Bitcoin dropped to $96,000 on heavy selling Friday, and falling risk appetite, leaving traders and analysts parsing whether this is normal profit-taking or a larger turning point for the market.

According to on-chain and market reports, the drop wiped out more than $700 million in long positions and left November down by more than 10%.

Whale Transfers Draw Focus

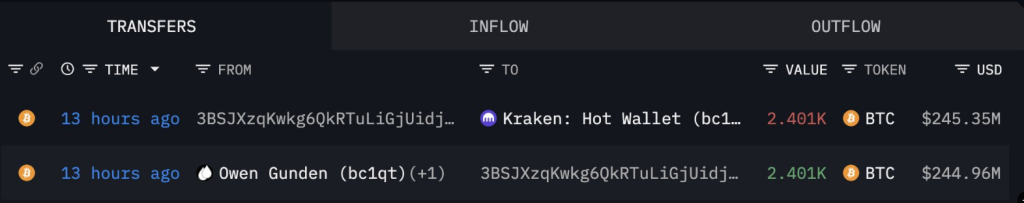

Reports have disclosed that a wallet tied to trader Owen Gunden moved 2,400 Bitcoin — about $237 million — onto the Kraken exchange, a transfer tracked by blockchain watcher Arkham.

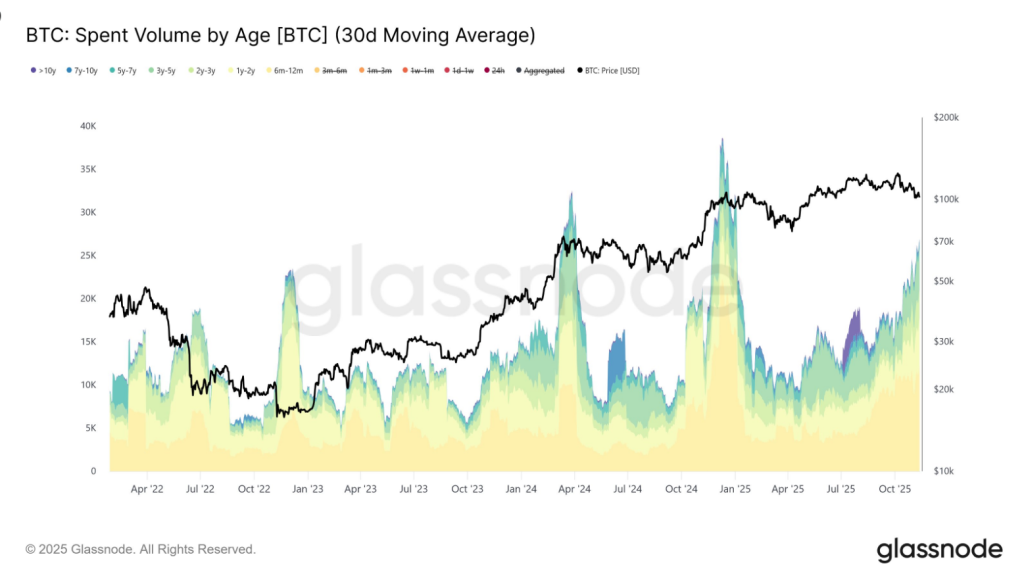

Based on analysis by Glassnode, long-term holders’ average daily spending rose from over 12,000 BTC per day in early July to roughly 26,000 BTC per day as of this week.

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Owen Gunden just moved all of the remaining BTC out of his accounts. He deposited over HALF of his holdings directly into Kraken, depositing a total of $290.7M of BTC into Kraken.

He now has only $250M of Bitcoin remaining. pic.twitter.com/ZUB3aToAgH

— Arkham (@arkham) November 13, 2025

That pattern, Glassnode analysts say, looks like orderly distribution by older holders rather than a sudden mass exit. It is being framed as late-cycle profit-taking: regular, steady, and spread out.

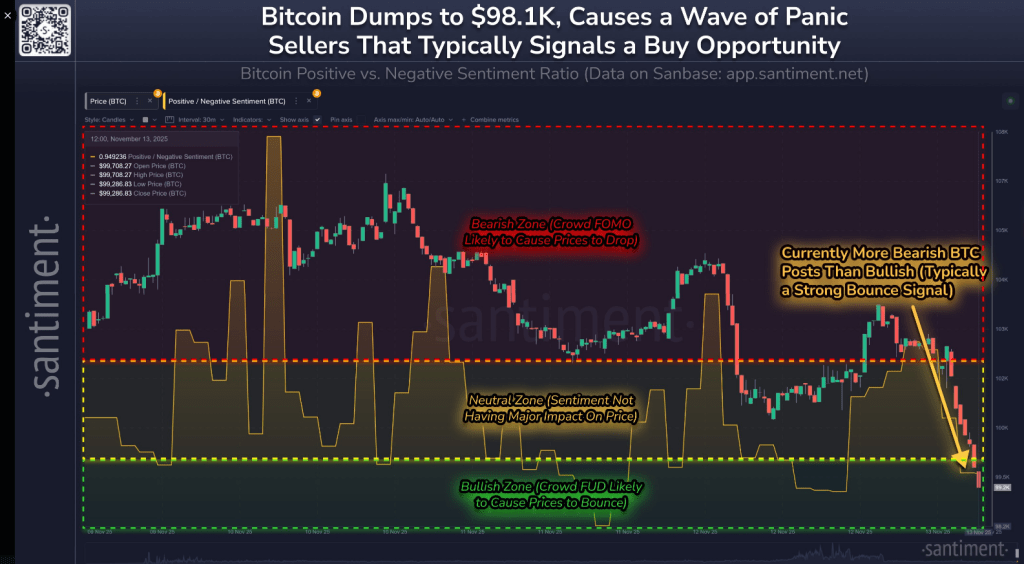

According to Santiment, Bitcoin has fallen below $100K for the second time this month, triggering a burst of fear and worried posts from retail traders.

Bitcoin has dumped below $100K for the second time this month. Predictably, this has caused a wave of FUD and concerned social media posts from retail traders. As shown below:

: Significant bullish/greedy bias (usually when markets are getting too much FOMO, prices will go… pic.twitter.com/rowUv3xIMd

— Santiment (@santimentfeed) November 13, 2025

No Meltdown: Late-Cycle Signals And On-Chain Readings

Vincent Liu, CIO at Kronos Research, disclosed that structured selling and steady rotation of gains often show up in late-cycle phases.

He cautioned that this phase doesn’t automatically signal a final peak, provided there are still buyers ready to take in the extra supply.

Being in a late cycle doesn’t mean the market has hit a ceiling, he pointed out. It just shows momentum has eased, and bigger forces like macro trends and liquidity are now in control, he said.

“Rate-cut doubts and recent market weakness have slowed the climb, not ended it,” Liu said. In other words, there’s no meltdown or anything like it.

On-chain indicators are being watched closely; Bitcoin’s net unrealized profit ratio stood near 0.476, a level some traders interpret as hinting at short-term lows forming.

That reading is only one of several signals, Liu added, and must be tracked alongside liquidity and macro conditions.

A closer look at the monthly average spending by long-term holders reveals a clear trend: outflows have climbed from roughly 12.5k BTC/day in early July to 26.5k BTC/day today (30D-SMA).

This steady rise reflects increasing distribution pressure from older investor cohorts — a… pic.twitter.com/wECe58CV66— glassnode (@glassnode) November 13, 2025

Market Pain Came From Stocks And Rates

The cryptocurrency sell-off came as crypto-related stocks plunged. Broader markets were weak as well, with the Nasdaq down 2% and the S&P 500 off 1.3%.

Cipher Mining fell 14%, Riot Platforms and Hut 8 dropped 13%, while MARA Holdings and Bitmine Immersion slid over 10%. Coinbase and Strategy were down about 7%.

Based on reports, large institutional flows have pressured prices. Firms including BlackRock, Binance and Wintermute reportedly sold more than $1 billion in Bitcoin, a wave of selling that produced a quick 5% drop inside minutes.

Meanwhile, social sentiment turned sharply negative, and the Crypto Fear & Greed Index hit 15, reflecting “extreme fear” among traders.

Featured image from Unsplash, chart from TradingView