Bitcoin Core, the reference implementation that underpins the majority of the BTC network, has undergone what Brink describes as the first-ever public, third-party security audit of its codebase. The assessment was carried out by security firm Quarkslab, coordinated by the Open Source Technology Improvement Fund (OSTIF) and funded by Brink with support from its donors.

Bitcoin Core Undergoes Historic Security Audit

Announcing the results, Mike Schmidt, co-founder and executive director of Brink, said the audit largely confirms the community’s long-held view of the project’s engineering standards. In his words, “The results confirm what long-time contributors and users already know: Bitcoin Core is a mature, conservatively engineered, and exceptionally well-tested codebase. Independent review only strengthens that confidence. This security assessment is a checkpoint in the mission to further secure Bitcoin, not a destination.”

Brink emphasized that this is the first public, external security review of Bitcoin Core. The organization stated that “as part of Brink’s mission to ensure the safety and robustness of the open-source Bitcoin Core software, we recently sponsored an independent security audit of the Core codebase. This represents the first public, third-party audit of Bitcoin Core.”

The motivation, according to Brink, is that “the project has a strong security track record, but it has never undergone an external security assessment. We wanted to provide an additional layer of assurance for developers, node operators, holders, and businesses who rely on Bitcoin Core every day.”

The scope of the audit focused explicitly on the most security-sensitive parts of the system. Brink explained that “the focus was on the most security-critical components of the software, including the peer-to-peer networking layer, mempool, chain management, and consensus logic.” To interrogate these areas, Quarkslab used “manual code review, static and dynamic analysis, [and] advanced fuzz testing.”

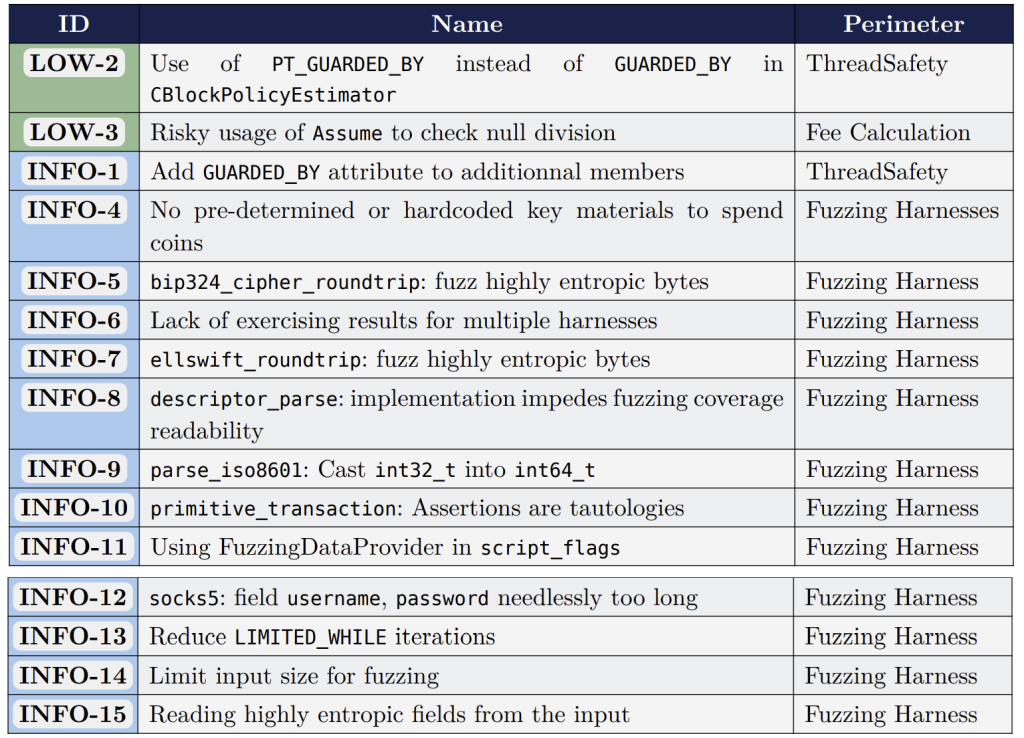

On findings, the result is unusually clear. Brink reported that “the auditors at Quarkslab reported no critical, high, or medium-severity issues. They identified two low-severity findings and thirteen informational recommendations, none of which were classified as security vulnerabilities under Core’s criteria.” That framing is deliberate: the issues are treated as hardening and quality improvements rather than vulnerabilities that could directly endanger funds or consensus.

Schmidt was careful not to present the report as a declaration that the software is bug-free. He wrote that “that isn’t to say there aren’t still bugs lurking in the software. More improvements still need to be made. But this audit is a nice step along the way to help ensure Bitcoin doesn’t break and continues to serve the world as a secure, reliable monetary network.”

Brink also highlighted the collaborative structure of the effort. The organization noted that “the assessment was conducted by Quarkslab (@quarkslab) and was coordinated with the help of the Open Source Technology Improvement Fund (OSTIF @OSTIFofficial). Funding was provided by Brink with the support of our donors, with technical collaboration from Niklas Gögge and Antoine Poinsot.” It publicly thanked “Quarkslab, the OSTIF, Niklas, and Antoine for their work on this project,” and made the full report freely available.

In its summary of the initiative, Brink tied the audit back to Bitcoin’s broader reliability guarantees. “Funding independent reviews like this is just one way we help ensure Bitcoin doesn’t break and continues to serve the world as a secure, reliable monetary network,” the organization said, repeating that “independent review only strengthens that confidence.”

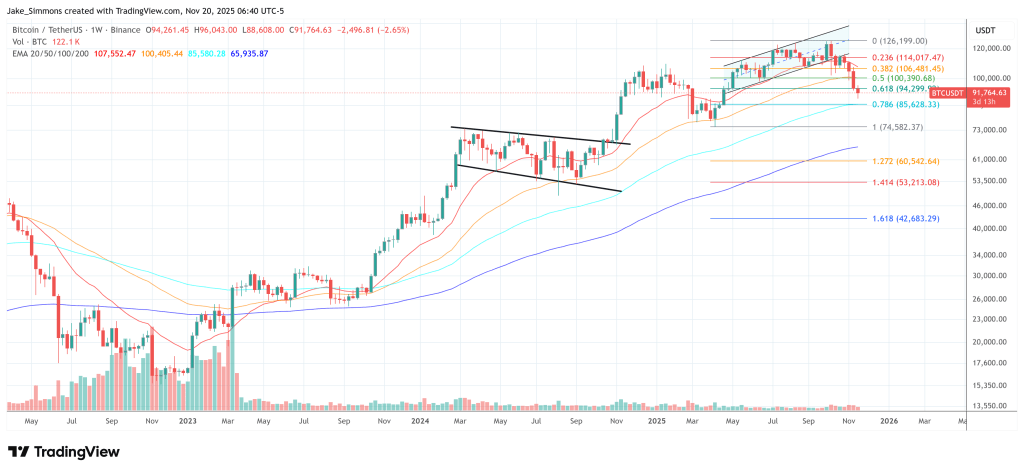

At press time, BTC traded at $91,764.