The post Ethereum Price Loses Key Support, Can Bulls Defend $4,300 Support? appeared first on Coinpedia Fintech News

After an overnight drop of 3.28%, the Ethereum price is wrestling against the selling pressure. The breach of the crucial $4,500 support level forced stop-loss orders to activate, causing a wave of cascading liquidations. Alongside macroeconomic headwinds from a stronger U.S. dollar and lingering uncertainty around Federal Reserve policy, market volatility intensified. As traders rotated capital toward BNB Chain, chasing lower fees and heightened on-chain activity.

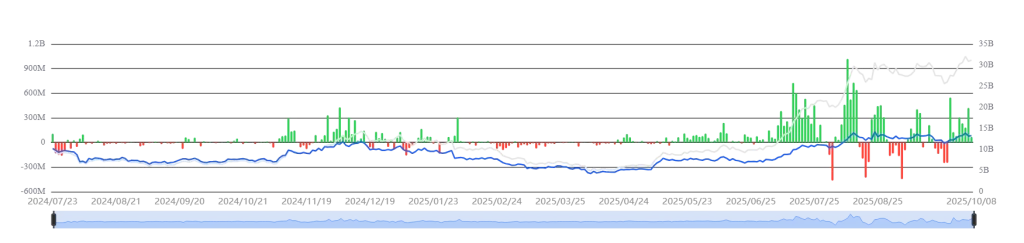

On-Chain Signals: ETF Flows & Liquidations

Recent ETF and liquidation charts paint a stark picture of increased volatility across Ethereum’s derivatives landscape. After failing to reclaim its 7-day SMA at $4,524, the asset plummeted past the Fibonacci 23.6% retracement level at $4,542, resulting in over $109.6 million in long position liquidations within 24 hours.

ETF inflows appear to be stalling, indicating cautious institutional sentiment. Meanwhile, market cap eroded to $523.56 billion, down 3.4%. Previous strength from ETF demand has taken a back seat, and traders are now readjusting risk in favor of alternative chains.

ETH Price Analysis:

Ethereum’s latest selloff has invalidated multiple technical support zones. The asset trades near $4,337.51, off 3.4% for the day and 1.12% on the week. With the average true high at $4,556.22 and a 24-hour low of $4,324.88, the price is consolidating near the key breakdown area. The loss of support at $4,500 exposes the Ethereum price to further downside, with immediate support eyed at $4,308.81. That being said, a deeper risk toward $4,101.88 is possible if bearish momentum sustains.

The RSI currently hovers around neutral territory but leans toward bearishness, signaling potential for continued selling. If ETH remains below its critical averages, retests of monthly lows and a broader crypto correction are possible. The all-time high of $4,953.73 remains distant, with upside capped unless risk sentiment turns.

FAQs

Given the recent breakdown below $4,500, the Ethereum price faces elevated short-term risk, but long-term prospects remain tied to fundamentals.

Buying after sharp corrections carries risk, Ethereum could see further downside if market sentiment stays bearish. Waiting for clear signs of support or strong on-chain flows is advised.

If bullish trends and ETF momentum return, we expect the Ethereum price to hit a maximum of $9,428.11 by the end of 2025.