The U.K. has unveiled “ambitious plans” to “robustly regulate” various crypto activities, while seeking to protect customers and grow its economy. In the next three months, British authorities will accept public feedback on the new regulatory proposals designed to govern digital assets like traditional finance.

British Government Sets Out to Regulate Crypto Market, Remains Committed to Innovation

The executive power in London has announced plans to regulate a wide range of crypto-related activities through new rules for the young industry that will be consistent with Britain’s regulations for the traditional financial sector.

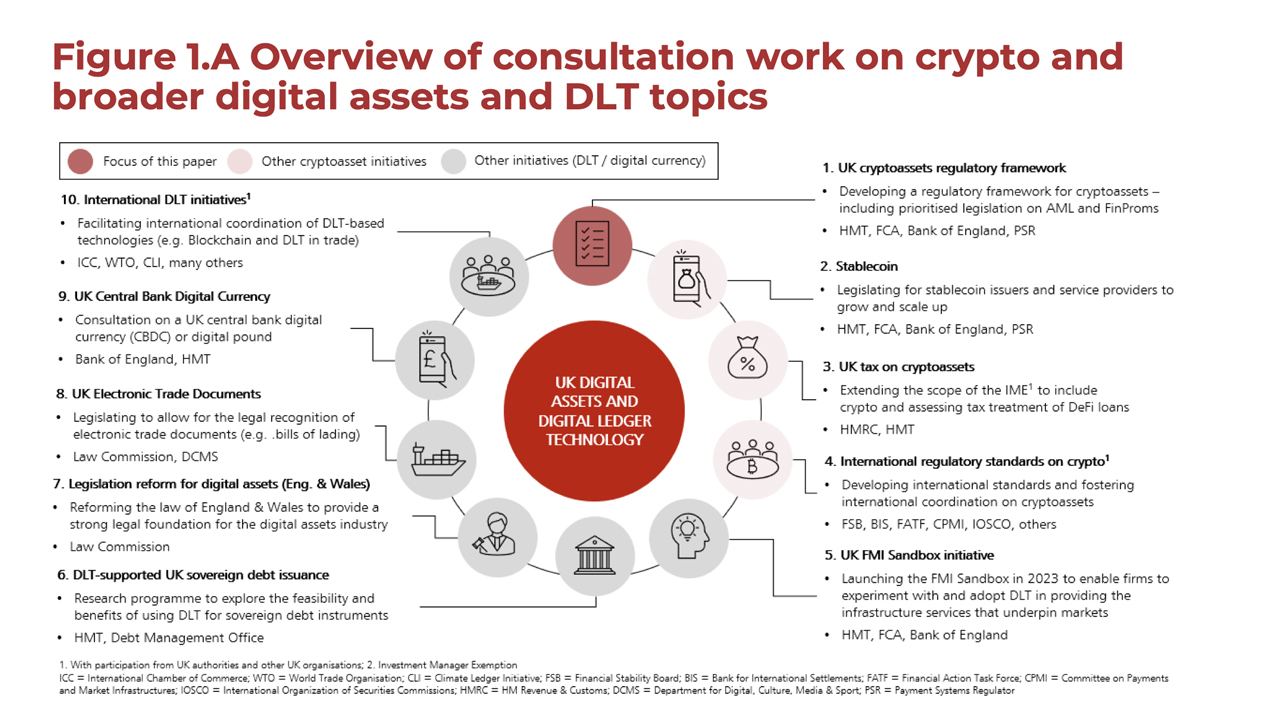

A public consultation on the proposals has been launched and will continue until the end of April. In the published paper, the U.K. Treasury reaffirms its belief that “crypto technologies can have a profound impact across financial services.” The document provides an overview of the consultation work ahead.

The British government also insisted its approach to regulation “mitigates the most significant risks, while harnessing the advantages of crypto technologies” and expressed hopes to enable the crypto industry to expand, invest, and create jobs. Economic Secretary to the Treasury Andrew Griffith emphasized:

We remain steadfast in our commitment to grow the economy and enable technological change and innovation – and this includes crypto-asset technology. But we must also protect consumers who are embracing this new technology.

The draft rules aim to ensure that crypto exchanges “have fair and robust standards.” They will be responsible for “defining the detailed content requirements for admission and disclosure documents,” an announcement revealed on Wednesday.

Officials also indicated they want to strengthen the rules for intermediaries and custodians that facilitate cryptocurrency transactions and store customer digital assets. They believe this would help to establish a “world-first regime” for crypto lending.

The move comes in the aftermath of several high-profile failures that shook the crypto space, including the collapse of major crypto exchange FTX. The British government has previously said that it intends to adopt regulations that would prevent market abuses.

Majority of Crypto Asset Companies in the UK Fail to Receive Regulatory Approval

The regulatory proposals follow last week’s announcement by the U.K.’s Financial Conduct Authority (FCA) that most entities that want to do business with crypto assets in Great Britain, 85% of all applicants, have failed to convince regulators they can meet the country’s minimum anti-money laundering (AML) requirements.

The regulator said it had identified significant failures in spheres such as due diligence, risk assessment, and transaction monitoring. “In many cases, key personnel lacked appropriate knowledge, skills and experience to carry out allocated roles and control risks effectively,” the FCA said.

Meanwhile, the Treasury Committee at the House of Commons is still looking into the potential threats and opportunities associated with crypto assets and the need for regulation. “We are in the middle of an inquiry into crypto regulation and these statistics have not disabused us of the impression that parts of this industry are a ‘Wild West,’” Harriett Baldwin, chair of the select committee, was quoted as stating.

What effect do you think the upcoming U.K. rules will have on the development of the country’s crypto industry? Share your expectations in the comments section below.