The most often used cryptocurrency worldwide, Bitcoin, has had an impressive price rise over the past few weeks, considerably raising trader confidence.

The bigger cryptocurrency market still exhibits volatility even with Bitcoin’s recent rallies. Thanks to Ethereum ETFs, which have created conditions perfect for significant price movements, the market is today far more liquid. As Ethereum ( ETH) and Bitcoin (BTC) negotiate these difficult waters, their mechanics as well as the risk of trend reversals are impacting each other.

According to Santiment statistics, since March 2023 the proportion of positive to negative comments about Bitcoin has climbed to its highest level. Seeing an all-time high within reach once more, investors are becoming more hopeful about the future of cryptocurrencies as they stay at $66,882.

Market Dynamics: Ripple Effect Of Ethereum ETFs

Ethereum exchange-traded funds (ETFs) have greatly raised market liquidity, therefore affecting overall stability. Not just Ethereum but also unintentionally Bitcoin has been impacted by this influx. Having a market valuation of $1.32 trillion and a 55% market domination, traders are closely watching how these events might change market dynamics.

Though it recently surged, the price of Bitcoin has declined by 1.36% during the previous day. This fall underlines how erratic the crypto sector is. Given changing opinions and uncertain circumstances, investors find it challenging to precisely predict short-term swings. However, the growing hope for Bitcoin suggests a revival of virtual currency interest and confidence.

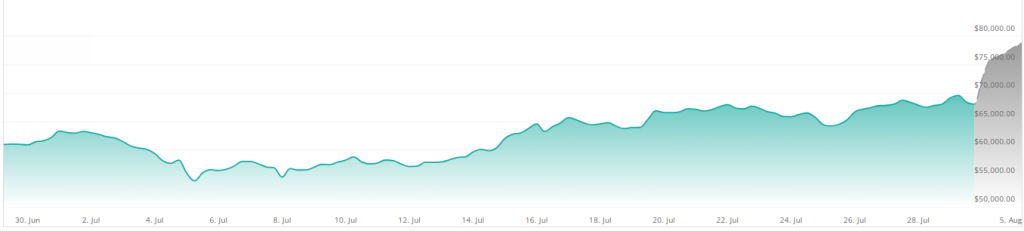

$BTC is very close to the Crucial 70k Resistance and is on the Cusp of Broadening Wedge Upside Breakout.

As the 70k Resistance weakens with each test, a Breakout is expected this time.

A successful Breakout could send Bitcoin above 80k in August..

#Crypto #Bitcion #BTC pic.twitter.com/r2n1p631xY

— Captain Faibik (@CryptoFaibik) July 29, 2024

Forecasts By Analysts: Breaking Limits, Scaling New Heights

Renowned bitcoin guru Captain Faibik has given a positive future price estimate for the coin. According to Faibik, Bitcoin is poised to test once more the crucial $70,000 resistance level. Historically a major barrier, this level seems to be becoming simpler with every test that comes around. Faibik says this declining resistance suggests a potential upward breakthrough shown as a broadening wedge.

A spreading wedge technical chart pattern suggests that the price of an asset could be poised to break out. A breakthrough is looking more plausible as Bitcoin approaches the $70,000 barrier level. According to Faibik, should Bitcoin be able to pass this obstacle, by August it might be valued beyond $80,000. This hopeful forecast is based on the trend of declining resistance, which generally indicates an approaching breakout and consequent price rise.

Path Of Development Of Bitcoin

Bitcoin seems to be going to have a notable increase in the following weeks. Although the price of the alpha coin is now 31% below the projection for the next month, short-term indicators show a positive trend that may cause the price to rise. Investors are preparing themselves for a probable resurgence as the market responds to several positive signals and increasing demand.

Based on CoinCheckup data, major resistance levels might be challenged soon; support is concentrated around the current trading price. For the expected climb, this projection provides a strong basis. Forecasts show a notable upward trend as Bitcoin will increase by 45% during the next three months.

Featured image from Pexels, chart from TradingView