The post Bitcoin Price Analysis: Key Levels to Watch for the Breakout This Week appeared first on Coinpedia Fintech News

Bitcoin is on fire! The king of cryptocurrency is showing strong bullish momentum, with its price currently around $68,000. Key technical indicators, chart patterns, price action, whale activity, and Bitcoin ETF inflows all suggest a potential upward rally. With just a few days until the election, all eyes are on how Bitcoin will react.

Curious to learn more? Read on!

Crypto Technical Indicators Analysis

As of now, Bitcoin is priced at $68,242. On October 14, it broke above its previous high of $65,831.41, creating a higher-high pattern that hints at further price increases.

The weekly Bitcoin chart shows that it is trying to break through a significant trendline that connects lower highs. The MACD indicator indicates a bullish crossover forming, and the chart also reveals an inverse head and shoulders pattern, signaling a possible rally.

ETF Inflows Continue – What Does This Mean?

Since October 11, the Bitcoin Spot ETF market has seen at least six consecutive positive inflows. The highest inflow recorded was +$555.90 million on October 14, while the lowest was +$253.60 million on October 11. Yesterday, the market reported a net inflow of +$273.70 million, highlighting strong interest in Bitcoin from investors.

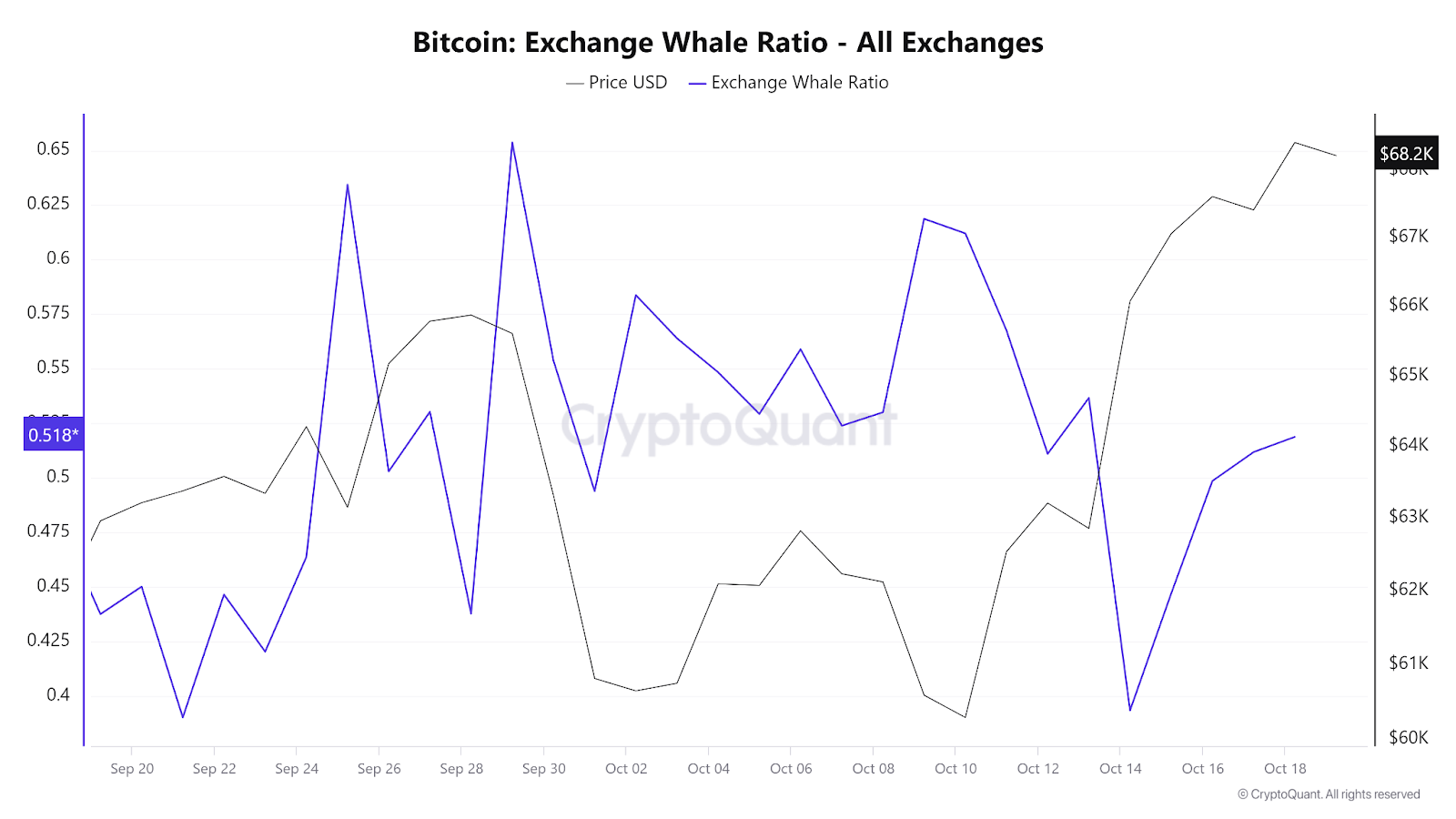

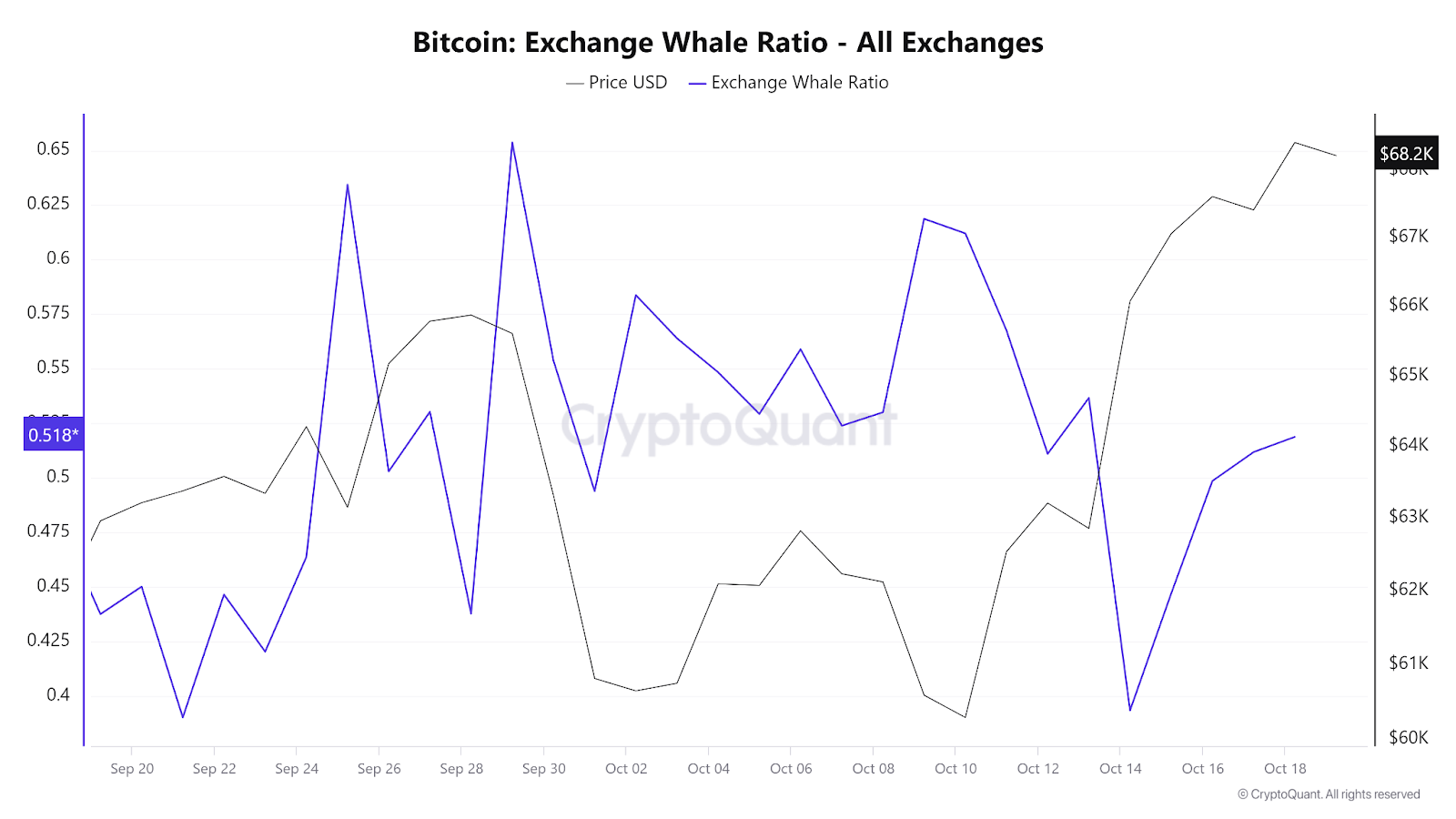

Yesterday, the exchange whale ratio was 0.51%, up from 0.49% at the beginning of the month. This increase shows that whales are buying significant amounts of Bitcoin, which is a bullish sign for the market.

Will Bitcoin Follow Gold’s Breakout?

Gold is also experiencing a notable breakout, with its price now at $2,721.20 per troy ounce—a 5.18% rise over the past month. Since Bitcoin and gold often move together, this trend could indicate similar movement for Bitcoin.

Election Countdown: What It Means for Bitcoin

With only 17 days until the election, many expect both Bitcoin and the stock market to see significant growth after the results, regardless of who wins. Past trends support this optimism, especially as many bettors on Polymarket believe Donald Trump—a pro-crypto candidate—will win the upcoming presidential election.

This sentiment could positively impact market dynamics, particularly as we approach the bullish phase of the Bitcoin halving cycle.

Bitcoin Market Insights

As per a crypto trading expert, identified on YouTube as Crypto Rover, Bitcoin is facing a resistance level of around $68,300. He predicts that the market may experience volatility over the weekend, but expects BTC’s price to return to the present range by Monday. The four-hour chart of Bitcoin shows a higher high, but the RSI applied to the chart points to a lower high. This suggests decreased momentum in the short term.

He also points out the level of $68,300 as an important level. He further opines that if the market strongly breaks the level, it can go far higher, potentially leading to a bullish Bitcoin price prediction.

In conclusion, while Bitcoin is currently facing resistance, various technical indicators, chart patterns, whale activity, and strong ETF inflows suggest that the market may soon break out. Keep an eye on these developments as the election approaches.