The post Bitcoin Bull Run Ends in 10 Days, Veteran Trader Warns of Cycle Peak appeared first on Coinpedia Fintech News

Bitcoin traders are on edge as the market nears what could be the final stage of this bull run. Veteran trader CryptoBirb warns that the current Bitcoin rally is 99.3% complete, leaving just 10 days before a possible cycle peak.

This period could decide whether Bitcoin makes one last big surge or crashes into a new bear market

Bitcoin Bull Run Nears Its Cycle End

CryptoBirb explains that it’s been 1,058 days since Bitcoin hit its last big bottom, which means this bull run is almost at the end of its usual cycle. His model, called the “Cycle Peak Countdown,” points to October 24 as the possible date for the next big peak.

In past cycles, Bitcoin usually peaks between 518 and 580 days after a halving. Right now, we’re at day 543, which puts us right in the middle of that peak zone.

“We’re not just getting close to the top, we’re already inside the same window where every major Bitcoin peak has happened before.”

However, the recent price drop of Bitcoin from its ATH of $126,300 to $102,560 is seen as a sign of a healthy correction that often happens to remove weak holders before the big rally.

Technical Indicators Show Pre-Peak Reset

Technical indicators support this view, the Fear & Greed Index has fallen from 71 to 38, and RSI has cooled to 45. These indicators suggest that emotions are resetting, creating a foundation for a possible final rally.

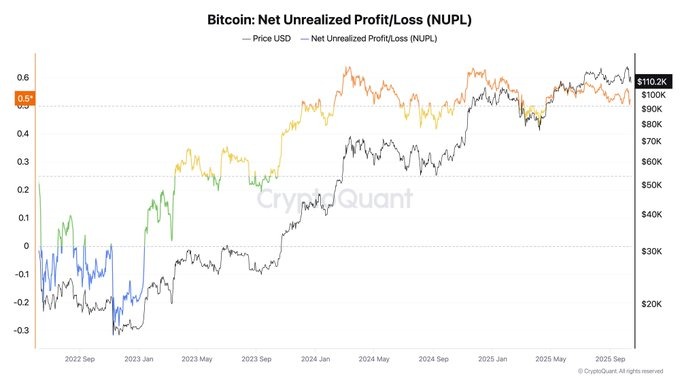

On-chain metrics also show some cooling, NUPL dropped to 0.522, and MVRV fell to 2.15, reflecting recent profit-taking.

Meanwhile, institutional behavior is also noteworthy. Bitcoin ETF inflows shifted from +$627 million to -$326.4 million, and Ethereum ETFs saw $428.5 million outflow. Experts interpret this as smart money taking profits before retail FOMO drives the last leg of the rally.

24 Oct – Make-or-Break Moment

Historically, the October 20–November 5 window marks the peak zone for Bitcoin cycles. With key dates like October 24th approaching, traders should expect heightened volatility and potential explosive moves.

As of now, BTC is trading around $112,281, reflecting a drop of 3% seen in the last 24 hours.