The post BitMine Buys 14,618 Ethereum, But ETH Price Still Stays Flat appeared first on Coinpedia Fintech News

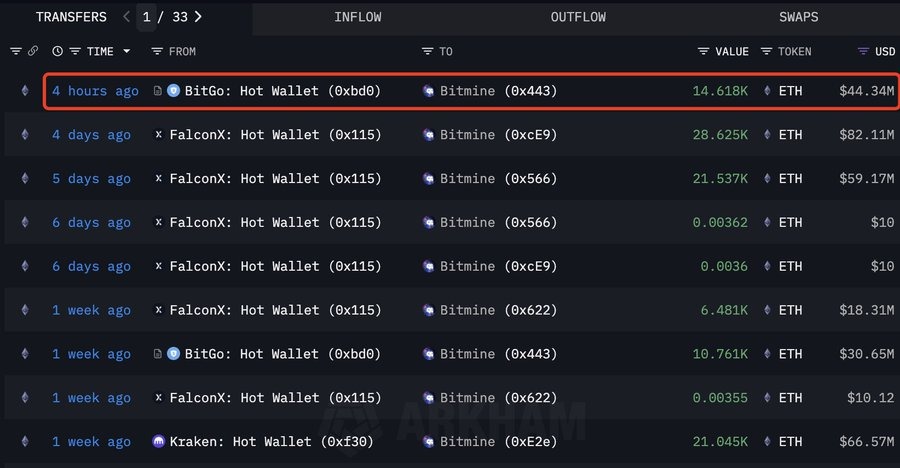

BitMine Immersion Technologies, led by market strategist Tom Lee, has continued its ETH buying spree into its treasury. In its latest purchase, BitMine added 14,618 ETH worth more than $44 million to its holdings.

But even with millions flowing into Ethereum, the ETH price refuses to pump, trading near $3000.

BitMine Adds 14,618 ETH Into Treasury

Data from Arkham Intelligence shows BitMine bought 14,618 ETH worth about $44.34 million on November 28. This is part of the company’s larger plan to own 5% of Ethereum’s total supply, equal to nearly 6 million ETH.

With this latest addition, BitMine is now halfway to its target. The company currently holds 3.63 million ETH, which represents about 3% of the total Ethereum network.

At the current price of around $3,027, BitMine’s Ethereum holdings are valued at roughly $10.39 billion, placing it among the biggest corporate ETH holders globally.

Corporate ETH holdings are rising fast, with companies now owning $24.97 billion, about 5.01% of the entire supply. This shows large institutions are quietly preparing for Ethereum’s future role in staking, yields, and tokenized assets.

BitMine Stock Jumps 9%, But Still Under Pressure

Interestingly, BitMine’s stock (BMNR) saw a strong reaction to the news, rising nearly 9% to around $31.74, outperforming ETH itself.

Despite the recent jump, BitMine’s stock is still down about 37% over the past month. The main reason is its strong correlation with Ethereum and the broader crypto market.

Since the crypto market has dropped nearly 22% during this period, BMNR stock has also faced heavy selling pressure.

Ethereum Price Stays Flat

Even with this accumulation, Ethereum continues to trade near $3,030, down 25% from the month before.

Some experts point to large outflows from spot ETH ETFs and shaken institutional sentiment as key reasons why the market hasn’t reacted. With liquidity still weak, big buys are not enough to flip the trend in the short term.