Since January 2022, the entire crypto economy has shed $1.36 trillion in value, as the market capitalization dropped from $2.34 trillion to today’s $979 billion. While the crypto economy is down in value, trade volumes are lower, and the value locked in decentralized finance (defi) has shed billions, treasuries held by decentralized autonomous organizations (DAOs) have increased by 7.69% in value since January, as roughly $700 million was added to the projects’ caches in eight months.

DAO Treasuries Jump 7.6% Higher in USD Value, Since 2016 the Value Held by Decentralized Autonomous Organizations Grew by 6,025%

On June 10, 2022, the total amount of funds held by decentralized autonomous organization (DAO) treasuries reached the $10 billion range for the first time in history. While the crypto industry is dealing with lower prices and bearish sentiment, the value held by DAO treasuries has managed to weather the storm.

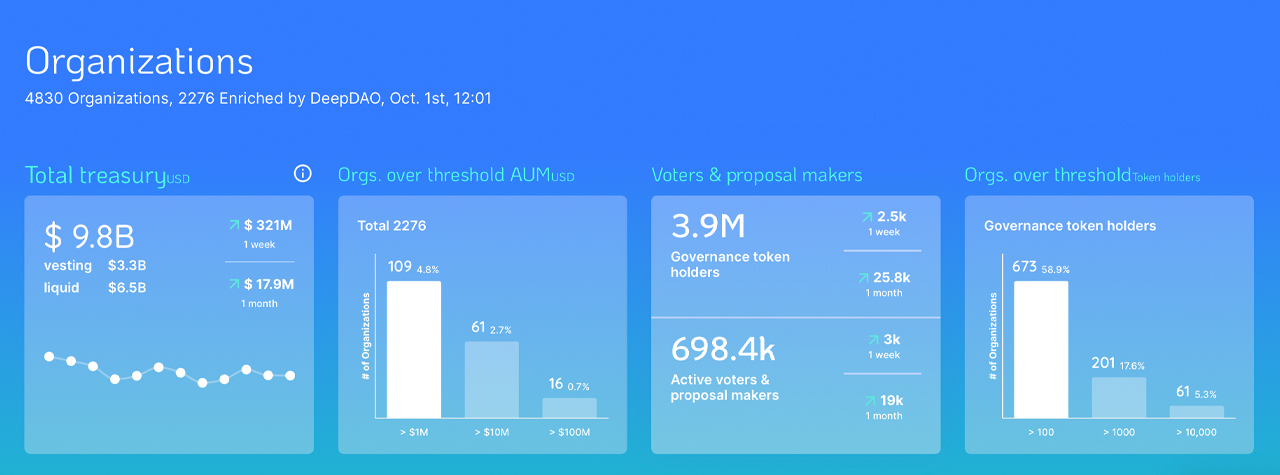

Presently, across 4,830 organizations, DAOs hold $9.8 billion, which is only $200 million less than the aggregate value held by DAOs 112 days ago. While it is $200 million less than it was three months ago, DAO treasury values have increased by $700 million since January, according to stats aggregated by deepdao.io.

On January 22, deepdao.io metrics recorded by archive.org indicate there were 4,227 organizations at that time, and collectively, $9.1 billion was held in DAO treasuries. With $9.8 billion today, that’s a 7.69% increase in USD value held by DAO treasuries over the last 251 days.

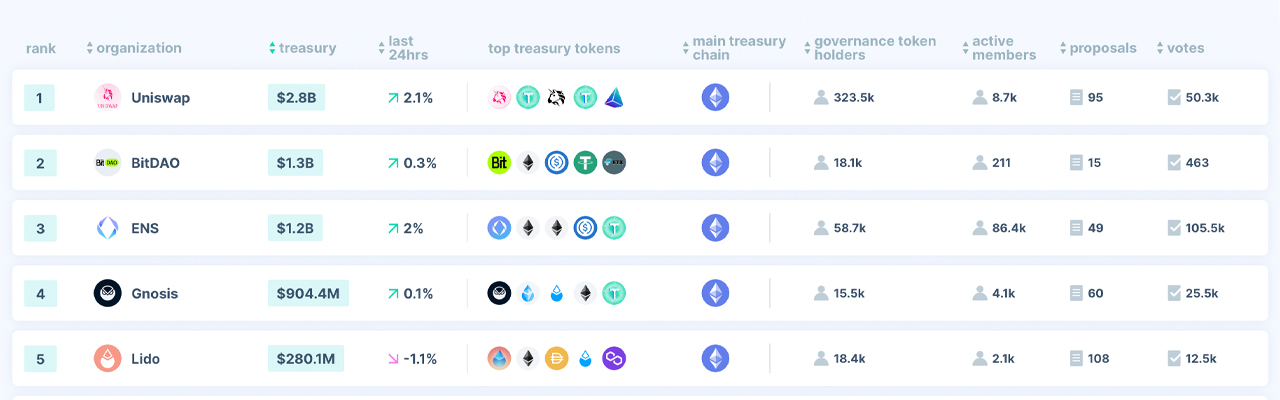

At the time, Bitdao held $2.4 billion in its treasury and it was the largest DAO treasury in January. Uniswap was the second largest at the time, with $2.1 billion. Both Bitdao and Uniswap are still the top two DAOs in terms of treasury size, but Uniswap is now the largest.

On October 1, Uniswap has $2.8 billion, while Bitdao’s cache has shrunk to $1.3 billion from the $2.4 billion held at the beginning of the year. Bitdao’s $1.3 billion makes it the second largest DAO treasury and it’s followed by ENS which holds roughly $1.2 billion.

251 days ago, ENS was the 14th largest and at the time, the third largest was Lido Finance. The liquid staking protocol’s DAO is now the fifth largest, with $283 million held in the Lido DAO today. The top ten DAO treasuries include Uniswap, Bitdao, ENS, Gnosis, Lido, Olympus DAO, Mango DAO, Merit Circle, Compound, and Aragon Network.

Out of the entire $9.8 billion, there are 3.9 million governance token holders, and 698,400 active voters and proposal makers. 109 DAOs hold $1 million or more, while only three DAOs have more than a billion in funds.

While Uniswap has $2.7 billion, 98.7% of the project’s treasury funds are held in uniswap (UNI) tokens, and Bitdao has a treasury comprised of a bunch of different crypto assets which include tokens like BIT, ETH, USDC, and USDT.

As the crypto economy continues to deal with tumultuous times, decentralized autonomous organization treasuries have seen steadfast growth since the start of the year. Since the first DAO was created in 2016, DAO treasuries have increased 6,025% in USD value during the last six years.

What do you think about the thousands of DAOs today and the $9.8 billion held by DAO treasuries? Let us know what you think about this subject in the comments section below.