The post Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near? appeared first on Coinpedia Fintech News

Avalanche is starting the week with a noticeable uptick in on-chain activity, fueled particularly by a sharp jump in DEX trading volumes. Over the past 24 hours, AVAX has stabilized near $14.68, rebounding from a long-term demand zone that previously triggered multiple rallies. With network usage rising and technical patterns aligning, traders are beginning to question whether the AVAX price is gearing up for a broader recovery after weeks of downward pressure.

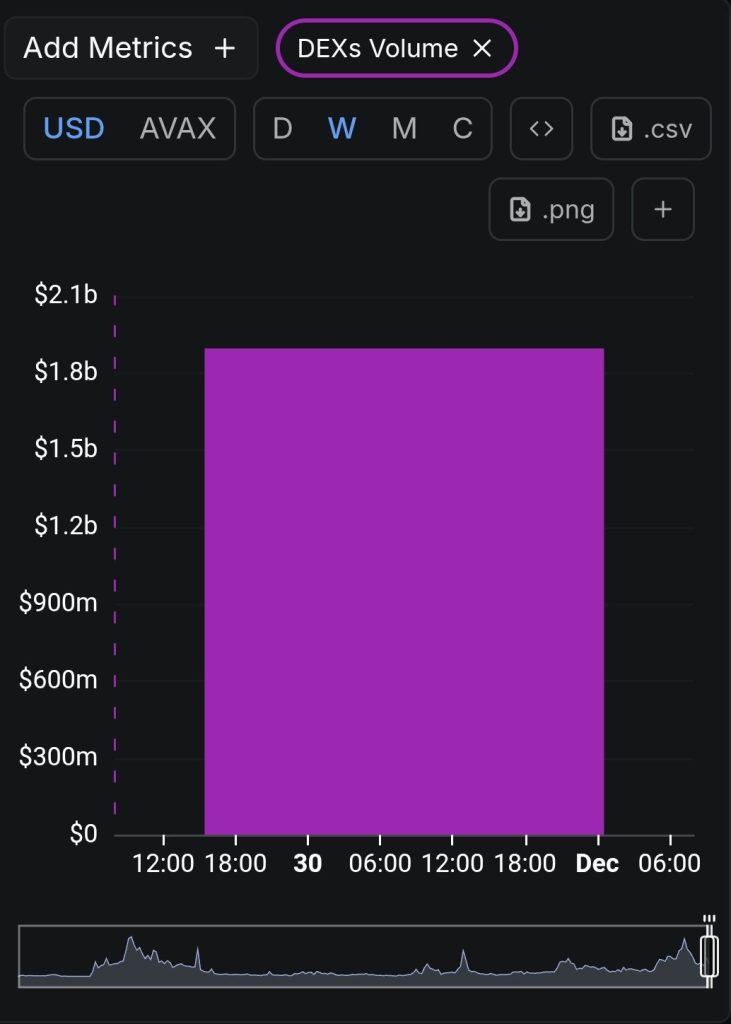

DEX Activity Surges: Over $1.8 Billion Volume in the Last 24 Hours

Avalanche’s on-chain activity saw a strong boost over the past 24 hours, with DEX trading volumes surpassing $1.8 billion. This sudden spike reflects rising liquidity inflows and growing user participation as AVAX attempts to stabilize near its long-term support zone.

This rise suggests:

- Increased liquidity rotation into AVAX-supported assets

- Higher volatility across AVAX DeFi pools

- Renewed user participation after a period of stagnation

The volume spike is particularly notable because it coincides with AVAX defending a historically strong accumulation zone, implying that large players may be positioning early for a potential breakout.

Technical Structure: Falling Wedge Reversal Is Still in Play

The weekly chart continues to respect a falling wedge pattern, typically known as a bullish reversal setup. The AVAX price has bounced off the lower wedge support multiple times, including this week. It is trading around $14.68, which remains inside a long-term support band that has repeatedly triggered counter-trend rallies. Therefore, this setup aligns with previous market cycles where AVAX saw large upside moves after prolonged compression phases.

The Avalanche price has been defending the lower support and the recent rebound has raised hopes for a 60% to 70% upswing. The weekly RSI has rebounded signalling the weakening of bearish momentum and the early stage of trend stablaization. On the other hand, the CMF rising finely in the past few days and stabilizing above zero shows a strong shift toward capital inflows while the buying pressure remains dominant. It also suggests the beginning of an accumulation phase with a high probability of a breakout.

If AVAX holds the base at the current range around $15, the next technical targets appear at:

- $22–$25: Mid-range resistance and wedge mid-line

- $32–$35: First major breakout zone after confirmation

- $55.80: Full wedge target if the weekly breakout follows historical patterns

What This Means for Avalanche at End of 2025 & Early 2026

Avalanche is entering an interesting phase where improving on-chain activity meets a historically strong technical support zone. The spike in DEX trading volume suggests renewed market participation, while the long-term falling wedge pattern indicates that sellers may be losing control. With AVAX sitting at $14.68, the coming weeks could determine whether the asset finally begins its long-awaited recovery. If the AVAX price maintains its current activity momentum, the first quarter of 2026 could become a turning point.