According to reports, Ripple is moving into corporate treasury services with an acquisition valued at $1 billion. The purchase, tied to a treasury management firm, has prompted some market educators to lay out aggressive price scenarios for XRP, including a top-end projection of $1,000+.

Ripple Hits Corporate Treasury

A crypto educator who posts under the name “X Finance Bull” has mapped out a sequence of price milestones. Based on his outline, investors might see XRP trade near $2 to $3 in the immediate phase, climb to $5–$10 over a longer stretch, and reach $20–$100+ in a bullish expansion.

The educator then presents a theoretical maximum of $1,000+ if XRP were to capture a major share of corporate treasury flows. These figures are being shared widely, often without the caveats that would temper expectations.

THIS IS WHERE IT BEGINS!

$XRP is about to go parabolic to $1,000 and beyond!

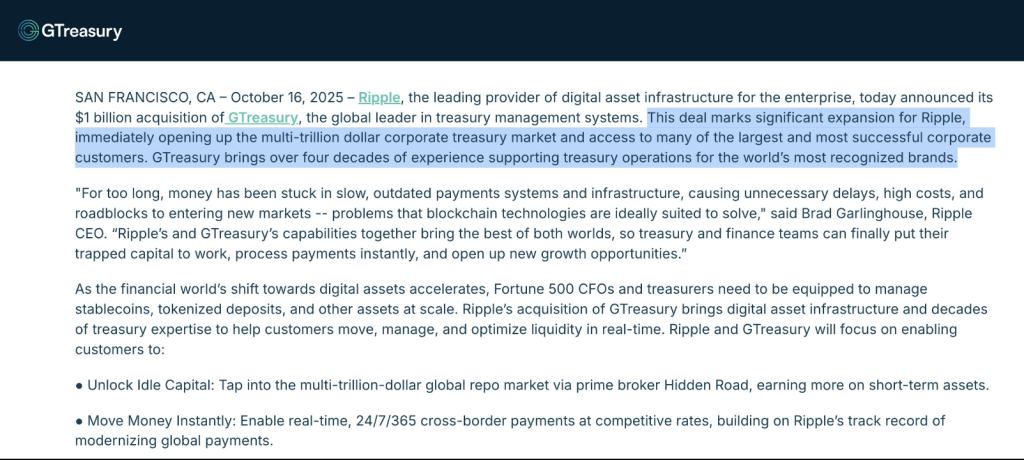

Ripple just acquired GTreasury for $1B

This is a domino that sets off the biggest capital flow event in crypto history

Make sure BUY every dips of $XRP!

Here’s what most aren’t seeingpic.twitter.com/6qs5KjKWgp

— X Finance Bull (@Xfinancebull) October 16, 2025

Why The Move Matters

The logic behind the bullish scenario is straightforward at a glance. If Ripple ties its software and token into treasury operations used by large firms, demand for on-ledger liquidity could rise.

Corporations handling cash, currency conversion, and liquidity tend to move very large sums. People in markets point out that tapping into those flows can change adoption dynamics for a token. Still, adoption at scale, legal clarity, and real usage patterns would all have to align for token prices to rise dramatically.

Bull Case And Numbers

Supporters highlight the $1 billion price tag of the deal as proof that Ripple sees enterprise opportunity. They argue that treasury customers could need fast settlement rails and that XRPL tools might fit into those processes.

The educator’s projections include concrete bands: $2 to $3 early, $5–10 mid, and $20–$100+ later. But those bands assume broad corporate adoption and token demand patterns that are not yet proven.

Market caps implied by a $1,000+ XRP would be orders of magnitude larger than today’s totals, unless the circulating supply shrinks or new economic models are introduced.

Regulatory Signals

Regulatory signals are a key variable. Courts and regulators have begun to clarify how tokens are treated in various jurisdictions, and that treatment will shape institutional appetite.

Also important are integration details: how the token is used in treasury software, whether firms hold or simply pass through XRP, and how custody and risk models adapt to tokenized liquidity.

Each of those steps can either support price appreciation or leave the token’s value marginal to enterprise operations.

Featured image from Unsplash, chart from TradingView