After having a notable run with Bitcoin and Ethereum, the spot Exchange-Traded Funds (ETFs) are taking a shot at Solana in this new phase of the cryptocurrency and financial market. SOL’s foray into the ETFs arena marks a crucial landmark in its market dynamics, which is likely to enhance its potential as a long-term and strategic asset.

A Milestone For Solana As It Steps Into The ETF Arena

Despite its price facing growing volatility, Solana continues to break boundaries and reach new landmarks. The most recent milestone is the introduction of the Solana Spot ETFs, an event that has triggered bullish optimism across the community.

At the forefront of this crucial move is Bitwise, a popular digital asset firm in the crypto space. Bitwise has created history and signaled a key turning point for SOL and its price action by launching the first-ever Spot Solana ETF.

According to Darkfost, a CryptoQuant author, the milestone not only marks a turning point for SOL, but it is also paving the way for the broader altcoin market. With this, institutional investors now have regulated access to SOL’s quickly growing ecosystem, marking a significant step toward the general acceptance of non-Bitcoin digital assets.

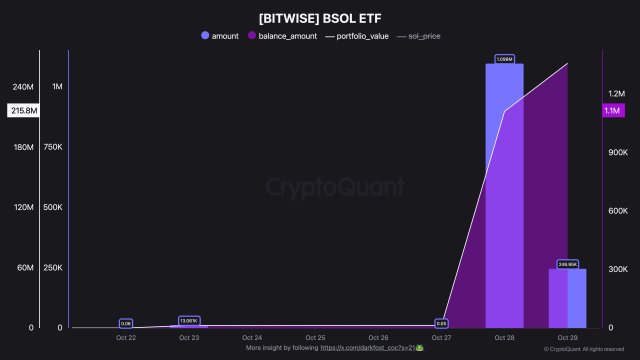

Darkfost highlighted that the path to altcoin ETFs has just gotten a little bit broader, with the debut of the BSOL ETF unveiled by Bitwise on October 28. Being the first ever SOL spot ETF in the crypto market, the BSOL is already recording notable capital flows in its early days of launch, ushering in a new phase of diversification within crypto investment portfolios.

Data from the expert reveals that BSOL attracted over $69.5 million in inflows on its first day. This figure also aligns with the available data from Farside Investors. As a result, Bitwise now has 1.358 million SOL in order to meet demand, with a massive 1.098 million SOL inflow occurring on October 28. After the substantial accumulation, the firm’s portfolio is valued at approximately $263.8 million, calculated with an average acquisition cost of $198.1.

Upon launch, Bitwise revealed that its BSOL ETF would have a 0.20% management fee. However, no fees will be applied during the first few months, and until the first $1 billion in inflows, a figure that reflects Bitwise’s expectation of strong interest and great success for this ETF.

Why SOL Was Selected By Bitwise

Bitwise’s choice of introducing a Solana Spot ETF is not a random pick. The firm’s decision is driven by the fact that SOL remains one of the fastest-growing technology platforms in the world. In the past year, SOL’s usage generated over $2 billion in network revenue, which is more than any other chain in the sector.

As capital markets shift on-chain, Solana, well-known for its low costs and high throughput, has had tremendous adoption in just five years since its inception and is expected to be a significant winner. “We think it’s a rising star and just getting started,” the firm added.