The market downturn has hit Solana hard as a majority of its supply is now underwater. Here’s how Bitcoin, XRP, and Ethereum compare.

Bitcoin, XRP, And Ethereum Are Currently Far Below Solana In Loss Supply

In a new post on X, on-chain analytics firm Glassnode has talked about how some of the top assets in the cryptocurrency sector compare in terms of the Percent Supply in Loss. This indicator measures, as its name suggests, the percentage of a given asset’s circulating supply that’s currently being held at a loss.

The metric works by going through the transaction history of each coin in circulation to see what price it was last moved at. If the last transfer price was more than the current spot price for any token, then that particular token is considered to be in a state of net unrealized loss.

The Percent Supply in Loss adds up all coins of this type and determines what part of the supply they make up. Like this indicator, there also exists the Percent Supply in Profit, which tracks the supply of the opposite type. Since the total supply should add up to 100%, only one of these metrics needs to be known; the other can simply be found by subtracting it from 100.

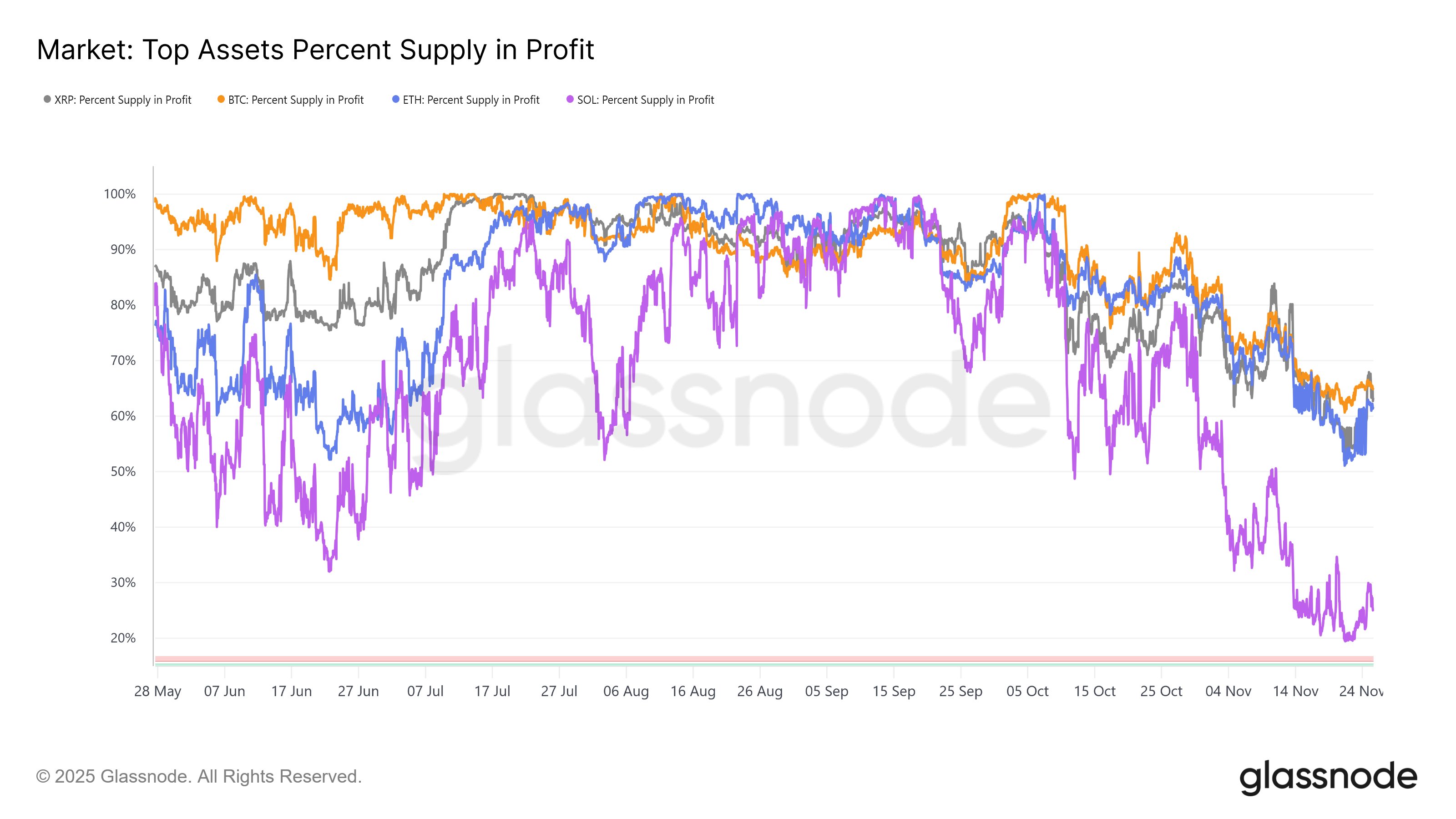

Now, here is the chart shared by Glassnode that shows how the Percent Supply in Profit has changed for Bitcoin, XRP, Ethereum, and Solana over the last few months:

As displayed in the above graph, the Percent Supply in Profit has plummeted for all of these cryptocurrencies recently. In other words, the Percent Supply in Loss has shot up. This shift in investor profitability has come as a result of the bearish momentum that the various assets have faced. It’s visible in the chart, however, that the change hasn’t been proportionate for all of the coins.

While XRP, Ethereum, and Bitcoin have shown similar trajectories, Solana has broken away with a much steeper decline in the indicator. Today, the Percent Supply in Profit is sitting at a value of 25.16%. This means that almost 75% of the cryptocurrency’s supply is underwater now.

In contrast, the Percent Supply in Loss remains at 34.91%, 38.37%, and 36.70% for Bitcoin, Ethereum, and XRP, respectively. Thus, despite the market downturn, a majority of the supply is still in the green for the three largest coins in the sector (excluding stablecoins).

Typically, a high value on the Percent Supply in Loss corresponds to market conditions where not many profit-sellers are left anymore. Considering this, Solana having most of its supply underwater could, in theory, imply that it’s closer to seller exhaustion than Bitcoin and company.

SOL Price

Solana has shown some recovery over the past few days as its price has climbed back to the $137 level.