The first successful discreet log contract has been executed on the Lightning Network by creating a new type of transaction when opening a Lightning channel.

The below is a direct excerpt of Marty's Bent Issue #1286: “The first mainnet DLC on Lightning has been executed.” Sign up for the newsletter here.

It's been exactly 11 months and two days since we wrote about discreet log contracts (DLCs) in this rag. For those of you who are a bit rusty or completely ignorant in regards to what a Discreet Log Contract is, it is a special type of bitcoin transaction that executes a smart contract with information provided by an oracle.

For example, if two people want to bet on the outcome of Saturday's NBA contest between the 76ers and Grizzlies they could create a DLC by locking up funds in a multisig address, pre-constructing outcome transactions — if the 76ers win send the sats to this address, if the Grizzlies win send the sats to this address — and choosing an oracle, a company that publishes final scores, e.g., Statmuse. The oracle provides a hash of the outcome of the game. When the game is over on Saturday the DLC could be closed out by the winner of the bet by signing the transaction that moves the sats in the smart contract to their address using the hash of the outcome provided by Statmuse.

A sports bet is but one example. Individuals could decide to wager on the price of bitcoin, the hash rate at a certain block height, the temperature on a particular day, or even create peer-to-peer derivatives like the team from ItchySats has done. If you freaks have been following our coverage of DLCs throughout the years, you probably know that your Uncle Marty is pretty bullish about the potential for DLCs to disrupt a number of industries. However, to date, one of the things limiting DLCs from hitting a critical tipping point is the fact that they have only been conducted on chain. Considering how many potential applications that could leverage DLCs and how many end users they could potentially touch, the thought of scaling this use case on chain seems untenable, especially if one considers the possibility of periods of elevated transaction fees that make certain DLCs uneconomical. To me, it makes sense for DLCs to operate on Layer 2 protocols, like the Lightning Network or Fedimint, which have relatively cheap fees.

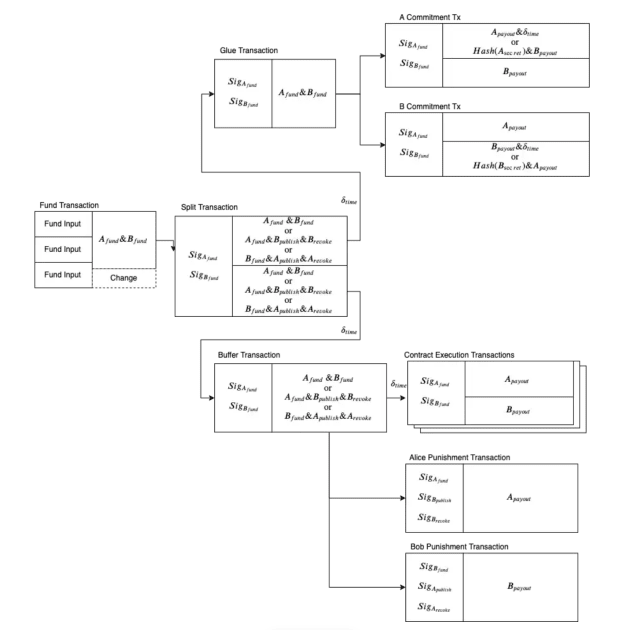

Well, the Crypto Garage team announced that they successfully opened and closed a Lightning channel with an embedded DLC channel on mainnet. Per their blogpost, it looks like the Crypto Garage team forked the Lightning Development Kit to add support for splitting a Lightning channel, which has enabled them to create a DLC channel within a Lightning channel. From there, they were able to create special transactions — a split transaction and a glue transaction — that would enable the different parties engaged in a DLC to update the state of their contract within the Lightning channel and the DLC channel without giving one of the parties an unfair advantage, which was one of the big design challenges that was previously unsolved. This is a massive step in the right direction.

With that being said, the Crypto Garage team is warning that this implementation is in its very early days and should not be considered stable. In fact, they warn that you are likely to lose your sats if you try to execute this on mainnet. Nonetheless, this is incredible to see. Shoutout to the Crypto Garage team and those that helped them out for pushing this forward.

Slowly but surely, as every naysayer on the planet is claiming bitcoin a failed Ponzi scheme, those who recognize the revolutionary nature of the protocol are building the tools that make bitcoin more useful for individuals the world over.