Onchain Highlights

DEFINITION: Number of Addresses with a Non-Zero Balance by Glassnode is the number of unique addresses holding a positive (non-zero) amount of coins.

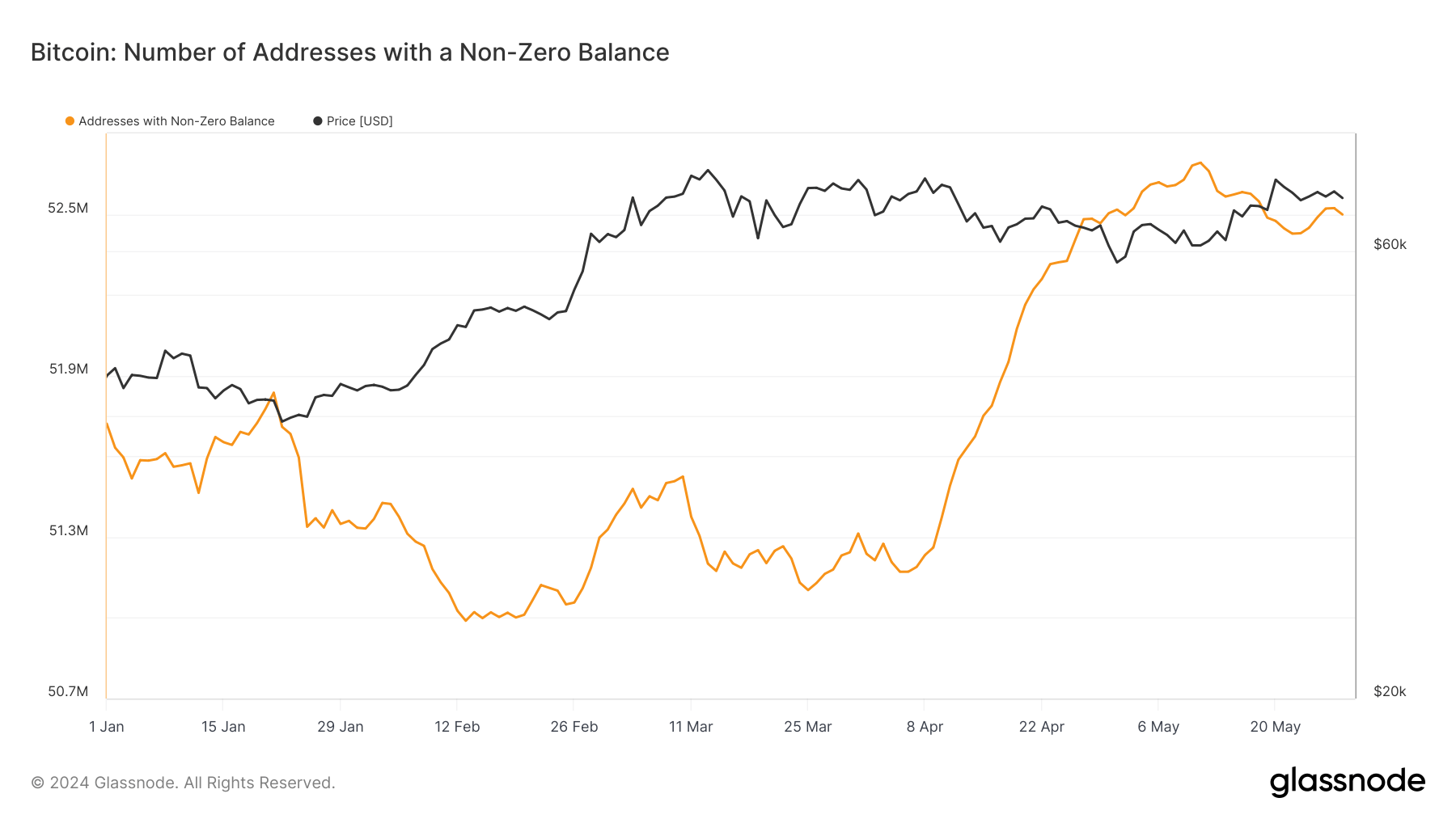

The number of addresses with a non-zero balance provides insights into the market forces and user adoption. The data from Glassnode shows a notable increase in addresses holding Bitcoin, surpassing 52.5 million in 2024. This growth signifies rising interest and engagement in the digital assets ecosystem. Notably, periods of price volatility are accompanied by shifts in address balances, reflecting investor behavior.

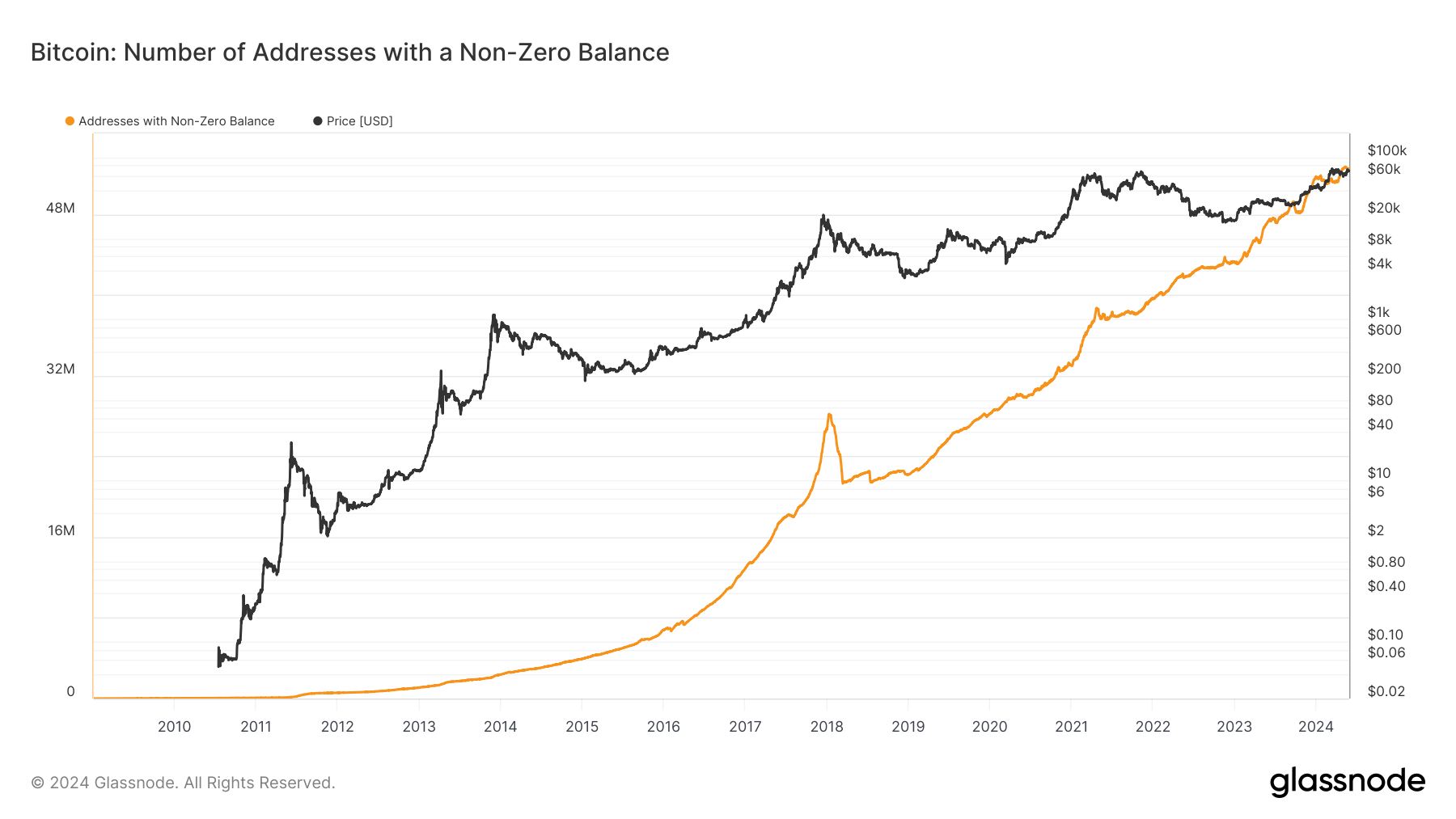

Since 2020, the Bitcoin ecosystem has added around 11 million new addresses with non-zero balances, indicating sustained growth. The increasing number of addresses demonstrates growing confidence in Bitcoin despite market volatility, aligning with broader market activities and regulatory developments that influence Bitcoin’s adoption and value fluctuations.

The trend highlights how market participants are diversifying their holdings and actively engaging with digital assets, reflecting a broader acceptance and integration into financial portfolios. As the market evolves, monitoring these metrics offers valuable insights into the health and direction of the digital assets landscape.

The post Bitcoin addresses with positive balances surpass 52.5 million amid strong growth since 2020 appeared first on CryptoSlate.