A handful of UK-listed companies have taken fresh steps to tie their balance sheets more closely to Bitcoin. Moves range from making new purchases to routing gold revenues and even opening retail crypto trading on the London Stock Exchange. The developments show growing corporate interest in holding and trading digital assets alongside more traditional operations.

Smarter Web Boosts Bitcoin Stash

According to company filings, The Smarter Web Company added 45.32 BTC this month, spending $4.73 million. Its total hoard now stands at 168 BTC. That marks an over 55% jump from its previous buy. The firm first rolled out its “10 Year Plan” in April as a way to build up a long-term treasury.

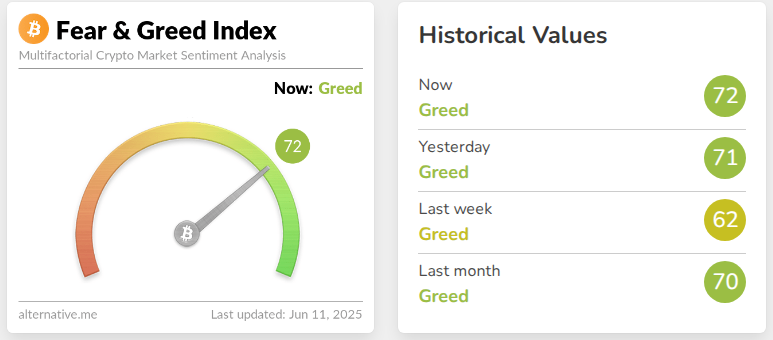

Based on reports, it has invested nearly $18 million so far, buying Bitcoin at an average of $105,779 each. Buying when the market’s Greed index hit 72 shows they’re willing to hold through ups and downs.

The Smarter Web Company (#SWC) RNS Announcement: Bitcoin Purchase.

Purchase of additional Bitcoin as part of “The 10 Year Plan” which includes an ongoing treasury policy of acquiring Bitcoin.

Please read the RNS on our website: https://t.co/z59Xf4oBRU pic.twitter.com/vmtFzjsQeY

— The Smarter Web Company (@smarterwebuk) June 10, 2025

Mining Firm Converts Gold Sales

Bluebird Mining Ventures Ltd, known for its gold operations, said it will funnel future revenue directly into Bitcoin. The miner aims to become the first UK-listed gold company with a fully BTC-focused treasury strategy. It made the decision after Bitcoin climbed to a record high of $111,965 in May.

Management sees this as a store of value alongside its mining output. The plan calls for regular conversions as income grows, betting that Bitcoin gains will outpace traditional reserves.

Trading Platform Opens Crypto Doors

IG Group, a long-standing trading firm on the London Stock Exchange, rolled out a new service this week. Retail clients can now buy and sell Bitcoin, Ethereum, and Ripple straight through IG’s regulated platform.

Previously, investors had to use ETFs or third-party wallets. The change means IG can tap into rising demand for direct crypto exposure. It also positions the firm to earn new fee revenue as more traders flock to its site.

Treasury Trend Spreads Among Firms

Based on market observers, several other British companies are weighing similar moves. Capital-heavy businesses are talking about setting aside funds for Bitcoin. Some view it as a buffer against inflation. Others simply don’t want to miss out if prices climb further.

While corporate treasurers were once cautious, the steady drumbeat of high crypto returns has pushed more boards to at least discuss pilot programs.

Taken together, these actions suggest that digital assets are no longer fringe experiments for big companies. They’re becoming part of mainstream treasury playbooks.

Featured image from Pexels, chart from TradingView