The cryptocurrency market has been hit with another wave of sell pressure as both the Bitcoin and Ethereum prices plunged sharply, triggering widespread panic and uncertainty. With over $536 million in Spot Bitcoin ETF outflows in a single day, the downturn has sparked renewed fears of an extended bearish phase. Analysts are calling this correction a “Bloody Friday,” a less but still severe reflection of last week’s brutal selloff that wiped billions in the market and saw BTC and ETH spiraling downwards.

ETF Outflows Trigger Bitcoin And Ethereum Price Crash

The recent crash in Bitcoin and Ethereum prices is being attributed to recent large-scale outflows from US Spot Bitcoin ETFs. Crypto analyst Jana on X social media described the event as one of the bloodiest weekly downturns of the quarter, with Bitcoin tumbling 13.3% in seven days and Ethereum sliding 17.8% over the past month. At press time, Bitcoin is trading slightly above $106,940 while Ethereum sits around $3,870, both suffering steep retracements from their recent highs.

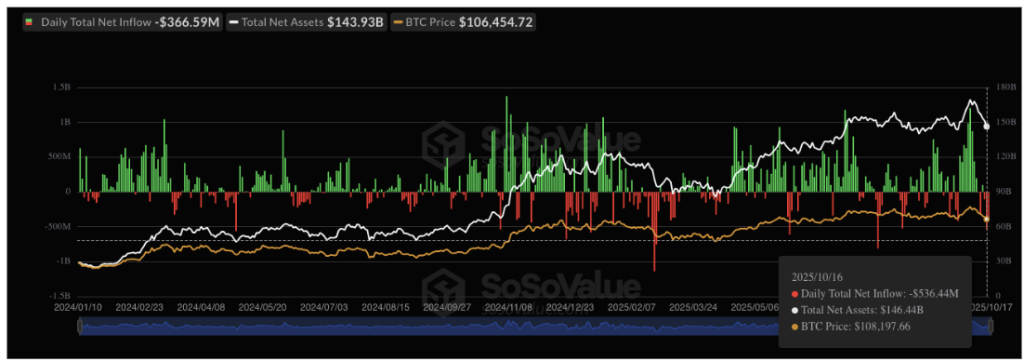

Data from SoSoValue shows that Thursday, October 16, saw a staggering $536.4 million in daily net outflows from Spot Bitcoin ETFs, marking the largest single-day negative flow since August 1, when $812 million exited the market. Out of twelve US Bitcoin ETFs, eight registered major outflows, led by $275.15 million leaving Ark & 21Shares’ ARKB, followed by $132 million from Fidelity’s FBTC. Notably, funds managed by other major companies like Grayscale, BlackRock, Bitwise, VanEck, and Valkyrie also reported significant withdrawals.

These persistent outflows have now stretched into their third consecutive day, with October 17, just a day ago, recording a massive outflow of $366.5 million. The sustained negative ETF flows underscore waning investor confidence and suggest that the broader market downturn could continue in the near term. Combined with the $19 billion liquidation event last Friday, increased outflows in ETFs could put more selling pressure on the already fragile market.

Experts Warn Of Deeper Market Pain Ahead

Many experts believe that the crypto market may still have more room for a decline. Data from Polymarket, one of the world’s largest prediction platforms, show that 52% of participants expect Bitcoin to drop below $100,000 before the end of October. Veteran economist and Bitcoin critic Peter Schiff has also warned that the coming months could be catastrophic for the industry, predicting widespread bankruptcies, defaults, and layoffs as Bitcoin and Ethereum face another major leg down.

Meanwhile, technical analysts are pointing to signs of deeper weakness in Ethereum’s structure. According to Crypto Damus, Ethereum has broken key weekly support and is displaying a bearish setup on the charts. He says that MACD is about to “cross red,” leaving a significant amount of room for a crash.

Other analysts like Marzell have echoed similar concerns, stating that Ethereum is now nearing a “crash zone.” However, he also highlighted the $3,690 – $3,750 range as a possible short-term demand area where buyers could step in again and trigger the next leg up.

Featured image from Unsplash, chart from TradingView