Bitcoin is facing a critical test after a sharp but modest correction from its all-time highs, falling from $126,000 to around $120,000. While bulls remain in control of the broader trend, market sentiment is starting to show signs of uncertainty, with some analysts suggesting that Bitcoin could be nearing a cycle top. Others, however, maintain a more optimistic view, arguing that the market is still in price discovery mode and preparing for another leg higher.

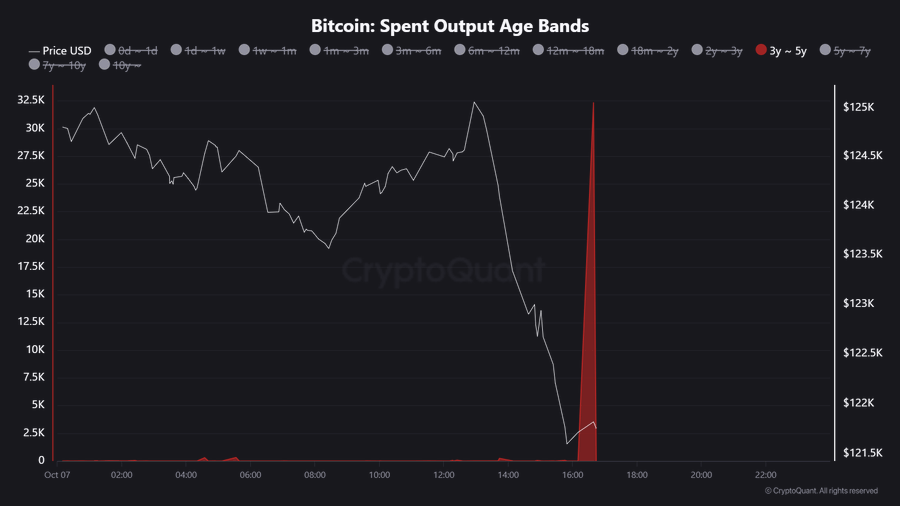

Amid this debate, top analyst Darkfost has cautioned investors about a recent wave of misleading onchain interpretations. Reports circulating across social media claimed that over 32,000 BTC, worth nearly $4 billion, moved onchain from wallets dormant for 3–5 years. However, Darkfost clarified that this information is incorrect and stems from a misunderstanding of Bitcoin’s UTXO (Unspent Transaction Output) mechanism.

He explains that while it appears as if tens of thousands of BTC were moved, the actual amount transferred was far smaller, caused by how Bitcoin’s transaction structure records activity. Darkfost’s clarification serves as a reminder to approach sensational onchain news with caution — especially during volatile market phases when fear and euphoria can distort analysis.

Analyst Clarifies Misleading Whale Movement Data

Darkfost shed light on the confusion surrounding the reported movement of 32,000 BTC from wallets that had been dormant for years. He explains that the whale involved — identified as the same trader who recently sold BTC on Hyperliquid to buy ETH — only moved 3,000 BTC, not 32,000.

The confusion arises because the whale’s original UTXO contained 32,321 BTC, which had been inactive for over three years. Since Bitcoin’s UTXO system doesn’t allow partial spending, the entire output had to be spent to move just the 3,000 BTC. After the transaction, the wallet still holds 29,321 BTC, meaning that only about 10% of the total balance actually changed hands.

Darkfost confirmed that this particular address hadn’t shown any outflows in years, adding to the intrigue. While large dormant wallets becoming active can sometimes signal selling pressure, he emphasized that the onchain data must be interpreted carefully to avoid exaggerating market activity.

In this case, the supposed “massive move” was simply a technical artifact of Bitcoin’s transaction structure, not an indication of large-scale selling. Still, analysts and traders are keeping a close eye on similar movements, as reactivated whale addresses can sometimes precede market volatility. Darkfost’s clarification serves as a valuable reminder that context and technical understanding are essential when analyzing on-chain data — especially in times when misinformation can easily fuel panic or speculation across the crypto market.

Bitcoin Holds Key Support After Sharp Pullback

Bitcoin is currently trading around $122,700, showing resilience after a sharp correction from its all-time high near $126,200. The 4-hour chart reveals that BTC successfully held above the $120,000 support zone, suggesting that buyers continue to defend key levels despite short-term volatility. The yellow line at $117,500 remains a crucial level — previously a resistance — now acting as the main structural support in case of further downside.

The short-term moving averages (blue and red lines) show that the price remains above both the 50-period and 200-period moving averages, confirming a bullish structure. The recent bounce from $121,000 aligns with strong demand absorption, which often precedes another upward attempt. If Bitcoin breaks above $124,500, it could signal renewed momentum toward retesting the $126,000 ATH, potentially leading to price discovery.

However, a rejection near current levels could lead to a deeper retest toward the $120,000–$118,000 range, where the next consolidation phase may form. Overall, the chart indicates that Bitcoin’s uptrend remains intact, but bulls need a decisive close above $125,000 to confirm continuation. The market appears to be in a healthy pause after a steep rally, preparing for its next decisive move.

Featured image from ChatGPT, chart from TradingView.com