Retail sentiment toward Ethereum (ETH) remains weak, but analysts suggest that a significant breakout could be on the horizon. Despite Ethereum’s sluggish price action, multiple on-chain indicators and technical patterns hint at an impending bullish reversal.

Ethereum Retail Sentiment At Low Amid Sluggish Price Action

According to cryptocurrency analyst Mister Crypto, retail interest in ETH is “extremely low,” as indicated by Google Trends data. Compared to its 2017 and 2021 peaks, Ethereum’s current sentiment ranks significantly lower, suggesting that many retail investors are sitting on the sidelines.

Historically, low retail sentiment often signals a prime buying opportunity for institutional investors looking to accumulate assets before the next price surge. While weak sentiment reflects a lack of confidence among small investors, institutions tend to take advantage of such conditions, positioning themselves ahead of the next bullish cycle.

Despite the pessimism, crypto analyst Ted pointed out that the potential approval of an Ethereum exchange-traded fund (ETF) staking and the upcoming Pectra update could serve as key catalysts for a breakout. He suggests that these developments may help Ethereum regain momentum and push its price toward new highs.

Fellow analyst Crypto Patel echoed this sentiment, noting that ETH is currently consolidating within an accumulation range. Based on historical price cycles and on-chain data, Patel expects Ethereum to break out after April, with a long-term target of $10,000.

Additionally, analyst Titan of Crypto highlighted a bullish crossover on Ethereum’s weekly Stochastic RSI, a signal that has historically marked market bottoms. He suggests that ETH may be nearing the end of its bearish cycle, setting the stage for a strong rally.

Further Pain For ETH?

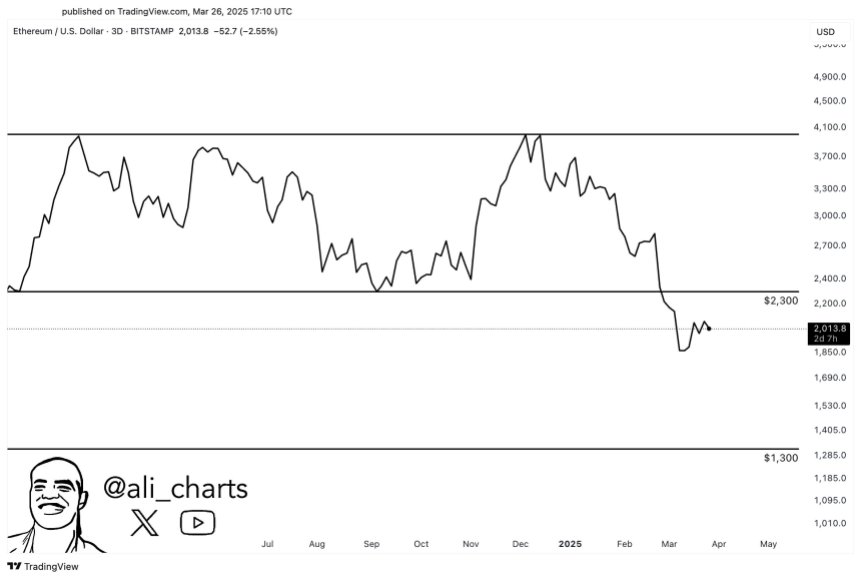

Sharing a contrasting viewpoint, noted crypto analyst Ali Martinez emphasized that there has been “no change in the outlook for Ethereum.” The analyst hinted that ETH is still likely to hit the lower-end of its current price range at $1,300.

However, some on-chain indicators suggest Ethereum may already be undervalued. An analysis using the Market Value to Realized Value Z-score (MVRV-Z) indicates that ETH is trading at levels historically associated with price rebounds. This metric, which compares Ethereum’s market value to its realized value, suggests that ETH might be primed for accumulation.

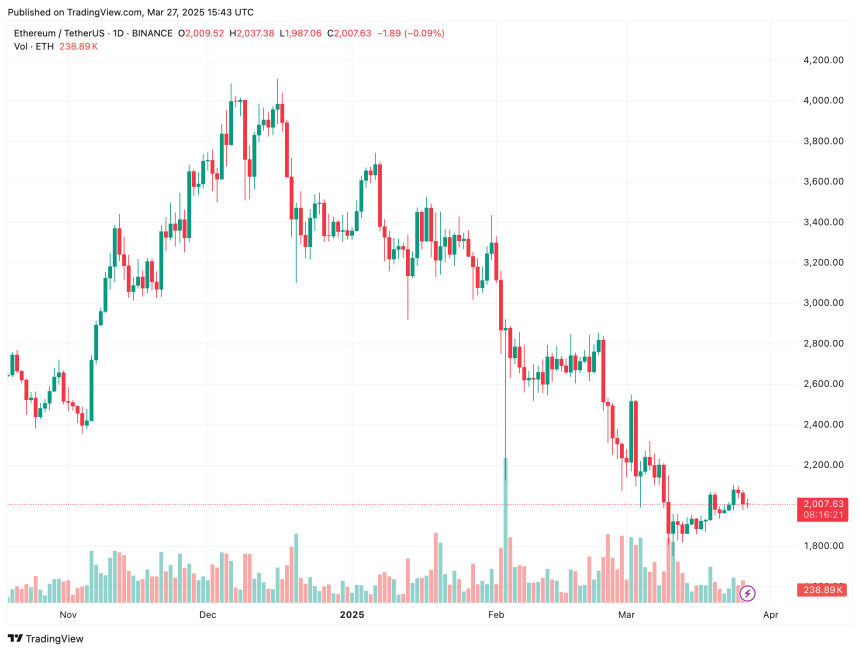

For Ethereum to confirm a bullish reversal, it must break through strong resistance at $2,300. A successful breakout could push ETH toward $3,000 in the short term. Failure to surpass this level, however, might result in extended consolidation or another price decline. At press time, ETH trades at $2,007, down 0.5% in the last 24 hours.