Quick Take

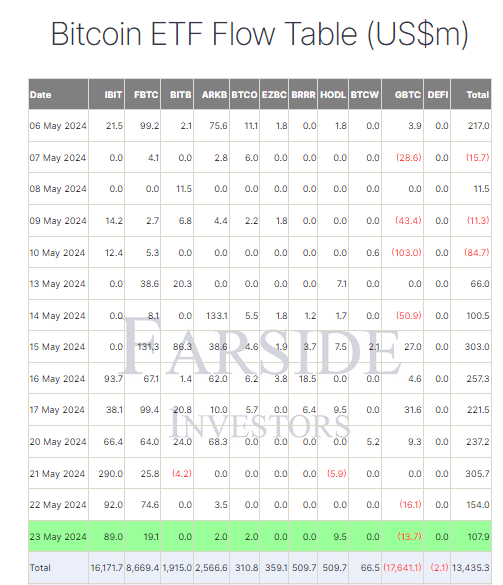

According to Farside data, on May 23, Bitcoin (BTC) exchange-traded funds (ETFs) saw a significant accumulation of $107.9 million. Notably, five out of the 11 tracked ETFs experienced net inflows. Leading the charge was BlackRock’s IBIT, which reported an inflow of $89.0 million, bringing its total net inflow to an impressive $16.2 billion. Fidelity’s FBTC followed with a $19.1 million inflow, increasing its total net inflow to $8.7 billion. VanEck’s HODL ETF also saw positive activity with a $9.5 million inflow, bringing its cumulative net inflow to $509.7 million. However, Grayscale’s GBTC faced a $13.7 million outflow, contributing to a substantial total net outflow of $17.6 billion. The aggregate net inflow to all ETFs stands at $13.4 billion.

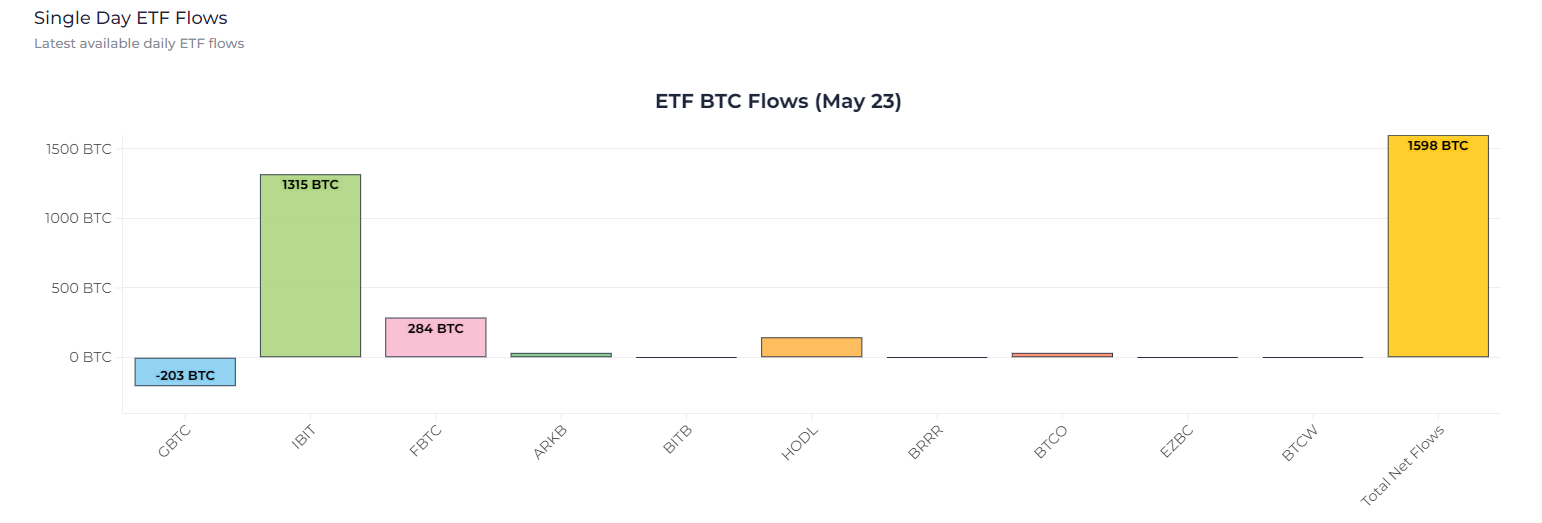

Heyapollo data indicates that BTC ETFs accumulated 1,598 BTC on May 23. This figure is more than 3.5 times the daily mining reward of approximately 450 BTC. IBIT now holds 284,518 BTC, while GBTC holds 289,079 BTC, a difference of just 4,561 BTC.

The post BlackRock’s IBIT inches closer, trails GBTC by just 4,561 BTC appeared first on CryptoSlate.