The post After Gold and the S&P 500 Moves, Could Bitcoin (BTC) Hit a New ATH? appeared first on Coinpedia Fintech News

Bitcoin price has recently regained momentum, with total market interest surpassing $116,000, signalling a potential shift in market dynamics. After underperforming traditional assets like gold and the S&P 500, BTC has turned the tables, fueled by growing institutional adoption, easing macroeconomic pressures, and renewed retail investor interest. This resurgence raises the question: Could Bitcoin’s bullish momentum propel it toward a new all-time high (ATH), making it a key asset to watch in the crypto market?

Investors Remain Cautious

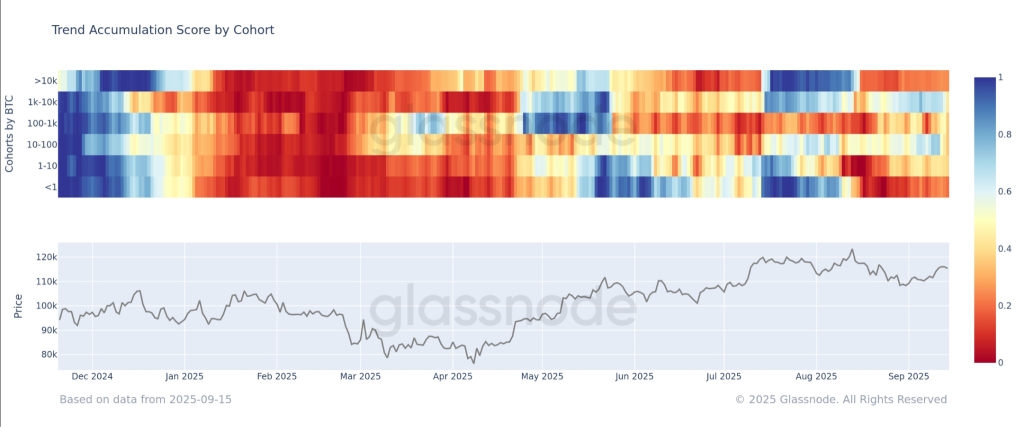

Since our August 25 update, Bitcoin’s market dynamics have shown subtle changes, but the overall trend remains cautious. Distribution—when holders sell their coins—has softened slightly, signalling that some selling pressure is easing, but it has not reversed into strong buying. Most BTC cohorts, segmented by the time they acquired their coins, are still below the 0.5 threshold, indicating that holders are not aggressively accumulating.

Data from Glassnode suggests that no group has reached the 0.8 level, which would signify strong buying interest.

In simple terms, while the market is stabilising, the majority of investors are still taking a neutral or slightly cautious stance rather than betting heavily on upward price movement. As a result, Bitcoin remains in a broadly neutral-to-distribution regime, with mild selling pressure persisting. Traders and investors should monitor this balance closely, as a clear shift toward accumulation could signal a potential bullish breakout.

What’s Next? Will BTC Price Mark a New ATH in 2025?

The Bitcoin price is fluctuating between two major ranges, with one acting as a significant resistance level between $116,200 and $116,700, and the other serving as a support range between $111,600 and $110,800. The price has failed to break the resistance for the second time since August, which validates a strong presence of the bears. Besides, the technicals do not flash a strong bullish signal that raises the possibility of a bearish continuation.

As seen in the above chart, the BTC price continues to remain within a consolidated zone as it trades within the Ichimoku cloud. Although the cloud has undergone a bullish crossover, a rise above the cloud is necessary to validate a bullish continuation. On the other hand, MACD may go bearish as the buying pressure seems to have faded with the levels heading towards a bearish crossover, being within the negative range.

Therefore, the current market sentiments are neutral as the investors wait for either bullish or bearish confirmation. However, as long as the Bitcoin (BTC) price trades above the pivotal support range, the possibility of a trend reversal remains higher. If the price requires marking new highs, the market sentiments need to flip, while the markets should turn euphoric.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin’s price surge in 2025 is fueled by growing institutional adoption, easing economic pressures, and renewed retail interest, signaling a potential bullish shift.

Bitcoin could hit a new all-time high in 2025 if it breaks the $116,200-$116,700 resistance and market sentiment turns strongly bullish, but investors remain cautious.

Investors are cautious as most Bitcoin holders aren’t aggressively buying, with mild selling pressure persisting and no strong accumulation signals yet.

The recent scarcity spike and institutional buying suggest renewed interest, which may signal the start of an accumulation phase. However, individual investors should conduct their own research and consider their risk tolerance.