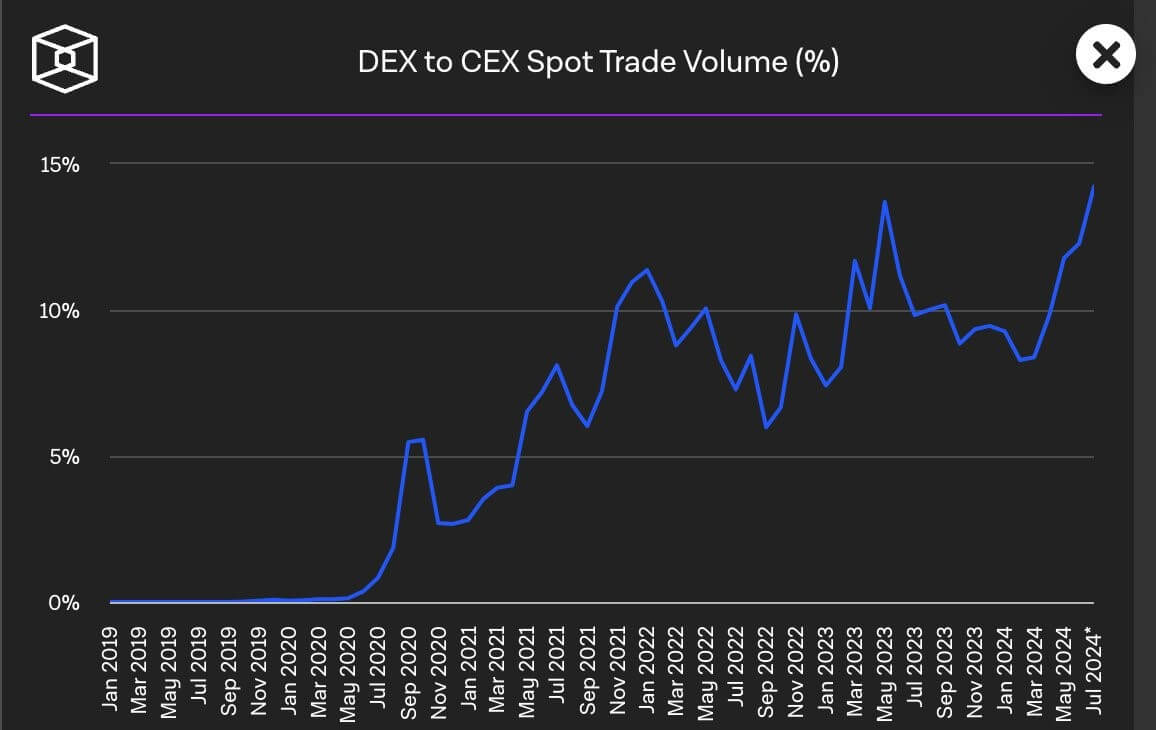

Decentralized exchanges (DEXs) now have their highest-ever trading volume ratio compared to centralized exchanges (CEXs).

On July 29, Uniswap founder Hayden Adams highlighted this achievement, noting that “DEX market share is at an all-time high relative to CEX.”

Adams referenced a chart from The Block showing that DEX trading volumes have been rising since the start of this year.

This trend correlates with a broader bullish market, driven by the US Securities and Exchange Commission’s (SEC) approval of spot exchange-traded funds (ETFs) for major digital assets, including Bitcoin and Ethereum.

Notably, the growth in DEX activity also comes during increased institutional and political interest in the crypto market, especially as the US election approaches.

DEX volume rising

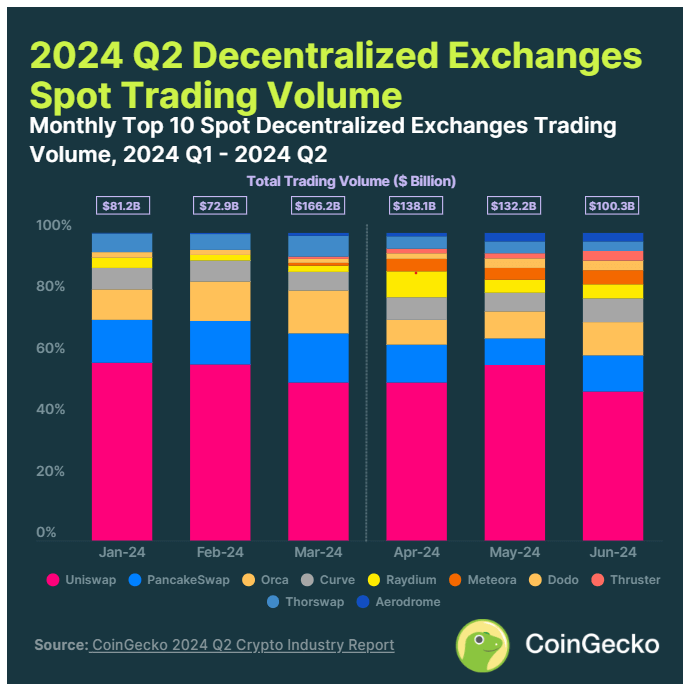

The above confirms findings from CoinGecko’s recently released second-quarter report, which shows a significant shift in crypto trading patterns. The data indicates a decline in spot trading volume on centralized exchanges, while DEXs have experienced a notable increase.

During the second quarter, trading volume on the top 10 DEXs surged 15.7% from the previous quarter, reaching $370.7 billion. This growth is largely attributed to a rise in memecoins and a flurry of airdrops during this period.

Uniswap remained the leading DEX, commanding 48% of the market share by the end of June. New entrants like Thruster and Aerodrome also saw substantial growth, challenging established players in the lower tier of the DEX market.

Conversely, centralized exchanges saw a 12.2% drop in spot trading volume, totaling $3.4 trillion for the quarter. Despite this decline, Binance continued to lead the market with a 45% share, while other exchanges such as Bybit, Gate.io, Bitget, and HTX performed well.

The post DEX market share reaches ATH as CEXs face shrinking volume appeared first on CryptoSlate.