As Bitcoin (BTC) resumes recording new all-time highs (ATH), focus is back on key price levels that could provide investors with an idea about the next possible resistance levels that may see a sell-off in BTC. Fresh on-chain data offers a map of BTC’s most important price levels.

Bitcoin May Face Resistance At These Levels

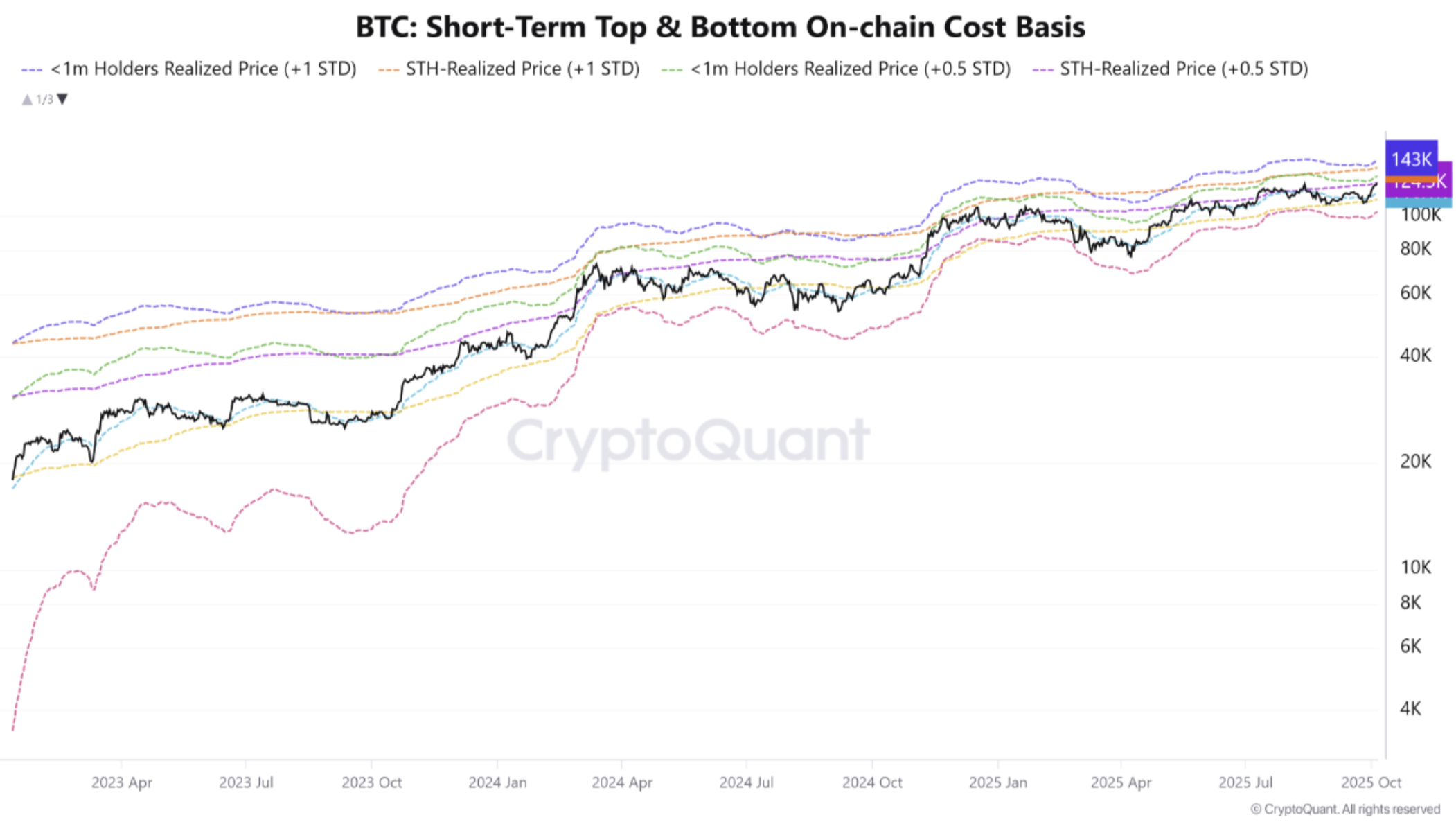

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, the cost basis (Realized Price) of BTC Short-Term Holders (STH) provides a snapshot of important support and resistance zones.

Notably, the STH Realized Price highlights the aggregate price at which recent market participants acquired their BTC. This information can give analysts an idea about potential price levels that can influence investors’ behavior to either take profits or hold their positions.

Crazzyblockk highlighted multiple price levels that could function as potential profit-taking zones. For instance, <1 month Holders Realized Price, +1 Standard Deviation, hovers at $143,170.

To explain, $143,170 is the price level where recent buyers (holding BTC for under a month) would, on average, be up by about one standard deviation on their cost – a zone that can trigger selling and serve as a near-term resistance.

Similarly, the <1 month Holders Realized Price, 0.5 Standard Deviation, is currently around $133,239. Meanwhile, the STH-Realized Price, +1 Standard Deviation, currently sits at $131,310.

The analyst added that the current BTC spot price is trading slightly above the “pivotal mid-point” level, which could determine the market’s next short-term move.

In addition, the CryptoQuant contributor noted multiple key support zones that could function as potential re-accumulation zones for BTC investors. These levels include $117,763, $111,963, and $103,239.

Fellow crypto analyst, Titan of Crypto, noted that while BTC has made a new ATH above $125,000, it must now break above the ascending channel and aim for a $130,000 target. Failure to break through could lead to price correction for the cryptocurrency.

Potential BTC Targets?

While some analysts fear that BTC is close to topping out for this market cycle, others are relatively more optimistic. For example, seasoned crypto analyst Ali Martinez predicts that BTC may reach $140,000 based on pricing bands.

Similarly, crypto analyst Alex Adler Jr. forecasted that BTC may surge as high as $160,000 if two key conditions are met. Further, depleting BTC reserves on crypto exchanges may hasten the digital asset’s upward price trajectory.

Finally, if Bitcoin follows its trajectory from the 2021 market cycle, then it could target at least $136,000, with an extended target of $147,000. At press time, BTC trades at $122,113, down 2.2% over the past 24 hours.