The volatility that has become synonymous with the crypto industry hasn’t deterred institutions from participating in it, as hedge funds investing in crypto are at an all-time high, according to PwC’s 2022 Global Crypto Hedge Fund Report.

The annual report surveys both traditional hedge funds and specialist crypto funds to gain a better understanding of how the relatively new, but extremely dynamic sector of the industry functions.

Crypto hedge funds surge in numbers

PwC’s research shows there are over 300 crypto-focused hedge funds currently on the market. While some might attribute this growth to the maturity of the crypto industry, data from the report suggests that the launch of new crypto hedge funds appears to be correlated to the price of Bitcoin (BTC).

Data showed that a large number of funds were launched in 2018, 2020, and 2021 — all very bullish years for Bitcoin — while less bullish years have seen much more moderate activity.

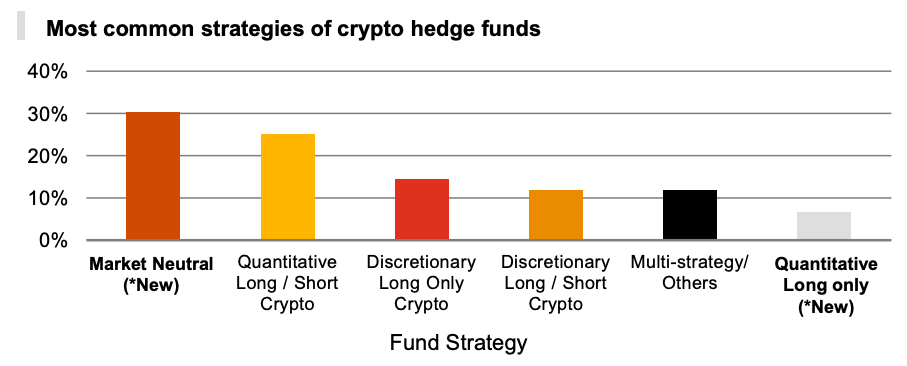

However, most new crypto hedge funds usually employ investment strategies that don’t rely on the market going up. In a survey of over 70 crypto hedge funds, PwC found that almost a third of them employed a market-neutral investing strategy. Aiming to profit regardless of the direction of the market, these funds usually use derivatives to mitigate risk and get more specific exposure to the underlying asset.

The second most popular trading strategy is a quantitative long and short strategy, where funds take both long and short positions based on a quantitative approach. Market-making, arbitrage, and low-latency trading are the most common strategies used. Despite being popular among hedge funds and providing good returns, these strategies restrict funds to only trading more liquid cryptocurrencies.

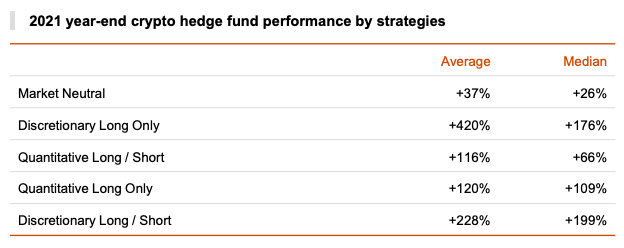

On a median basis, funds employing a discretionary long and short strategy have been the best-performing ones. PwC’s data showed that these funds showed a median return of 199% in 2021. Looking at the average return shows that discretionary long funds have been the best performing ones, showing returns of 420% in 2021. Market neutral funds considerably underperformed funds with other strategies, showing an average return of just 37%.

PwC notes that returns shown by discretionary long and short funds were the ones employing a strategy that best fits the market at the time, as intra-period Bitcoin returns peaked at 131% last year.

However, with a median performance of 63.4% in 2021, PwC’s sample of hedge funds was only able to slightly outperform Bitcoin’s price, which increased by around 60% throughout the year. And while different strategies yielded different levels of performance, all strategies in 2021 underperformed when compared to 2020.

“The bull market in 2021 did not result in the same level of gains as that of 2020, with BTC increasing just 60% compared to about 305% the year before.”

PwC noted that returns aren’t the only value proposition of hedge funds. What they offer investors is protection against volatility and the data in the report doesn’t paint a picture of whether the strategies were able to offer higher or lower volatility in return to cryptocurrencies. Even with low returns, hedge funds that provide lower volatility could be more attractive to investors.

Assets under management on the rise

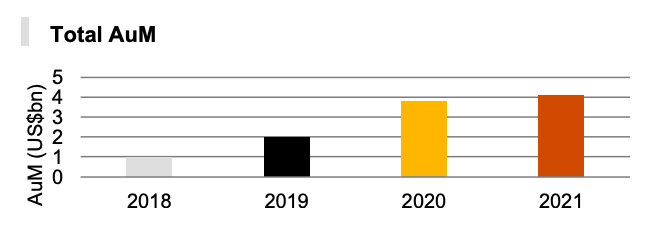

Last year’s slow performance and high market volatility certainly haven’t affected the amount of money investors put into hedge funds.

The report estimates that the total assets under management (AuM) of crypto hedge funds increased by 8% to about $4.1 billion in 2021. The median AuM of crypto hedge funds tripled to $24.5 million in 2021 compared to the previous year, while the average AuM increased from $23.5 million in 2020 to $58.6 million in 2021.

Managing all of those assets comes with a cost. Just like traditional hedge funds, crypto funds charge their investors a 2% management and a 20% performance fee.

“One would expect crypto hedge fund managers to be charging higher fees given the lower degree of familiarity with the product and the higher operational complexity such as opening and managing wallets – leading to a less accessible market for individual investors, but it seems this has not been the case.”

PwC expects crypto funds to incur higher costs as the overall crypto market develops. With regulators around the world demanding higher security and compliance standards, crypto hedge funds will most likely have to up their management fees to keep profitable.

However, the 20% performance fee could continue to get lower in the coming years as more funds and other institutions begin entering the crypto space. Average performance fees decreased from 22.5% to 21.6% percent in 2021, showing that the rising number of new funds entering the space are beginning to compete to attract new clients.

One of the methods crypto funds seem to be using to attract clients is offering a diverse investment portfolio. While 86% of the funds said that they have invested in “store of value cryptocurrencies” such as Bitcoin, 78% said that they have been investing in DeFi.

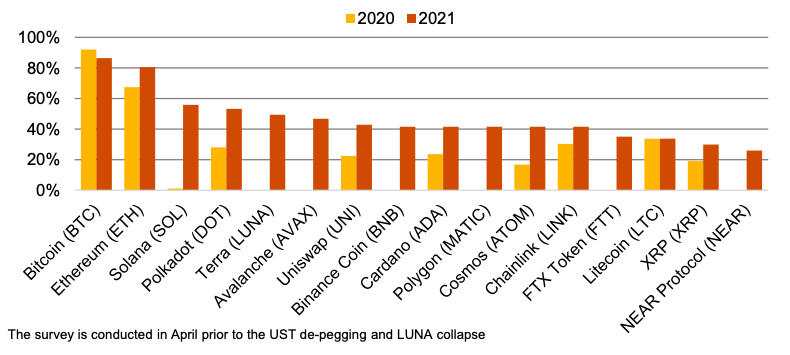

Less than a third of funds said that half of their daily trading volume is in BTC. When compared to last year’s 56%, it shows that funds are rapidly diversifying into altcoins. After BTC and Ethereum (ETH), the top five altcoins crypto hedge funds traded were Solana (SOL), Polkadot (DOT), Terra (LUNA), Avalanche (AVAX), and Uniswap (UNI).

It’s still unclear how the de-pegging of TerraUSD (UST) and the subsequent collapse of LUNA affected these funds, as PwC’s survey was conducted in April before those events took place. The company believes that we’ll see capital inflows into the crypto market slow down for the remainder of the year as investors become more cautious.

“Many funds have yet to post their May 2022 returns and it will only be once these are out that it will be possible to judge the impact of the Terra collapse and the wider downturn in crypto markets. Of course, there will also be funds that already had a bearish outlook or were able to adjust and identify the issues at Terra better, managing their exposures or even taking short positions over this period. Corrections are to be expected. The market has recovered before and there is no reason to believe it won’t rebound again,” John Garvey, the global financial services leader at PwC, told CryptoSlate.

PwC believes that the caution will spread to stablecoins as well. In addition to altcoins, stablecoins have also significantly grown in popularity among hedge funds. The two largest stablecoins in terms of usage were USDC and USDT, with 73% and 63% of funds using them, respectively. Just under a third of crypto funds reported using TerraUSD (UST) in the first quarter of the year.

“It is interesting to note that despite USDT’s market capitalization being almost double that of USDC, hedge funds seem to prefer using USDC. We believe this is due to the greater transparency offered by USDC around the assets backing the stablecoin.”

The increase in stablecoin usage could be explained by a similar increase in the use of decentralized exchanges. According to PwC’s report, 41% of crypto funds reported using DEXs. Those dabbling in DeFi seem to flock to Uniswap, as data showed that 20% of funds used the platform as their preferred DEX.

Bullish on Bitcoin

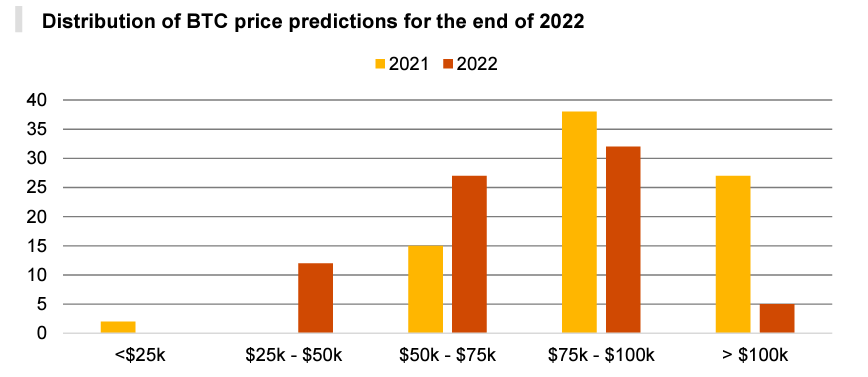

Despite the market being quite bearish at the time PwC’s survey was conducted, most crypto funds remained bullish on Bitcoin. When asked to give their estimate on where the price of BTC will be at the end of the year, the majority (42%) put it in the $75,000 to $100,000 range. Another 35% predicted it would range between $50,000 and $75,000.

The post Crypto hedge funds are bullish on Bitcoin and knee-deep in DeFi appeared first on CryptoSlate.