The cryptocurrency market has had a year filled with ups and downs, with most large-cap digital assets turning in mixed performances in 2025. After a rough start to the year, things started to look up for the price of Bitcoin in the second and third quarters, as it set multiple all-time highs across the six-month period.

However, the flagship cryptocurrency has largely struggled in the final months of 2025, looking set to end the year in the red. Interestingly, the latest on-chain data and historical patterns suggest that the price of Bitcoin might be set for a fairly stronger yearly close than expected.

No Negative Days Left In 2025, But 2026 Could Feature A Deep Correction

On Saturday, December 6, Alphractal CEO and founder Joao Wedson took to the X platform to share what to expect from the Bitcoin price in the last days of 2025. According to the on-chain expert, the market leader is likely to close the year in a sideways price range.

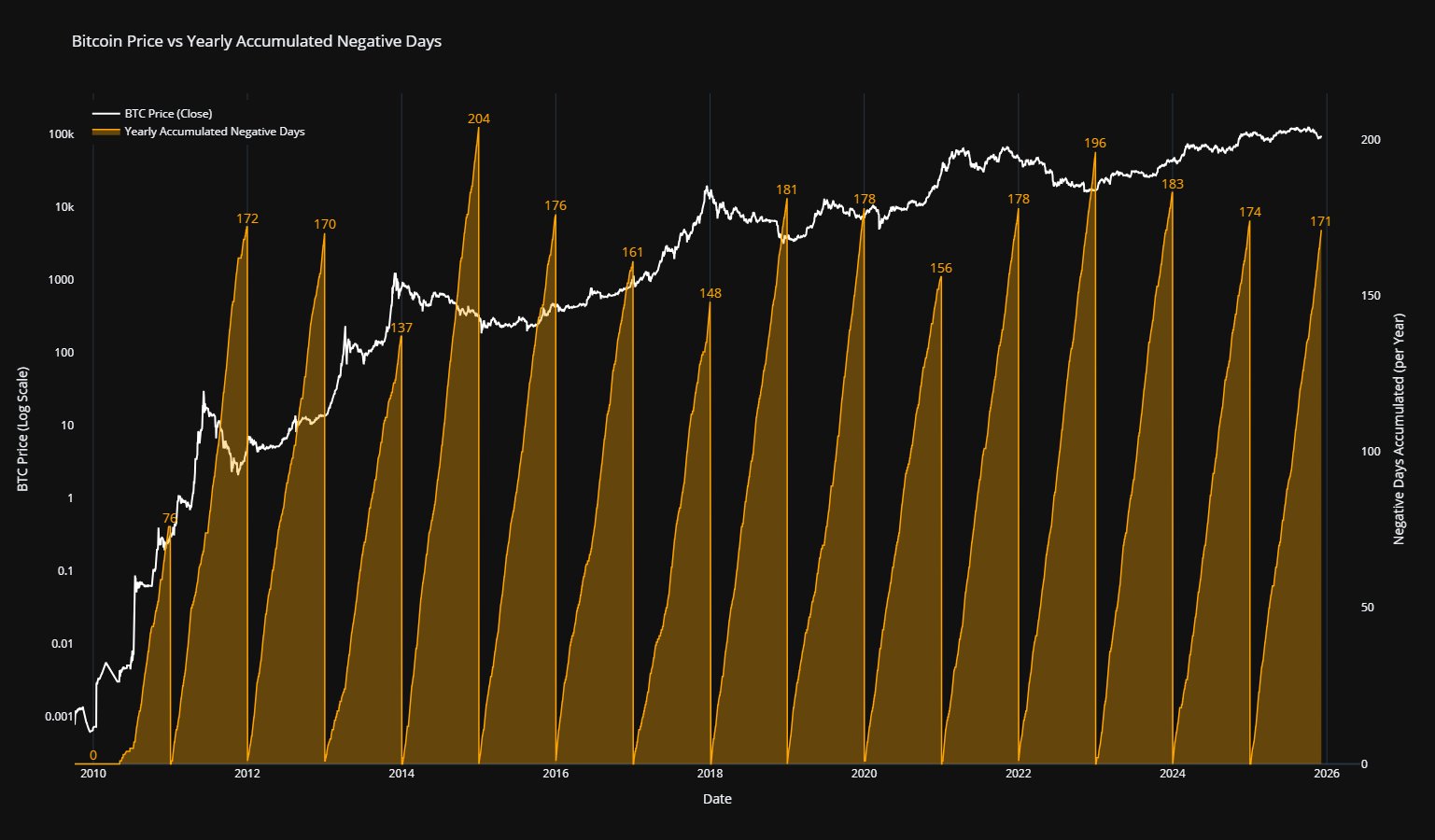

The relevant metric here is the Yearly Accumulated Negative Days, which tracks market resilience by measuring the number of days in a year where an asset’s daily price candlestick closed in the red.

According to historical data and patterns, Bitcoin typically witnesses an average of 170 days of negative price movement in a year. This mean figure or level provides insight into the stress threshold for the world’s largest cryptocurrency by market cap.

When the number of negative days is approaching or exceeds this threshold of 170 days, as Bitcoin already has in 2025, the selling pressure in the market tends to wane as fatigue sets in among the bears. Wedson revealed that the premier cryptocurrency has already accumulated 171 negative days so far in 2025.

The on-chain expert noted that exceeding this threshold “strongly suggests” that the price of Bitcoin might not witness any more negative days in the final few weeks of 2025. Wedson said that if a deeper correction is imminent for the market leader, it will most likely happen in the next year.

However, as the Alphractal founder highlighted, the Bitcoin price is more likely to end the year within a consolidation range. Adding further credence to this postulation is the lack of market demand, as seen with reduced capital influx into spot Bitcoin exchange-traded funds.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $89,397, reflecting a mere 0.3% drop in the past 24 hours.