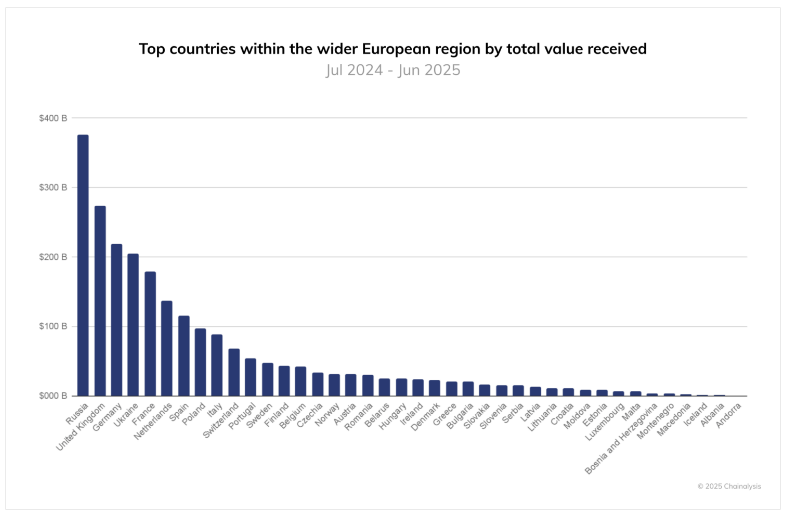

According to Chainalysis, Russia received over $376 billion in on-chain crypto transfers between July 2024 and June 2025, ahead of the United Kingdom’s $273 billion.

That metric measures value moved into wallets and addresses tied to Russia during the 12-month window. Based on reports, the figure was driven by a mix of very large transfers, rising DeFi activity, and growing use of rouble-linked stablecoins.

Big Transfers And DeFi Activity

Large transactions appear to have pushed the overall totals up. Transfers greater than $10 million rose by 86% in Russia over the year, a much faster increase than seen across other European markets.

DeFi activity also expanded sharply — rising roughly eightfold in early 2025 compared with mid-2023 levels before settling at about 3.5 times that earlier baseline. Those moves suggest that bigger players, including funds and institutional traders, are moving significant amounts on-chain.

Stablecoins Drive Cross-Border Movement

Reports have pointed to a rouble-pegged stablecoin, known as A7A5, as one of the rails used for cross-border settlement.

That token reached roughly $500 million in market capitalization in early October, and on-chain transfers tied to it topped $40 billion in recent months, according to blockchain trackers.

US and European officials have raised concerns about connections between some stablecoin flows and sanctioned entities, which has drawn extra attention to where the money is coming from and where it’s going.

Regulatory Shifts And Digital Ruble

Russia is also preparing formal digital money options. Based on reports, the central bank plans a national digital ruble launch on September 1, 2026, and lawmakers have discussed rules that could require major companies to support the CBDC from the start.

There has been talk of a national crypto bank and measures to open retail access to trading, steps that might shift some informal activity into regulated channels.

Pressure Points And Practical Effects

High transaction volume does not mean mass retail adoption across the population. Much of the growth is concentrated in wholesale flows — trading desks, settlement transfers, and firms using stablecoin rails.

That concentration makes the aggregate numbers large and real, but it also means the typical consumer may not be using crypto for routine payments. Still, the A7A5 case shows how quickly on-chain rails can scale when other payment routes are constrained.

Featured image from Unsplash, chart from TradingView