Ethereum has reclaimed the $3,000 level after weeks of heavy selling pressure, yet the recovery remains fragile as momentum continues to fade. The market is still dominated by fear, and confidence among retail traders has weakened significantly.

Analysts warn that bulls are losing control of the trend, and some are beginning to call for the early stages of a potential bear market. With Ethereum trading nearly 40% below its August all-time high, every move upward is being met with hesitation, and the broader market environment has yet to stabilize.

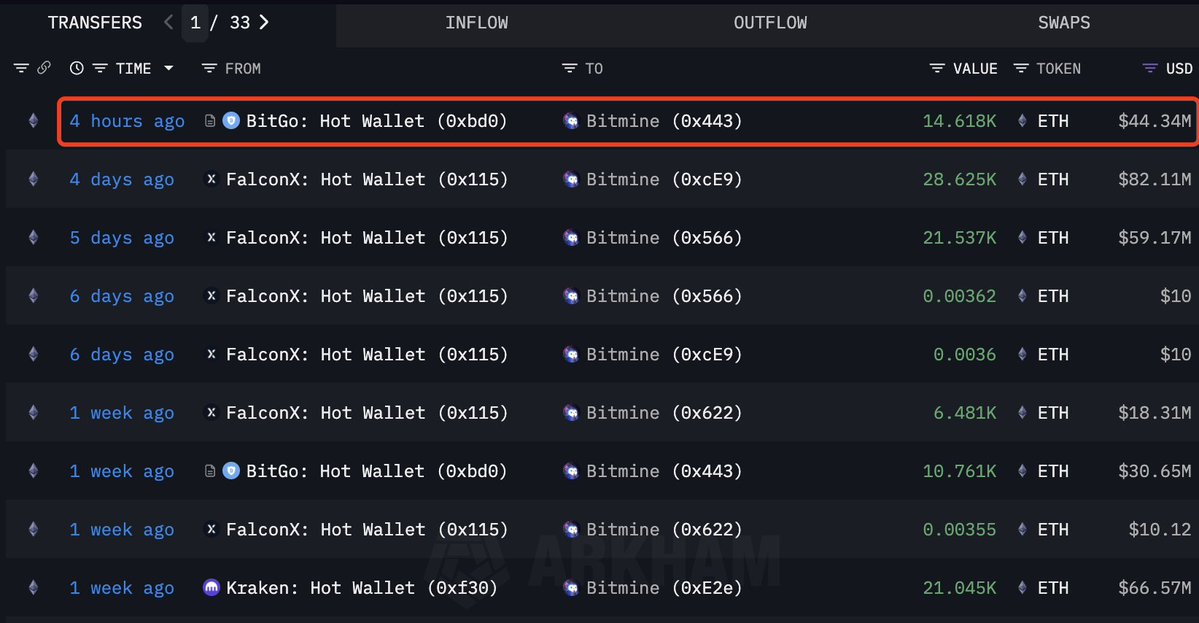

Despite this uncertainty, large players continue to accumulate ETH, offering a contrasting signal to the prevailing bearish sentiment. According to new data from Lookonchain, Bitmine has been consistently buying Ethereum during this downturn, showing no signs of slowing its accumulation strategy.

This persistent interest from large holders suggests that institutional and high-net-worth buyers may still see long-term value at current levels, even as short-term traders remain cautious.

Bitmine Deepens Accumulation as Ethereum Struggles for Momentum

Lookonchain reports that Bitmine has continued its aggressive accumulation strategy, purchasing another 14,618 ETH—worth roughly $44.34 million—a few hours ago. This new acquisition further strengthens Bitmine’s already massive Ethereum position, which now totals 3.436 million ETH. At current prices, their holdings are valued at approximately $10.39 billion, underscoring their long-term conviction despite the ongoing market turbulence.

This level of accumulation from a major player stands in sharp contrast to the broader sentiment across the market, where uncertainty and fear persist. Retail investors remain cautious, and many analysts argue that Ethereum’s failure to reclaim momentum above $3,000 signals a weakening trend.

However, Bitmine’s continued purchases suggest a fundamentally different outlook—one rooted in long-term valuation rather than short-term volatility.

Large, disciplined buyers often accumulate in periods of market weakness, viewing discounted prices as strategic entry points. Bitmine’s behavior mirrors this pattern and could indicate expectations of higher prices in the months ahead.

Still, for Ethereum to benefit from this institutional confidence, it must stabilize and build a stronger support base. The coming weeks will reveal whether this sustained whale demand will outweigh broader selling pressure and help ETH break out of its current downtrend.

ETH Attempts Recovery but Faces Strong Resistance

Ethereum is attempting to recover after weeks of sustained selling pressure, reclaiming the $3,000 level but still struggling to build meaningful momentum. The chart shows ETH bouncing from the recent low near the mid-$2,600s, where a cluster of demand emerged and halted the sharp decline.

However, despite this rebound, Ethereum remains below all three major moving averages—the 50-day, 100-day, and 200-day—which now act as layered resistance zones.

The 50-day SMA is trending downward and has already crossed below the 100-day SMA, signaling a weakening market structure. Meanwhile, the 200-day SMA sits slightly above current prices, reinforcing the idea that ETH is still in a vulnerable position. Price action remains choppy, with lower highs forming consistently since the peak in early October, reflecting persistent bearish control.

Volume patterns also confirm this cautionary picture. While the recent bounce came with a modest increase in buying activity, it is still far weaker than the selling volume observed during the November capitulation. For a meaningful trend reversal, ETH must break above the $3,300–$3,400 region, reclaim its moving averages, and establish a higher low.

Featured image from ChatGPT, chart from TradingView.com