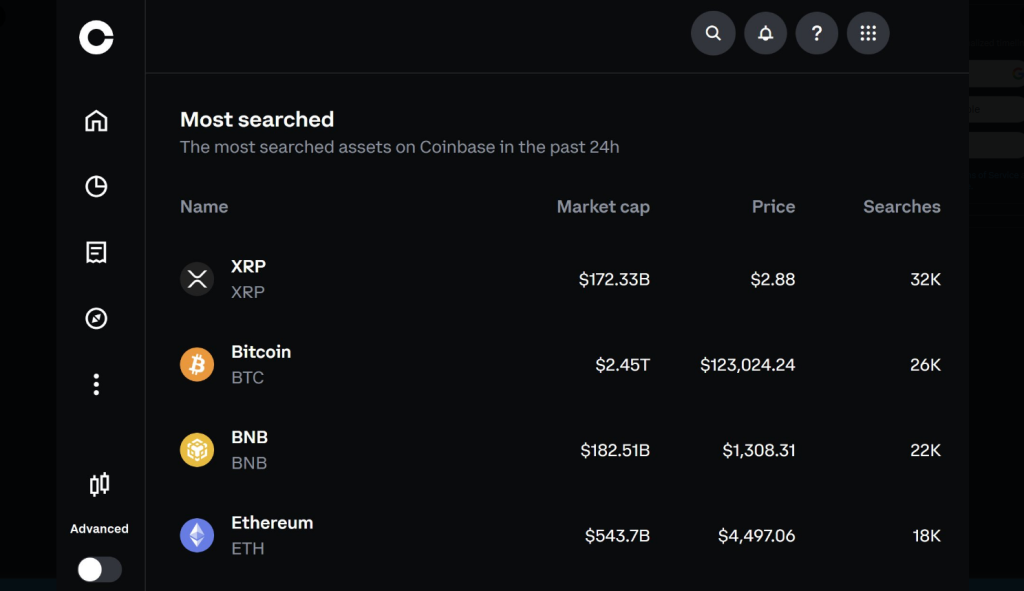

According to Coinbase’s internal metrics shared by community figure Moonkie, XRP drew 32,000 searches on the exchange in the past 24 hours, making it the most searched token on the platform.

Bitcoin trailed with 26,000 searches, BNB pulled 22,000, and Ethereum recorded 18,000. The spike in search activity comes amid rising debate about whether retail interest will turn into real buying pressure.

Search Interest Surges

Based on reports, search trends can sometimes foreshadow market moves. Traders and new investors often look up tokens before placing orders.

Some observers tied the rush of queries to hopes for an XRP-focused spot ETF, with a final SEC decision originally expected later this month.

The US government shutdown has been flagged as a factor that could delay the regulator’s timeline. Also, the SEC’s adoption of Generic Listing Standards has blurred strict deadlines, leaving approval windows more flexible than before.

XRP is the most searched asset on Coinbase in the past 24h pic.twitter.com/bRsAnZCCqH

— moonkie

(@xmoonkie) October 8, 2025

Strong Yearly Gains, Recent Pullback

XRP has enjoyed a remarkable run over the past year. Price climbed from about $0.51 to $2.82, a jump that equals roughly 440% growth.

Reports show XRP outpaced Bitcoin by 162% and beat Ethereum by 188% over that same period, numbers that have captured investor attention. Still, momentum has cooled a bit.

XRP slipped below $3 and is trading at $2.81 now, down 5% across the last week and down 1.05% in the past 24 hours.

Trading Volume Lags

Volume figures underline mixed market signals. Market screens show XRP’s 24-hour volume fell to $4.50 billion. Of that, $180 million — about 3.90% — was recorded on Coinbase.

On the exchange, XRP ranks as the fourth most traded asset, behind Solana, Ethereum, and Bitcoin, which posted $265 million, $578 million, and $716 million respectively.

Coinbase’s reserve of XRP rose to 16 million tokens, marking a 3% increase when compared with the figure reported on October 6, 2025.

Whales Are Selling

Large holders are adding pressure. Based on Whale Flow data using a 30-day moving average, roughly $50 million worth of XRP leaves whale wallets every day.

For this metric, whales are those holding more than 1,000 tokens. CryptoQuant charts have shown sustained net outflows since early 2024, which analysts say could keep the market biased toward selling even if ETF news turns out positive.

Featured image from Getty Images, chart from TradingView