Data shows the Ethereum Funding Rate has declined into the negative zone. Here’s what has usually followed this trend in the last two months.

Ethereum Funding Rate Suggests Traders Are Now Bearish

As explained by analytics firm Santiment in a new post on X, shorts are dominating the Ethereum derivatives market now. The indicator of relevance here is the “Funding Rate,” which measures the amount of periodic fee that traders are exchanging between each other on the various derivatives platforms.

When the value of this metric is positive, it means long holders are paying a premium to those with short bets in order to hold onto their positions. Such a trend implies a bullish sentiment is dominant.

On the other hand, the indicator being under the zero mark suggests the derivatives traders as a whole may be holding a bearish mentality as short positions outweigh the long ones.

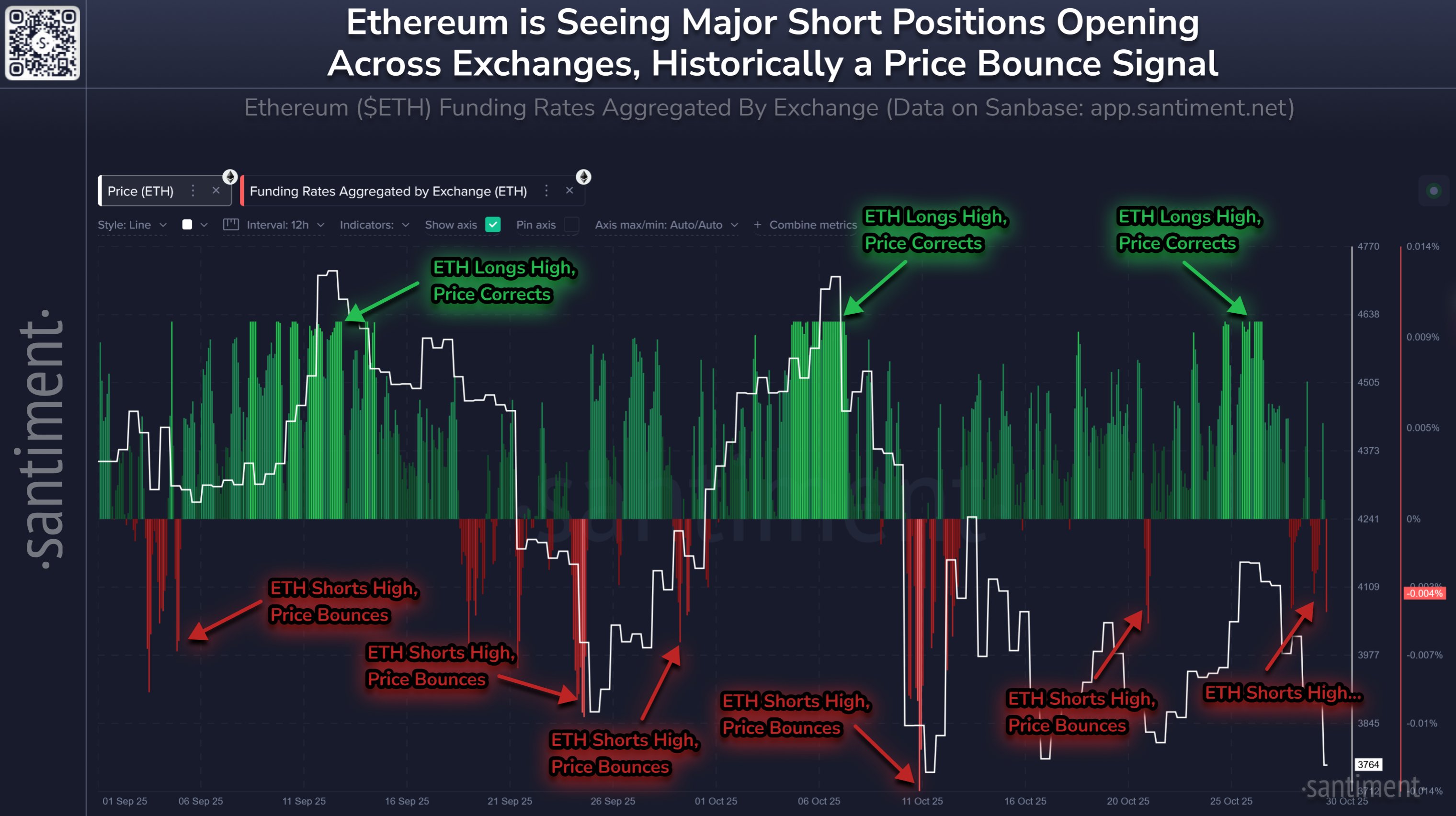

Now, here is the chart shared by Santiment that shows the trend in the Ethereum Funding Rate across all exchanges over the last couple of months:

As displayed in the above graph, the Ethereum Funding Rate has witnessed a decline into the negative zone recently, which implies derivatives market balance has shifted toward bearish positions.

The market sentiment turning red, however, may not actually be a negative for the cryptocurrency’s price. In the chart, the analytics firm has highlighted the pattern that the asset has followed with this metric during the past two months.

It would appear that ETH has tended to go against the Funding Rate in this window. That is, a notable positive level has led into price corrections, while a negative one into price rebounds.

The explanation behind the trend may lie in the fact that the dominant side of the market is more likely to get entangled in a liquidation squeeze. Such an event tends to be violent, involving a cascade of liquidations that feeds back into price volatility.

While the Ethereum Funding Rate has turned red, its value is still not as negative as some of the previous lows that resulted in short squeezes, so it only remains to be seen whether one will follow this time.

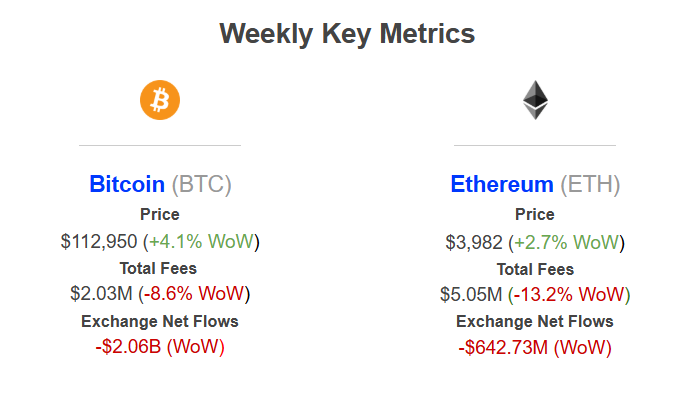

In some other news, Ethereum saw significant net exchange outflows of about $643 million over the past week, as revealed by institutional DeFi solutions provider Sentora in an X post.

Bitcoin saw even greater exchange withdrawals of more than $2 billion. “This is a strong bullish signal despite market uncertainty, as investors are moving coins into self-custody for long-term holding,” explained Sentora.

ETH Price

At the time of writing, Ethereum is trading around $3,850, up over 2% over the last 24 hours.