Bitcoin continues to see green across all short-time and medium-timeframes as the cryptocurrency reconquest lost territory. As of this writing, the BTC price stood above the significant psychological mark of $24,000 and seems ready to keep smashing resistance levels.

The Magnetic Forces Pushing Bitcoin To The Upside

Bitcoin has been on an upside trend since January 9th. At that time, the cryptocurrency broke above the 200-day Simple Moving Average (SMA), a critical level that has historically operated as support and resistance during major market trends.

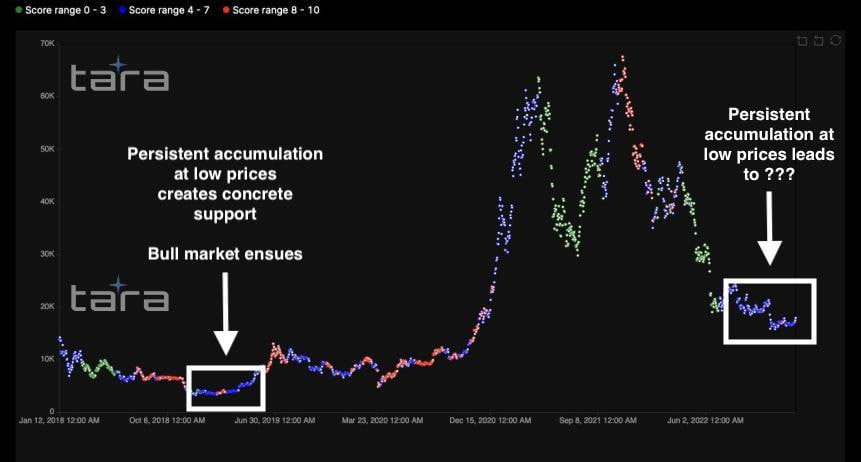

At these levels, big players choose to accumulate or take profit from their BTC holdings. When the cryptocurrency was below its 200-day SMA, the market took advantage of the low prices and began an aggressive accumulation, as seen in the chart below.

This accumulation resembles the 2019 BTC bottom that preceded the massive 2021 rally into new all-time highs. The reclaim of the 200-day SMA forecasted both shifts in trends and market conditions.

According to Samson Mow, long-time Bitcoin supporter and CEO at Jan3, these levels have a major influence on the BTC market:

The Bitcoin 200 WMA is like a magnet. When price is below, it’s an attractive force pulling price upwards. After we cross the the 200 WMA, the polarity flips and it becomes a repulsive force pushing price upwards.

What’s Behind The Bitcoin Rally?

A positive performance in legacy financial markets, an improvement in macroeconomic conditions, as the U.S. Federal Reserve announced a 25 basis point (bps) and a spike in the BTC spot trading volume. These three factors support what appears has an enduring trend for 2023.

After a long period of selling pressure, downside price action, and accumulation, the bulls seem ready to take over the market. In the short term, Bitcoin could trend higher into the $30,000 region if the trend continues.

According to economic Alex Krüger, BTC market participants could see some resistance at those levels before resuming the bullish momentum:

(…) breaking through 30k then pulling back would be normal market dynamics. Markets tend to run key round levels over, trigger stops, bring suckers in, then flush them out. And 30k-35k looks very doable.