The post Bitcoin-Gold Correlation Turns Negative: What It Means for BTC Price Action appeared first on Coinpedia Fintech News

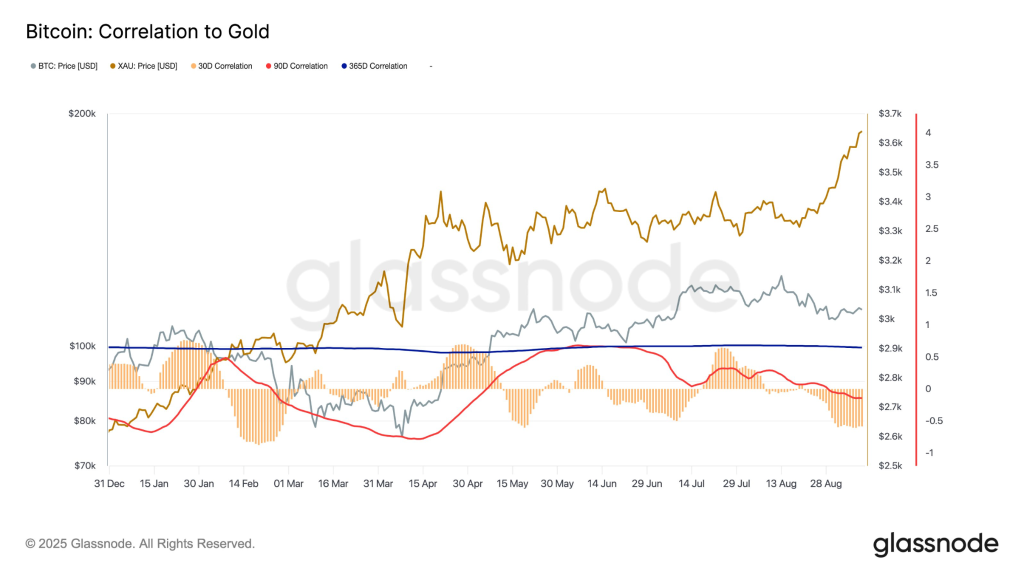

Bitcoin’s 30-day correlation with Gold has plunged to -0.53, according to Glassnode. This marks a significant shift in market behaviour, with BTC price moving in the opposite direction of Gold more often than not. The data highlights how investors are currently positioning Bitcoin as a risk-on asset, decoupling it from the traditional safe-haven narrative. This divergence has critical implications for price action, risk management, and trading strategies as macro volatility heats up.

Bitcoin’s Correlation Shift Explained

Before Bitcoin’s invention, Gold was the only safe-haven asset for investment. Ever since the 2021 bull run, a major portion of investors have shifted their focus to Bitcoin. As the global tensions have been the prime focus, investors have turned back to Gold, which is helping the price to mark new highs. This could be the reason why the BTC price is consolidating within a narrow range, as the star crypto is inversely correlated to Gold.

Correlation measures how two assets move relative to each other, with +1 showing perfect positive correlation and -1 showing perfect inverse correlation. As per the Glassnode data, the current reading is -0.53. This suggests that when Gold rallies, Bitcoin tends to pull back — and vice versa. This indicates traders are rotating between the two assets depending on risk sentiment. When uncertainty rises, Gold attracts safe-haven flows, while Bitcoin sees selling pressure.

Bitcoin (BTC) Price Analysis: Here’s What to Expect This Month

Bitcoin is currently consolidating between $57,200 – $64,000, with strong demand visible near $58K. A breakout above $64K could send BTC toward $68K – $70K, while a breakdown below $57K risks a move toward $54K – $55K. Traders should monitor macro events such as CPI data and Fed rate guidance, as they can act as catalysts for volatility and potentially realign Bitcoin’s correlation with Gold.

Bitcoin is currently consolidating above $115,500, showing strength despite Gold’s record highs near $3,645/oz. The next key resistance sits at $120K – $122K, and a breakout above this zone could open the path to $128K – $130K. On the downside, strong support lies near $110K – $105K, where buyers are expected to step in aggressively if risk-off pressure builds.

Trading Strategies to Consider

- Bullish Setup: Buy dips near $ 110,000 with a stop-loss below $ 105,000, targeting $ 120,000 and then $ 130,000.

- Bearish Hedge: Short if BTC breaks below $105K with momentum, targeting $98K – $100K.

- Watch Correlation: If gold continues to rally, BTC may experience more short-term pullbacks before resuming its uptrend.

Bitcoin’s negative correlation with Gold highlights its growing role as a risk-sensitive asset rather than a safe haven. This creates opportunities for traders to capitalise on market sentiment swings. If macro conditions turn risk-on, Bitcoin price could lead the charge toward higher levels, but sustained risk-off phases may keep it under pressure.