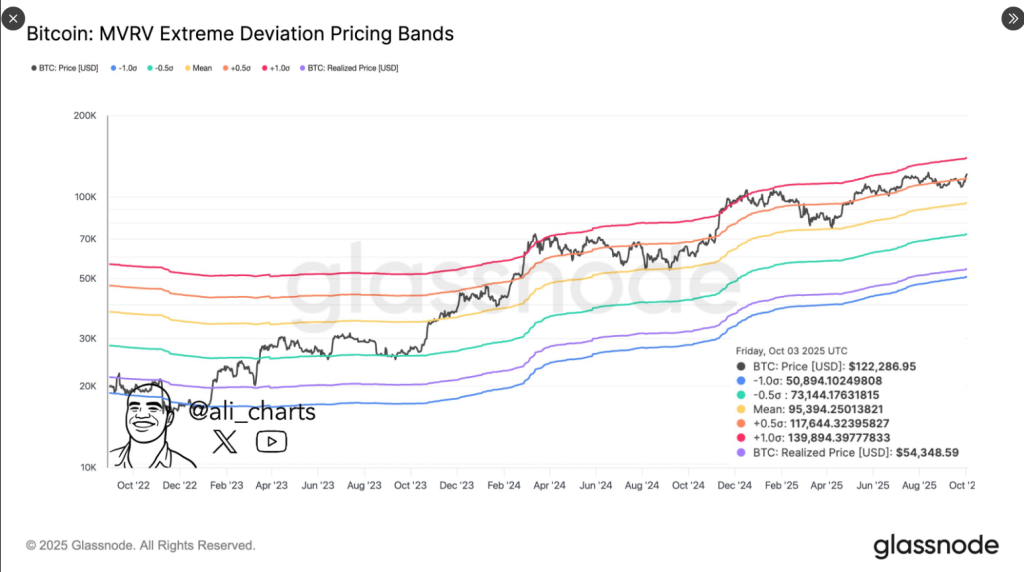

As long as Bitcoin $BTC holds above $117,650, the Pricing Bands point to $139,800 next. pic.twitter.com/DTPtz3Wj52

— Ali (@ali_charts) October 4, 2025

Glassnode’s pricing bands were used by some analysts to argue that Bitcoin was holding a key support area and that upside toward $139,800 was possible if that support stayed intact.

Another forecast mentioned a lower time horizon at around $135,000. These targets were used in the market commentary, and they helped shape market expectations during the move up.

Trading flows, too, indicated a clear bias: investors were generally long. As James Butterfill, head of research at CoinShares, describes, buyers did not even turn to short investment products at price highs. If this behavior does not reflect an intent to hedge against the uptick, then it reflects confidence that the asset continues to appreciate.

Featured image from Unsplash, chart from TradingView