The price of Bitcoin has struggled around the $95,000 mark after showing some early-weekend strength on Saturday, November 15. According to a prominent analyst on the social media platform X, the premier cryptocurrency seems to be showing signs of a potential rebound in the coming days.

BTC Price To Return To $110,000?

In a November 15 post on X, market analyst Burak Kesmeci shared that the price of Bitcoin is showing signs of recovery based on different technical indicators. In his analysis, Kesmeci fiddled with the possibility of BTC rising to $110,000 and the risk of falling to $85,000.

Firstly, Kesmeci analyzed the Bitcoin fear (VIX) score, a technical indicator that evaluates volatility and fear in the market. According to data provided by the analyst, this indicator has been above the crucial 16.50 level for two consecutive days for the first time in 250 days, suggesting the presence of a buy opportunity.

However, Kesmeci also highlighted that this signal does not automatically confirm a price rebound for the premier cryptocurrency from the current point. This buy signal might even persist and intensify if the VIX indicator continues to decline in the oversold zone.

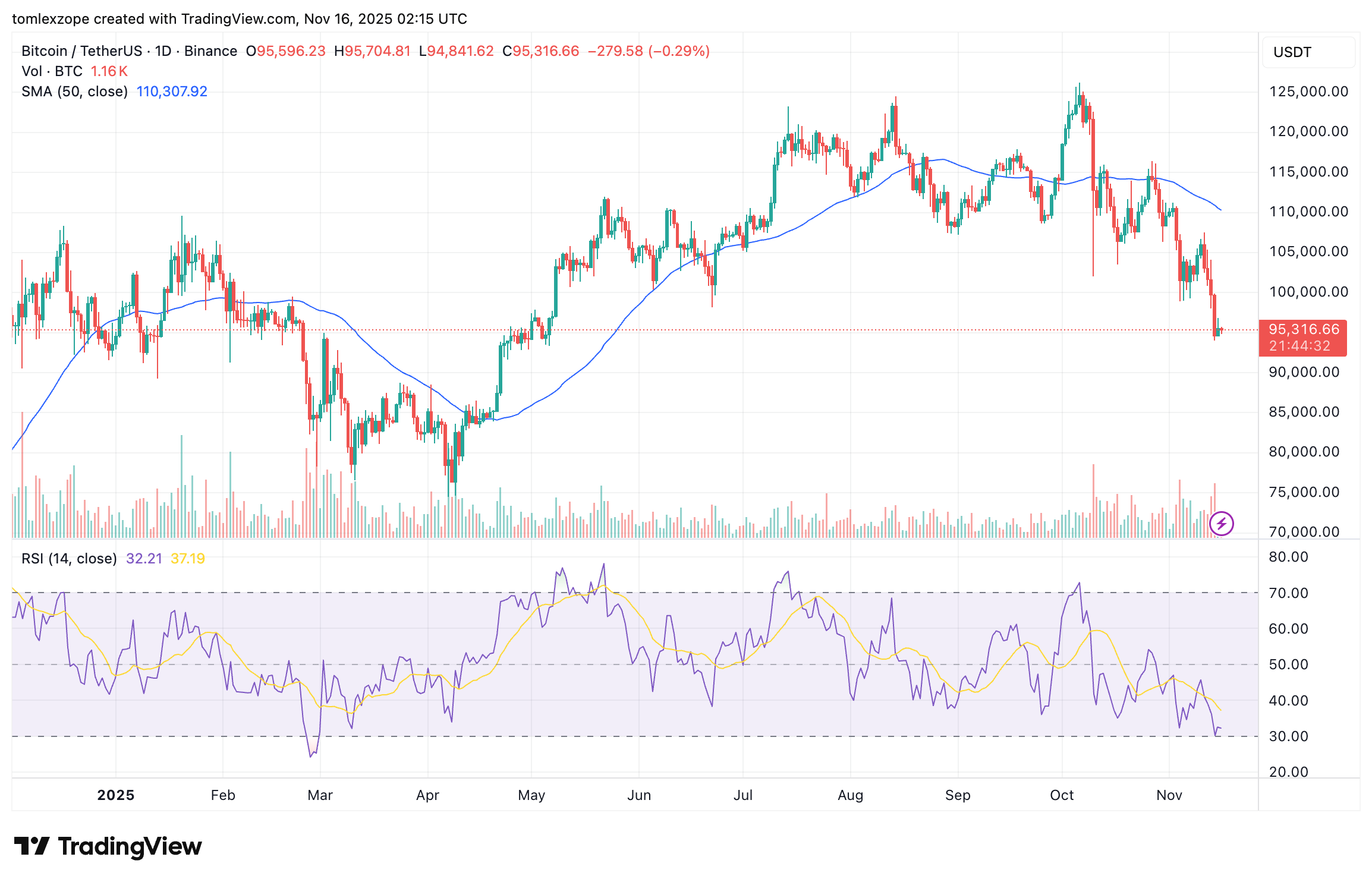

The crypto analyst noted that the Bitcoin price reacted a little to the daily Relative Strength Index (RSI) falling to 30, which marks the oversold territory. But Kesmeci mentioned that this RSI movement should offer little excitement, except if there is a positive divergence where RSI makes higher lows while price makes lower lows.

Furthermore, Kesmeci examined the Fixed Range Volume Profile (FRVP), stating that there is a small gap with no volume between $95,000 and $85,000. According to the crypto analyst, a close below $95,000 could see the Bitcoin price fall—in a single candle—to as low as $85,000 in a bid to fill the FRVP gap.

Kesmeci then hypothesized that holding above $95,000 could mean that Bitcoin is resting and building volume. With the current data suggesting that market makers are choosing to defend the $95,000, the crypto pundit believes that BTC could enjoy a reaction rally up toward $110,000, which is the real decision zone.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands around $95,076, reflecting no significant movement in the past 24 hours.