The post Bitcoin Price Drops 4% Today as Old Whales Reawaken Amid Leverage Flush appeared first on Coinpedia Fintech News

Bitcoin (BTC) price experienced a flash selloff on Tuesday after hitting its all-time high (ATH) of above $126k on Monday. The flagship coin dropped over 3% in the past 24 hours to reach a range low of about $120,681 before rebounding to trade about $122k at press time.

The wider altcoin market – with the exclusion of Binance Coin (BNB), PancakeSwap (CAKE), and a few other altcoins – dropped in tandem with Bitcoin. As such, the total crypto market cap had slipped 3.5% to hover about $4.16 trillion at press time.

Major Reasons Why Bitcoin Price Dropped Today

High Leveraged Flush

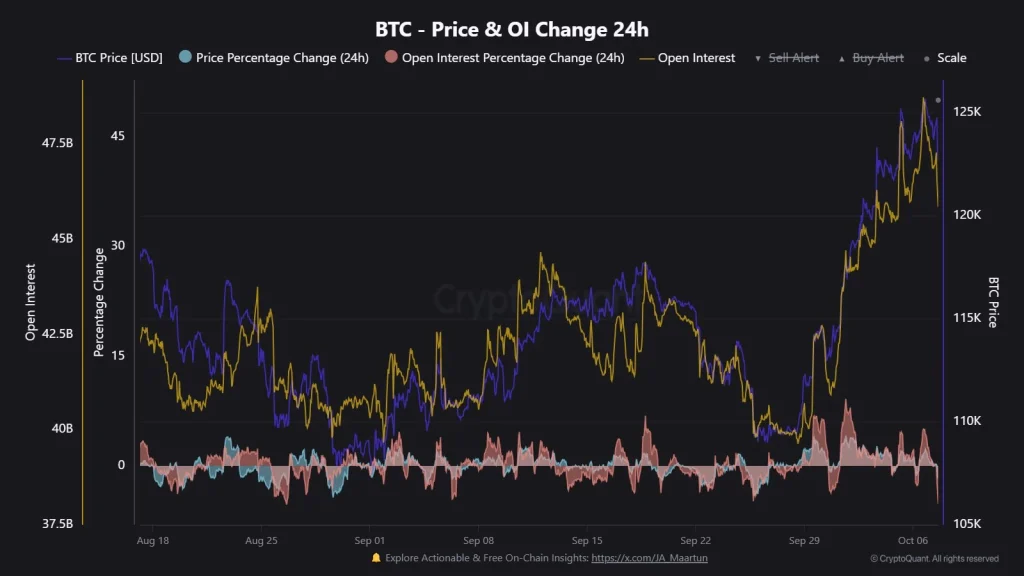

Following the sudden crypto drop on Tuesday, more than $625 million was liquidated from leveraged traders, with the majority involving long traders. According to market data analysis from CryptoQuant, Bitcoin’s Open Interests (OI) dropped over 5%, the biggest single-day wipeout in six weeks.

Old Whales Reawakening

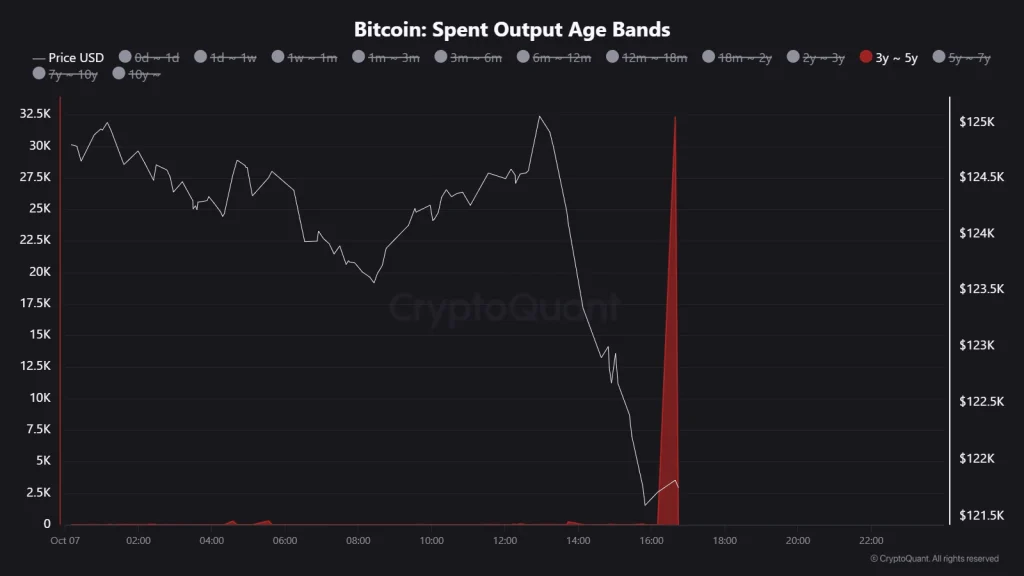

After BTC price surged to a new ATH on Monday, on-chain data analysis showed an increase in profit-taking. According to data from CryptoQuant roughly 15k BTC, valued at nearly $2 billion, was deposited into crypto exchanges during the last 24 hours.

On Tuesday, the largest Bitcoin whale movement in 2025 was recorded, whereby wallets that were dormant for 3-5 years moved 32,322 BTCs valued at about $4 billion.

What’s Next for BTC Price?

Bitcoin price has been under the influence of high demand from institutional investors, a supportive macroeconomic backdrop, and amid the ‘Uptober’ bullish sentiment.

From a technical analysis standpoint, BTC price is well-positioned to rebound towards its parabolic phase in the coming weeks. Moreover, BTC price is the digital gold, and the gold price has been in a parabolic rally since mid-August. Additionally, the global money supply has increased gradually in the recent past, which is bullish for Bitcoin and the wider crypto market.